Benchmark indices Sensex and Nifty closed in the red on September 12 on profit-booking as investors turned cautious ahead of the release of key macroeconomic numbers.

Later in the day, data released by the Central Statistics Office (CSO) showed that India's retail inflation rate in August grew 3.21 percent, remaining within Reserve Bank of India's target level of 4 percent.

On the other hand, the country's industrial output grew 4.3 percent month-on-month (MoM) in July against a growth of 2.0 percent in June.

Manufacturing output, which accounts for more than three-fourths of the entire index, grew 4.2 percent in July, against 1.2 percent growth in June.

After a rangebound session, Sensex closed the day with a loss of 167 points, or 0.45 percent, at 37,104.28, with 8 stocks in the green and 22 in the red.

The Nifty pack fell 53 points, or 0.48 percent, to end at 10,982.80. Among the 50 stocks in the index, only 15 could log gains.

Broader BSE Midcap and Smallcap indices closed 0.18 percent down and 0.12 percent up, respectively.

India VIX fell by 3.06 percent to 14.90 level.

Rupee's healthy gain against the US dollar capped the fall of the domestic market, whereas firm global cues amid the signs of easing US-China trade war also saved the market from suffering a steep fall.

Continuing its winning run for the sixth straight session, the rupee climbed 52 paise to end at 71.14 against the US dollar.

Nifty formed a bearish candle which resembled a bearish engulfing kind of pattern on daily charts.

A bearish candlestick pattern suggests that bears were able to regain control after the index moved in a narrow range for the past few sessions. It is usually seen as the end of an uptrend but if the index breaks below its crucial support level of 10,850, selling pressure could accelerate.

"This pattern indicates a formation of a bearish engulfing pattern, which signals a profit booking at the higher levels," said Nagaraj Shetti – Technical & Derivative Analyst, HDFC securities.

"The present weakness is unlikely to damage the near-term positive sentiment of the market and we are likely to see upside bounce from the lows. Next lower supports to be watched are at 10,920-900 levels," Shetti added.

We have collated 15 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, key support level for Nifty is placed at 10,937.93, followed by 10,893.07. If the index starts moving up, key resistance levels to watch out for are 11,054.73 and 11,126.67.

Nifty Bank

The Nifty Bank closed at 27,818.50, up 0.15 percent on September 12. The important pivot level, which will act as crucial support for the index, is placed at 27,701.37, followed by 27,584.23. On the upside, key resistance levels are placed at 27,998.97 and 28,179.44.

Call options data

Maximum call open interest (OI) of 23.87 lakh contracts was seen at the 11,000 strike price. It will act as a crucial resistance level in the September series.

This is followed by 11,200 strike price, which now holds 21.57 lakh contracts in open interest, and 11,500, which has accumulated 21.43 lakh contracts in open interest.

Significant call writing was seen at the 11,000 strike price, which added 3.82 lakh contracts, followed by 11,000 strike price that added 3.63 lakh contracts and 10,900 strike which added 3.60 lakh contracts.

Call unwinding was seen at 11,400 strike price, which shed 2.45 lakh contracts, followed by 10,800 strike, which shed 1.40 lakh contracts.

Put options data

Maximum put open interest of 29.42 lakh contracts was seen at 10,800 strike price, which will act as crucial support in September series.

This is followed by 11,000 strike price, which holds 28.64 lakh contracts in open interest, and 10,600 strike price, which has accumulated 26.15 lakh contracts in open interest.

Put writing was seen at the 11,000 strike price, which added 3.15 lakh contracts, followed by 10,600 strike, which added 1.65 lakh contracts and 11,100 strike which added 98,925 contracts.

Put unwinding was seen at the 10,500 strike price, which shed 52,575 contracts, followed by 11,500 strike which shed 39,450 contracts.

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

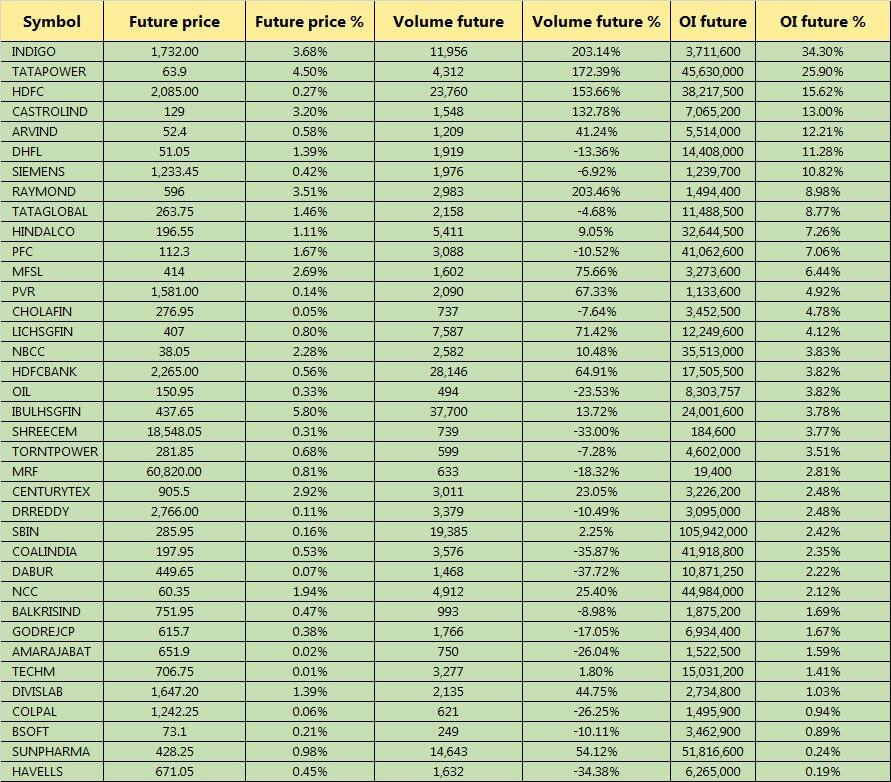

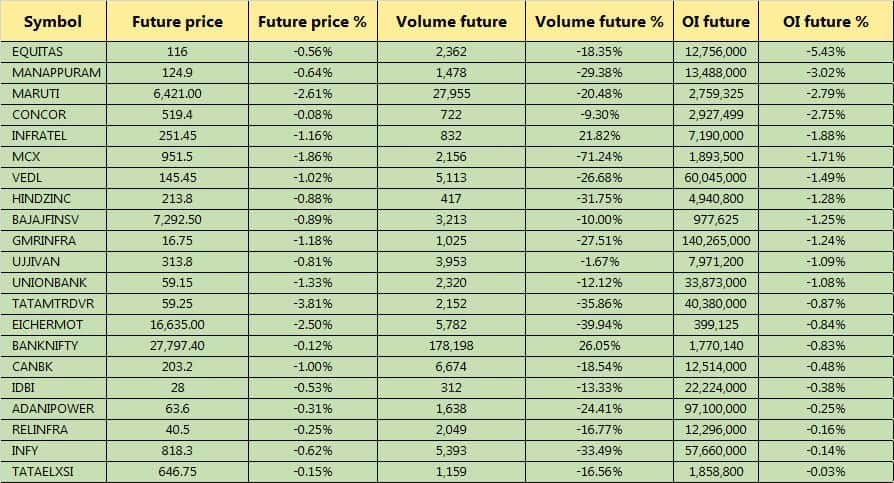

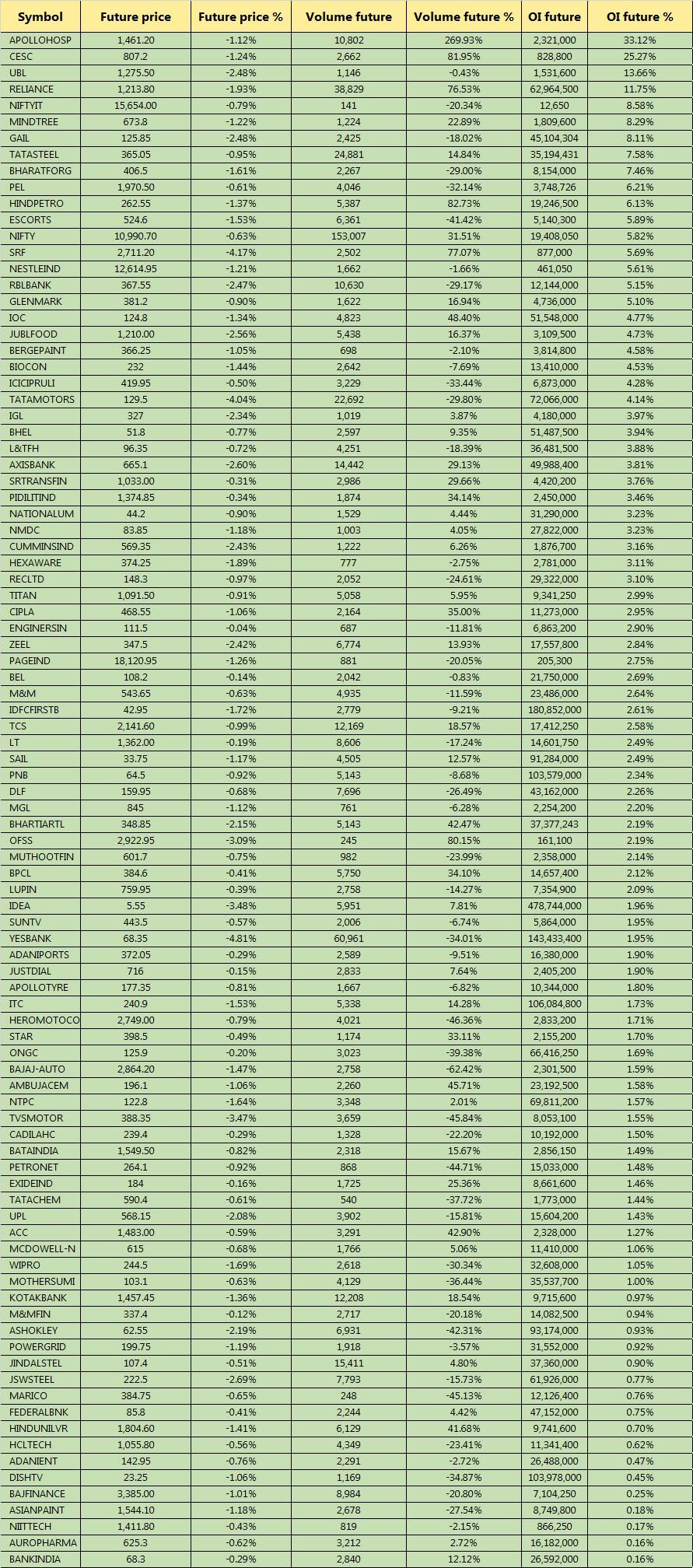

37 stocks saw long buildup

21 stocks saw long unwinding

11 stocks saw short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short covering.

94 stocks saw short build-up

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions.

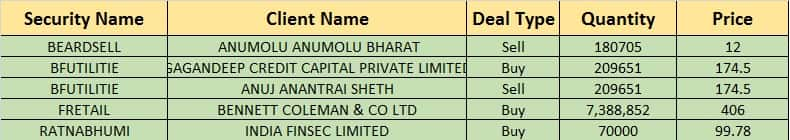

Bulk deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings:

Acrysil: The board will meet on September 13 to consider and approve the cost audit report for the financial year 2018-19.

Adharshila Capital Services: The board of the company will meet on September 13 to consider and approve quarterly results.

Bemco Hydraulics: The board of the company will meet on September 13 to consider and approve quarterly results.

Canara Bank: The board of directors of the bank is scheduled to meet on September 13 to consider the amalgamation of Syndicate Bank into Canara Bank and to consider capital infusion up to Rs 9,000 crore by the government by way of preferential issue of equity shares.

Stocks in news:

Dr Reddy's Labs: The company said it has received an EIR from the USFDA, indicating the closure of the audit of its formulations manufacturing plants at Duvvada, Visakhapatnam, which was completed on June 21, 2019.

Biocon: The company said it has signed a license and supply agreement with a subsidiary of China Medical System Holdings for three generic formulation products.

PNB: Punjab National Bank said CARE Ratings has placed the ratings of its bonds on "credit watch with developing implications".

SBI: State bank Of India has informed the exchange regarding an offer for sale of equity shares of SBI Life Insurance Company.

Coffee Day Enterprises: The exchange has sought clarification from the company with respect to recent news item captioned ICRA Cuts Rating Of Coffee Day's Long-Term Loans. The response from the Company is awaited.

International Paper APPM: ICICI Securities has informed the exchange regarding an open offer for the acquisition of up to 99,42,510 fully paid-up equity shares of face value of Rs 10 each from the public Shareholders of International Paper APPM.

PVR: The exchange has sought clarification from the company with respect to recent news item captioned PVR, NY Cinemas probed for not passing on GST perks. The response from the Company is awaited.

Oriental Bank Of Commerce: CARE Ratings has revised the rating outlook of Tier I & II Bonds from "stable" to "under credit watch with developing implications".

Shirpur Gold Refinery: CRISIL and CARE Rating has downgraded the company's long term and short term ratings to 'D'.

Adani Ports: Lien on 74 lakh promoter shares released on September 6 & 7.

Adani Transmission: Lien on 2.96 percent promoter stake released on September 6,7 & 11.

DHFL: The company defaulted on payment of interest & principal on NCDs worth Rs 197 crore.

L&T Finance Holdings: The company will consider raising up to Rs 150 crore via preference shares.

FII & DII data

Foreign institutional investors (FIIs) bought shares worth Rs 783.55 crore, while domestic institutional investors (DIIs) sold

Rs 126.82 crore worth of shares in the Indian equity market on September 12, as per provisional data available on the NSE.

Fund Flow

No stock under ban period on NSE

For September 13, not a single stock is under F&O ban. Securities in ban period under the F&O segment include companies

in which the security has crossed 95 percent of the market-wide position limit.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!