Benchmarks indices closed rangebound session on a flat note on February 22, but the broader markets outperformed as Nifty Midcap index rose 0.4 percent.

The 30-share BSE Sensex fell 26.87 points to 35,871.48 whereas the Nifty50 gained 1.8 points to close at 10,791.65. The index formed small bullish candle on the daily chart and 'Hammer' like a pattern on weekly scale.

For the week, the index rose 0.6 percent. It started the week on a negative note followed by recovery from around 10,600. The immediate resistance placed around 10,810 remained intact.

Chart pattern along with the position of leading indicators is pointing that the Nifty is unlikely to find an escape route out of the prolonged range 10,600-11,000, experts said.

"Candle pattern suggests, the benchmark index may again see buying on dips around critical supports placed around 10,740 and 10,600. However, the benchmark index breaking out from 10,810 is still a possibility as long as pivotal support placed around 10,600 remains intact," Jaydeb Dey, Technical Research Analyst at Stewart & Mackertich Research told Moneycontrol.

On an extended note, the house expects Nifty to continue oscillating in the broader price band of 10,600-10,950 in the first half of the week, he said.

India VIX spiked higher in the last week but again it fell to 15.45 percent.

Gradual dips in VIX suggests short-term stability in the market, Chandan Taparia, Associate Vice President | Analyst-Derivatives at Motilal Oswal Financial Services said, adding option band signifies a broader trading range between 10,650 to 10,929.

Key support and resistance level for Nifty

Nifty closed at 10,791.65 on February 22. According to Pivot charts, the key support level is placed at 10,766.23, followed by 10,740.77. If the index starts moving upward, key resistance levels to watch out are 10,809.33 and then 10,826.97.

Nifty Bank

The Nifty Bank index closed at 26,867.55, down 184.85 points on February 22. The important Pivot level, which will act as crucial support for the index, is placed at 26,811.17, followed by 26,754.73. On the upside, key resistance levels are placed at 26,960.67, followed by 27,053.73.

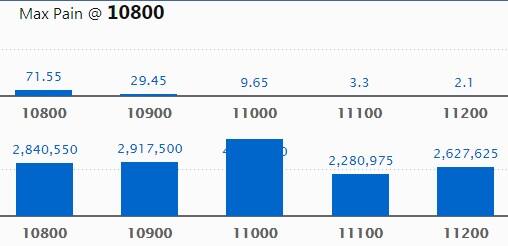

Call options data

Maximum Call open interest (OI) of 41.10 lakh contracts was seen at the 11,000 strike price. This will act as a crucial resistance level for the February series.

This was followed by the 10,900 strike price, which now holds 29.17 lakh contracts in open interest, and 10,800, which has accumulated 28.40 lakh contracts in open interest.

Significant Call writing was seen at the strike price of 10,800, which added 1.74 lakh contracts, followed by 11,100 strike that added 1.22 lakh contracts and 11,200 strike that added 1.08 lakh contracts.

Call unwinding was seen at the strike price of 10,700 that shed 1.92 lakh contracts, followed by 10,600 strike that shed 0.31 lakh contracts and 10,500 strike that shed 0.25 lakh contracts.

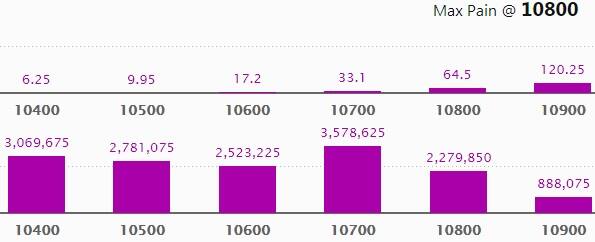

Put options data

Maximum Put open interest of 35.78 lakh contracts was seen at the 10,700 strike price. This will act as a crucial support level for the February series.

This was followed by the 10,400 strike price, which now holds 30.69 lakh contracts in open interest, and the 10,500 strike price, which has now accumulated 27.81 lakh contracts in open interest.

Put writing was seen at the strike price of 10,800 which added 2.74 lakh contracts, followed by 10,700 strike that added 0.46 lakh contracts and 10,900 strike that added 0.27 lakh contracts.

Put unwinding was seen at the strike price of 10,600 that shed 3.63 lakh contracts, followed by 10,300 strike that shed 1.6 lakh contracts.

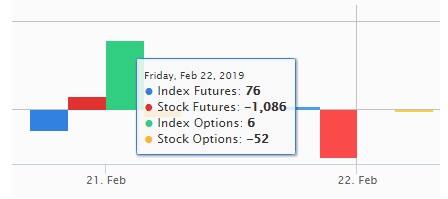

FII & DII data

Foreign Institutional Investors (FIIs) bought shares worth Rs 6,311.01 crore and Domestic Institutional Investors purchased Rs 838.88 crore worth of shares in the Indian equity market on February 22, as per provisional data available on the NSE.

Fund flow picture

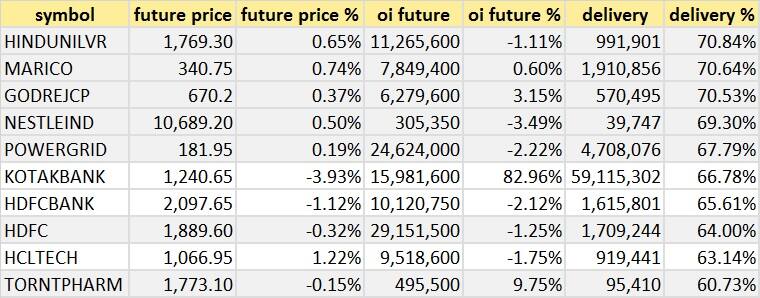

Stocks with a high delivery percentage

High delivery percentage suggests investors are accepting delivery of the stock, which means that investors are bullish on it.

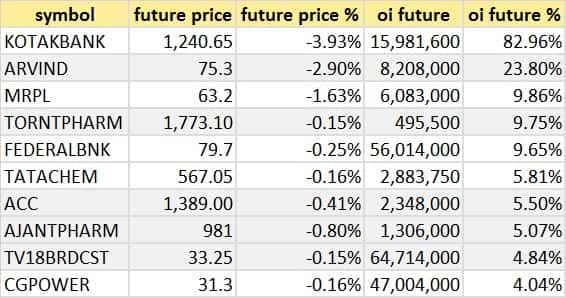

64 stocks saw a long buildup

64 stocks saw short covering

A decrease in open interest along with an increase in price mostly indicates short covering.

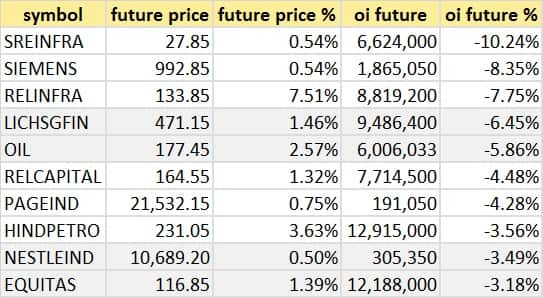

40 stocks saw a short build-up

An increase in open interest along with a decrease in price mostly indicates a build-up of short positions.

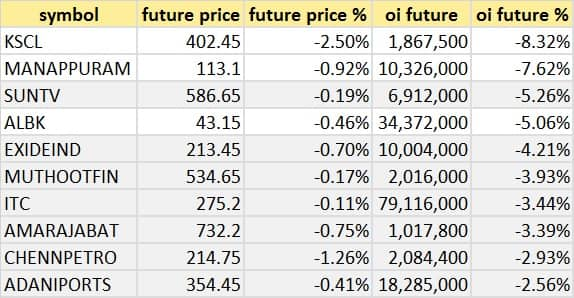

29 stocks saw long unwinding

Bulk Deals on February 22

IndInfravit Trust: Omers Infrastructure Asia Holdings Pte Ltd bought 8,28,00,000 shares of the company at Rs 104.5 per share on the NSE. However, ICICI Prudential Mutual Fund (1,00,00,000 shares), L&T Transportation Infrastructure Limited (26,00,000 shares), Larsen & Toubro Limited (6,62,00,000 shares) and Yes Bank (26,00,000 shares) were net sellers at same price.

Kotak Mahindra Bank: ING Mauritius Investments I sold 2,92,26,738 shares of the bank at Rs 1,228.51 per share and bought the same number of shares at Rs 1,225.14 per share.

Nagarjuna Oil Refinery: Zuari Investments sold 25,24,278 shares of the company at 38 paise per share.

Refex Industries: Sheil Atulbhai Patel sold 90,000 shares of the company at Rs 27.5 per share.

Reliance Communications: STCI Finance Limited sold 2,60,00,000 shares of the company at Rs 6.75 per share.

Sanco Industries: Ajay Kumar Bokadia sold 98,100 shares of the company at Rs 13.90 per share.

Silver Touch Techno: Thakkar Keyur Balkrishna HUF purchased 72,000 shares of the company at Rs 122.05 per share.

Sintercom India: Pivotal Enterprises Private Limited sold 1,64,000 shares of the company at Rs 58.92 per share.

(For more bulk deals, click here)

Analyst or Board Meet/Briefings

Som Distilleries & Breweries: Board meeting is scheduled on March 2 to consider allotment of 12,88,906 equity shares upon conversion of an equal number of convertible warrants and to convey an EGM on March 26.

Zeal Aqua: Company's officials will be meeting Trust Capital, M3 Investments and Moneybee Securities on February 25 in Mumbai.

KNR Constructions: Company will be participating in HDFC Infra Day conducted by HDFC Securities on February 25 in Mumbai.

Power Grid Corporation: Board meeting scheduled on March 7 to consider and approve the declaration of interim dividend for the financial year 2018-19.

Pacific Industries: Board meeting is scheduled on February 27 to consider the rights issue of equity shares to the existing shareholders of the company.

Ashoka Buildcon: Company will be attending the Investors Conference organised by HDFC Securities on February 25 in Mumbai.

PNC Infratech: Company will be attending the Investors Conference organised by HDFC Securities on February 25 in Mumbai.

JMC Projects: Company will be attending the Investors Conference organised by HDFC Securities on February 25 in Mumbai.

Tata Chemicals: Company's officials will meet Baron Capital Managment Inc on February 25.

Escorts: Company has scheduled meeting with TT International HK on February 25.

Mahindra & Mahindra: Company's officials will meet UBS Global Asset Management and Janus Henderson Investors on February 26, and GIC Singapore on February 27 in Mumbai.

Fine Organic Industries: Officials of the company will be interacting with investors and analyst on February 25 and 26.

Mahanagar Gas: Company's officials will meet Mathews International on February 25.

Endurance Technologies: Various meetings have been planned with institutional investors on certain dates during the next two weeks starting February 25.

Welspun Enterprises: Company will be attending HDFC Infra Day Conference on February 25.

Ahluwalia Contracts: Company will be attending HDFC Infra Day Conference on February 25.

Eris Lifesciences: Company's officials will meet Investec Capital Services (India) Private Limited on February 25.

Syndicate Bank: Board meeting is scheduled on February 27 to consider raising of equity capital by way of preferential allotment.

Dr Lal PathLabs: Company's officials will meet C Worldwide Asset Management on February 25 and Bay Capital on February 27.

Tata Motors: Company's officials will meet analysts/investors during February 25 and 28.

Share India Securities: Board meeting is scheduled on February 26 to consider the proposal for migration of company's present listing on BSE SME Platform to the BSE Main Board Platform.

Welspun Corp: Extra Ordinary General Meeting of the company to be held on March 19.

Stocks in news

Results on February 25: JMT Auto, Khaitan India, Rollatainers, United Drilling Tools.

NBFCs: RBI to merge 3 categories of NBFCs to create a new category called NBFC-ICC.

Motilal Oswal, IIFL Holdings: SEBI declares commodity arms of Motilal Oswal, IIFL 'not fit and proper'.

IIFL Holdings clarification: SEBI order on IIFL Commodities has no impact on businesses of other companies of IIFL Group.

Motilal Oswal Financial Services clarification: SEBI order against subsidiary company Motilal Oswal Commodities Broker Private Limited will have no impact on overall business activities of companies of Motilal Oswal group.

NTPC: Nabinagar Thermal Power Project has been declared running commercial operation.

Sharon Bio-Medicine: API facility located at Taloja, Maharashtra received 4 Form 483 observations after the inspection completed by USFDA

Corporation Bank: Company received Rs 9,086 crore from Government of India.

Hubtown: Company divested and transferred its entire holding of 4,720 equity shares in its subsidiary Heet Builders.

Tulive Developers: Board approved the buyback of up to 4,80,000 equity shares of the company at a price of Rs 350 per equity share.

Vyapar Industries: Board approved the buyback of up to 15,30,000 equity shares of the company at a price of Rs 29 per equity share.

Jet Airways: An additional two aircrafts have been grounded due to non-payment of amount outstanding to lessors under their respective lease agreements.

GVK Power & Infrastructure: Equity shareholding of the GVK Group will increase to 64 percent from the existing 50.5 percent of the total paid-up share capital of Mumbai International Airport Limited after the acquisition of 13.5 percent stake from Bid Services Division (Mauritius).

Shakti Pumps: Akhilesh Maru tendered his resignation from the post of Chief Financial Officer as he is looking to start his own enterprise.

Adani Green Energy: Company awarded 150 MWac solar power project to its wholly-owned subsidiaries.

Adani Power: Board approved the proposal for acquisition of entire stake of Adani Power Dahej Limited; Adani Pench Power Limited; and Kutchh Power Generation Limited, which are wholly owned subsidiaries of Adani Enterprises (AEL) from AEL.

Adani Ports & Special Economic Zone: Subsidiary Adani Logistics approved the proposal for acquisition of 100 percent equity shares of Adani Agri Logistics Limited, Adani Agri Logistics (Dahod) Limited, Adani Agri Logistics (Darbhanga) Limited and Adani Agri Logistics (Samastipur) Limited from Adani Enterprises Limited.

Sandhar Technologies: India Ratings and Research assigned a rating of A1+ to company's commercial paper.

Lux Industries: Company incorporated subsidiary Altai Industries Private Limited.

Manappuram Finance: Board approved equity infusion up to Rs 100 crore in its subsidiary Asirvad Micro Finance Ltd.

Tilaknagar Industries Q3: Consolidated loss at Rs 49 crore versus loss Rs 16.6 crore; revenue rises to Rs 425 crore versus Rs 366.5 crore YoY.

Asahi Songwon Colors: Company planned a shutdown of CPC Crude Blue Plant at Padra, Vadodara with effect from February 24 to carry out the periodic maintenance, which will affect CPC crude blue production for the quarter ending March 2019. The shutdown is expected to last up to March 7, 2019.

SKF India: Company closed its share buyback.

Manugraph India: Suresh Narayan, Chief Financial Officer of the company has decided to pursue other opportunities and tendered his resignation.

Allahabad Bank: Out of the capital infusion fund of Rs 6,896 crore received from the Government of India, Rs 2,750 crore has been appropriated to make loan loss provision in order to bring down the net NPA ratio below the threshold under Prompt Corrective Action Framework and remaining

Rs 4,146 crore has been appropriated towards shoring up the capital base so as to enhance the Capital to Risk Weight Asset Ratio (CRAR).

Kotak Mahindra Bank: Mark Newman, a Non-Executive Non-Independent Director of the bank has resigned from the board.

PVP Ventures: Company approved the Scheme of Amalgamation amongst PVP Ventures Limited, Picturehouse Media Limited, PVP Media Private Limited and PVP Cinema Private limited & their respective shareholders and creditors.

Birla Precision Technologies: Company approved the issue of 6,07,005 equity shares at Rs 16.24 each on preferential basis to Zenith Dyeintermediates Limited, promoter company.

Mcleod Russel: Company announced execution of Memorandum of Understandings by the wholly owned subsidiary (WOS) for disposal of its stake in one of its subsidiaries and disposal of a part of its holding in another subsidiary by the WOS.

Hindustan Zinc: Agnivesh Agarwal steps down as Chairman and Director of company to pursue other interests.

Reliance Industries: Subsidiary Reliance Industrial Investments and Holdings Limited (RIIHL) entered into agreement for acquisition of equity shares of software service and data solutions company Surajya Services Private Limited (Easygov) for up to Rs 18 crore. RIIHL will further invest an amount up to Rs 50 crore. The said investment upon completion will translate into 76 percent equity stake in Easygov on a fully diluted basis. The total investment is likely to be completed by March 2021.

Reliance Industries: Subsidiary RIIHL entered into an agreement for acquisition of equity shares of software company SankhyaSutra Labs Private Limited (SSL) for up to Rs 16,02,08,808. RIIHL will further invest an amount of up to Rs 200 crore and is likely to be completed by December 2021. The said investment will translate into around 83 percent of equity capital in SSL on a fully diluted basis.

Reliance Industries: RIIHL entered into a agreement for acquisition of equity shares of Reverie Language Technologies Private Limited (Reverie) for up to Rs 190 crore. RIIHL will further invest an amount up to Rs 77 crore. The said investment upon completion will translate into 83.30 percent equity capital in Reverie on a fully diluted basis.

Seven stocks under ban period on NSE

Securities in ban period for the next day's trade under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

For February 25, Adani Enterprises, Adani Power, Allahabad Bank, IDBI Bank, Jet Airways, PC Jeweller and Reliance Power stocks are present in this list.

Disclaimer: Reliance Industries is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.