The market snapped two-day weakness and recouped some of those losses on June 2 despite a downtrend in Asian counterparts, supported by technology, metal, select pharma stocks and index heavyweight Reliance Industries.

The BSE Sensex rallied 437 points to 55,818, while the Nifty50 climbed 105 points to 16,628 and formed a Bullish Engulfing candle on the daily charts.

"On the daily charts, it has sustained above the 16,400-mark for four days, showing a positive undertone," Vidnyan Sawant, AVP-Technical Research at GEPL Capital said.

He further said that on the indicator front, the relative strength index (RSI) plotted on the daily charts is holding above the 50 mark and making a higher top, higher bottom formation, which shows positive momentum in the short term.

The immediate resistance is at 16,700 and 16,975 followed by 17,132, the market expert said, adding that the downside support for the Nifty is at 16,370, 16,000 and 15,671 levels.

The buying was also seen in broader space as the Nifty Midcap 100 and Smallcap 100 indices have gained 0.68 percent and 0.61 percent respectively on positive market breadth. About three shares advanced for every two declining shares on the NSE.

We have collated 15 data points to help you spot profitable trades:

Note: The open interest (OI) and volume data of stocks given in this story are the aggregates of three-month data and not of the current month only.

Key support and resistance levels on the Nifty

As per the pivot charts, the key support level for the Nifty is placed at 16,499, followed by 16,369. If the index moves up, the key resistance levels to watch out for are 16,702 and 16,776.

Nifty Bank fell 7 points to 35,614 on Thursday, underperforming the broader space. The important pivot level, which will act as crucial support for the index, is placed at 35,440, followed by 35,267. On the upside, key resistance levels are placed at 35,732 and 35,849 levels.

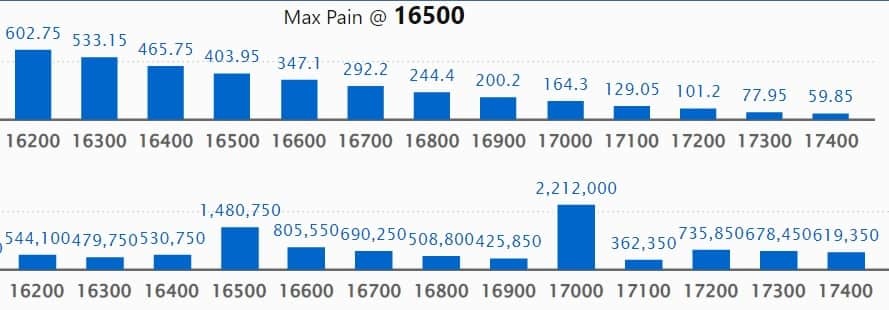

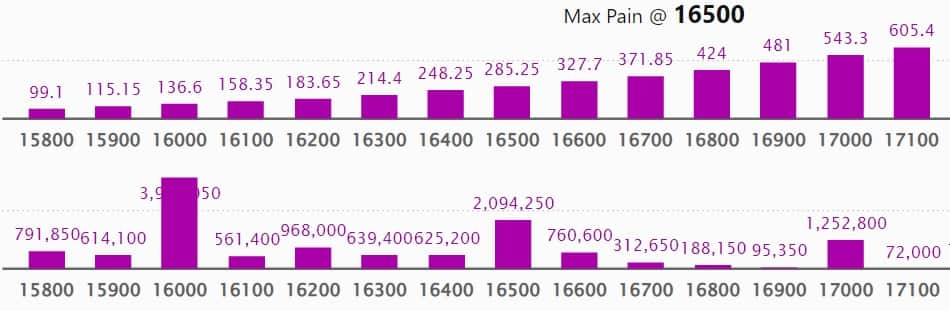

Maximum Call open interest of 24.28 lakh contracts was seen at 17,500 strike, which will act as a crucial resistance level in the June series.

This is followed by 17,000 strike, which holds 22.12 lakh contracts, and 18,000 strike, which has accumulated 16.21 lakh contracts.

Call writing was seen at 17,500 strike, which added 1.91 lakh contracts, followed by 17,700 strike which added 76,950 contracts and 16,400 strike which added 74,150 contracts.

Call unwinding was seen at 16,900 strike, which shed 1.76 lakh contracts, followed by 17,000 strike which shed 42,350 contracts and 16,800 strike which shed 25,050 contracts.

Maximum Put open interest of 39.07 lakh contracts was seen at 16,000 strike, which will act as a crucial support level in the June series.

This is followed by 15,500 strike, which holds 30.29 lakh contracts, and 15,000 strike, which has accumulated 23.29 lakh contracts.

Put writing was seen at 16,500 strike, which added 2.74 lakh contracts, followed by 16,000 strike, which added 2.12 lakh contracts and 16,400 strike which added 1.51 lakh contracts.

Put unwinding was seen at 15,500 strike, which shed 86,850 contracts, followed by 15,000 strike which shed 37,400 contracts, and 17,500 strike which shed 4,250 contracts.

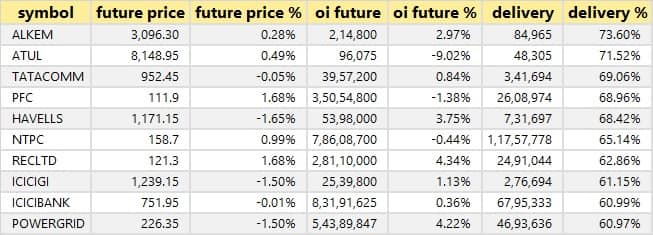

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks. The highest delivery was seen in Alkem Laboratories, Atul, Tata Communications, PFC, and Havells India, among others.

An increase in open interest, along with an increase in price, mostly indicates a build-up of long positions. Based on the open interest future percentage, here are the top 10 stocks including Abbott India, Federal Bank, Intellect Design Arena, Polycab India, and United Breweries, in which a long build-up was seen.

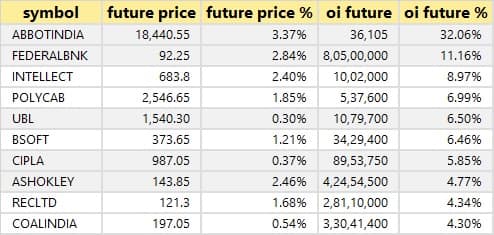

A decline in open interest, along with a decrease in price, mostly indicates a long unwinding. Based on the open interest future percentage, here are the top 10 stocks including Aditya Birla Fashion & Retail, Astral, Torrent Pharma, Navin Fluorine International, and PI Industries, in which long unwinding was seen.

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on the open interest future percentage, here are the top 10 stocks including Coromandel International, Apollo Hospitals Enterprises, Metropolis Healthcare, Biocon and Tech Mahindra, in which a short build-up was seen.

60 stocks witnessed short-covering

A decrease in open interest, along with an increase in price, mostly indicates a short-covering. Based on the open interest future percentage, here are the top 10 stocks including Atul, Hindustan Aeronautics, Berger Paints, Cummins India, and Asian Paints, in which short-covering was seen.

Arvind: Birla Sunlife Insurance Company sold 16,29,479 equity shares in the company via open market transactions at an average price of Rs 101.12 per share.

Vishwaraj Sugar Industries: Societe Generale bought 12,43,456 equity shares in the company via open market transactions at an average price of Rs 18.75 per share. However, Marshall Wace Investment Strategies Market Neutral Tops Fund was the seller for this deal.

(For more bulk deals, click here)

Investors Meetings on June 3

Larsen & Toubro, Himatsingka Seide, MM Forgings, Birlasoft, VA Tech Wabag, Home First Finance Company India, and Voltamp Transformers: Officials of these companies will attend B&K Securities Annual Investor Conference - Trinity India 2022.

Greaves Cotton: The company will update on the investment agreement in Greaves Electric Mobility, in its investor and analyst call.

Stocks in News

Aether Industries: The specialty chemical manufacturer will make its debut on the bourses on June 3. The issue price has been fixed at Rs 642 per share.

Fiem Industries: Elevation Capital V FII Holdings sold a 2.16 percent equity stake in the company via open market transactions on June 1. With this, its shareholding in the company stands reduced to 6.59 percent, down from 8.75 percent earlier.

Pharmaids Pharmaceuticals: Promoter Sadhanala Venkata Rao offloaded a 7.75 percent equity stake in the company via open market transactions on June 2. With this, Rao's shareholding in the company stands reduced to 22.39 percent, down 30.14 percent earlier.

Prudent Corporate Advisory Services: Promoter Rameshchandra Chimanlal Shah and persons acting in concert (PACs) acquired 4.25 lakh equity shares in the company via open market transactions on June 2. With this, their shareholding in the company stands increased to 57.81 percent, up from 56.78 percent earlier.

UltraTech Cement: The cement major announced Rs 12,886 crore towards increasing capacity by 22.6 mtpa with a mix of brownfield and greenfield expansion. This would be achieved by setting up integrated and grinding units as well as bulk terminals. The additional capacity will be created across the country. Commercial production from these new capacities is expected to go on stream in a phased manner by FY25.

MTAR Technologies: The defence company has entered into a Share Purchase Agreement with sellers and GEE PEE Aerospace & Defence Private Limited for the acquisition of 100 percent stake in GEE PEE Aerospace & Defence. The acquisition cost is Rs 8.82 crore.

Wardwizard Innovations & Mobility: The electric two-wheeler brand Joy e-bike maker sold 2,055 units in May 2022. With that, the company has clocked a growth of 329 percent as compared to May 2021, when the company had sold 479 units. WardWizard recently forayed into the highspeed scooter segment with Wolf+, Gen Next Nanu+ and fleet management electric scooter Del Go.

Fund Flow

Foreign institutional investors (FIIs) have net sold Rs 451.82 crore worth of shares, whereas domestic institutional investors (DIIs) remained net buyers, to the tune of Rs 130.63 crore worth of shares on June 2, as per provisional data available on the NSE.

Stocks under F&O ban on NSE

The National Stock Exchange has not put any stock under its F&O ban segment for June 3. Securities in the ban period under the F&O segment include companies in which the security has crossed 95 percent of the market-wide position limit.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Disclaimer: MoneyControl is a part of the Network18 group. Network18 is controlled by Independent Media Trust, of which Reliance Industries is the sole beneficiary.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!