Indian equities witnessed a fresh wave of selling in the second half of the March 12 session that dragged the benchmarks Sensex and Nifty lower by about a percent. On a weekly basis, however, the Sensex climbed 0.7 percent and the Nifty 0.62 percent.

The Nifty closed above 15,000 on March 12 and experts say the index needs to sustain above the psychologically important mark for a couple of more days for the uptrend to continue.

"On the downside, the index has strong and good support at 14,850 zone. Any decisive break below the said levels can show some more pressure towards 14,500 on an immediate basis. The strong hurdle is still at 15,250 and only above that level we may see some stability," said Rohit Singre, Senior Technical Analyst at LKP Securities.

We have collated 15 data points to help you spot profitable trades:Note: The open interest (OI) and volume data of the stocks in this story are the aggregate of three-month data and not the current month only.

Key support and resistance levels for NiftyAccording to pivot charts, the key support levels for the Nifty are placed at 14,877.63 followed by 14,724.27. If the index moves up, key resistance levels to watch out for are 15,260.33 and 15,489.67.

Nifty BankThe Nifty Bank index fell 442 points to 35,496.65 on March 12. The important pivot level, which will act as crucial support for the index, is placed at 34,957.34, followed by 34,418.07. On the upside, key resistance

levels are placed at 36,266.63 and 37,036.66 levels.

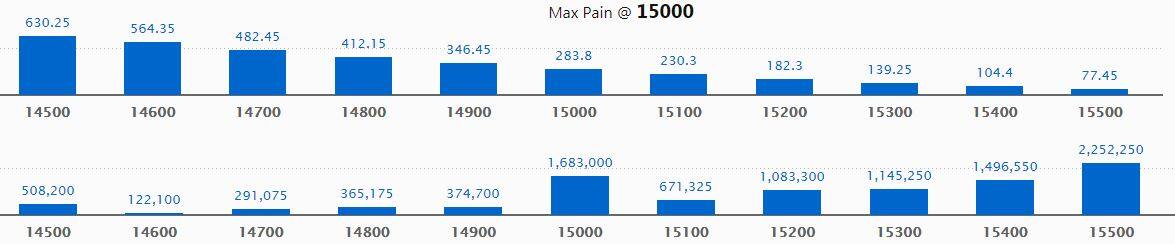

Call option dataMaximum Call open interest of 22.52 lakh contracts was seen at 15,500 strike, which will act as a crucial resistance level in the March series.

This is followed by 15,000 strike, which holds 16.83 lakh contracts, and 15,400 strike, which has accumulated 14.97 lakh contracts.

Call writing was seen at 15,400 strike, which added 3.48 lakh contracts, followed by 15,300 strike which added 3.40 lakh contracts and 15,500 strike which added 3.09 lakh contracts.

Call unwinding was seen at 14,900 strike, which shed 42,300 contracts, followed by 14,800 strike which shed 16,425 contracts.

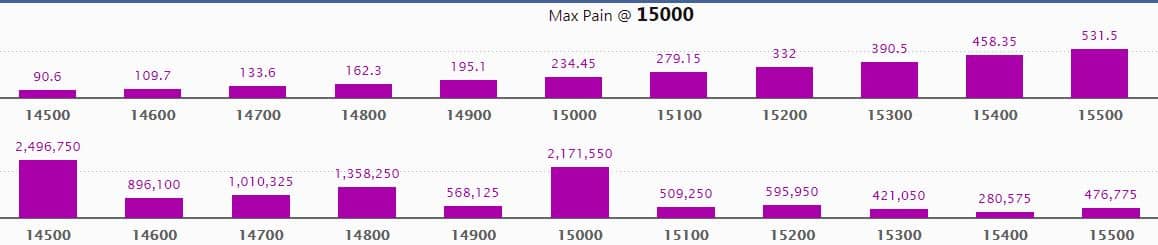

Maximum Put open interest of 24.97 lakh contracts was seen at 14,500 strike, which will act as a crucial support in the March series.

This is followed by 15,000 strike, which holds 21.72 lakh contracts, and 14,800 strike, which has accumulated 13.58 lakh contracts.

Put writing was seen at 15,300 strike, which added 2.4 lakh contracts, followed by 15,400 strike, which added 1.51 lakh contracts and 14,700 strike which added 80,400 contracts.

Put unwinding was seen at 14,500 strike, which shed 1.9 lakh contracts, followed by 14,900 strike which shed 15,150 contracts.

A high delivery percentage suggests that investors are showing interest in these stocks.

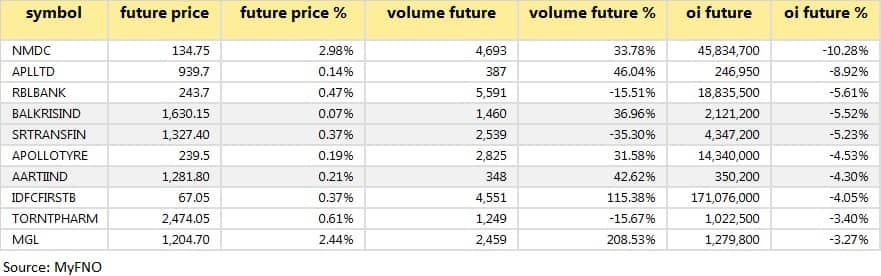

Based on the open interest future percentage, here are the top 10 stocks in which long unwinding was seen:

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks in which a short build-up was seen:

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks in which short-covering was seen.

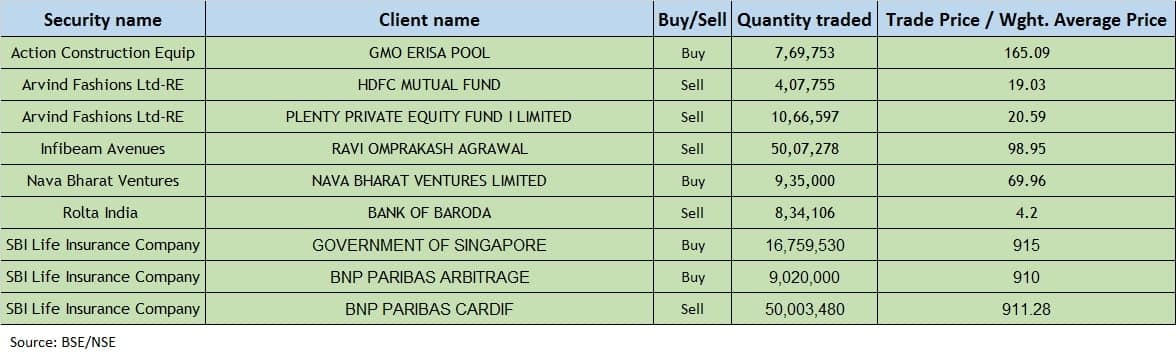

(For more bulk deals, click here)

Board MeetingsAGI Infra: The board will meet on March 15 to consider and approve interim dividends.

Allcargo Logistics:The board will meet on March 15 to consider and approve interim dividends.

GAIL:The board will meet on March 15 to consider and approve interim dividends.

National Aluminium:The board will meet on March 15 to consider and approve interim dividends.

Som Distilleries & Breweries:The board will meet on March 15 to consider and approve stock option plans, issue of warrants, etc.

Stocks in the newsJindal Saw:Brickwork Ratings revalidated its rating as 'BWR AA/Stable' for bonds amounting to Rs 500 crores of the company.

Kotak Mahindra Bank: The board of directors approved dividend on 100 crore Nos. 8.10 percent non-convertible perpetual non-cumulative preference shares of the face value of Rs 5 each for FY21. The record date for the purpose of payment will be March 19, 2021.

Bajaj Finance:The debenture allotment committee of the company has allotted 300 secured redeemable non-convertibles debentures on a private placement basis.

JSW Steel: India Ratings and Research has reaffirmed the company's rating at 'AA', with the outlook revised to "stable" from "negative".

IIFL Finance:The company will close its bond issue early on March 18 instead of March 23, 2021.

SBI Card:The board approved raising up to Rs 2,000 crore by issuing bonds.

Fund flow

Foreign institutional investors (FIIs) net sold shares worth Rs 942.6 crore, while domestic institutional investors (DIIs) also net sold shares worth Rs 163.87 crore in the Indian equity market on March 12, as per provisional data available on the NSE.

Stocks under F&O ban on NSEFour stocks—BHEL, Punjab National Bank, SAIL and Sun TV Network—are under the F&O ban for March 15. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!