Benchmark indices ended in the red on October 10 with Sensex closing 297.55 points lower at 37,880.40 while Nifty fell 78.80 points to close at 11,234.50.

The market breath remained in favour of declines, as 1 share advanced for every 2 shares fall.

On the sectoral front, selling was seen in the bank, metal, FMCG, auto and IT stocks while some buying interest was seen in select energy and infra stocks.

The daily chart shows that the index has come down to test the key daily moving averages that it had surpassed in the last session. The moving averages are now proving to be good supports, said Gaurav Ratnaparkhi, Senior Technical Analyst, Sharekhan by BNP Paribas.We have collated 14 data points to help you spot profitable trades:

Key support and resistance level for Nifty

According to the pivot charts, the key support level for Nifty is placed at 11,195.37, followed by 11,159.53. If the index starts moving up, key resistance levels to watch out for are 11,280.17 and 11,329.13.

Nifty Bank

Nifty Bank closed with a loss of 2.68 percent at 28,013.45. The important pivot level, which will act as crucial support for the index, is placed at 27,804.93, followed by 27,596.16. On the upside, key resistance levels are placed at 28,387.63 and 28,761.57.

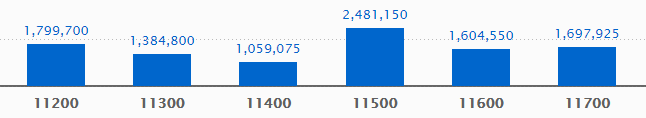

Call options data

Maximum call open interest (OI) of 24.81 lakh contracts was seen at the 11,500 strike price. It will act as a crucial resistance level for the October series.

This is followed by 11,200 strike price, which holds 17.99 lakh contracts in open interest, and 11,700, which has accumulated 16.97 lakh contracts in open interest.

Call writing was seen at the 11,300 strike price, which added 3.42 lakh contracts, followed by 11,700 strike price that added 1.49 lakh contracts.

No major call unwinding seen.

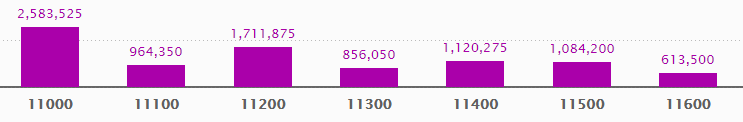

Put options data

Maximum put open interest of 25.83 lakh contracts was seen at 11,000 strike price, which will act as crucial support in October series.

This is followed by 11,200 strike price, which holds 17.11 lakh contracts in open interest, and 11,400 strike price, which has accumulated 11.20 lakh contracts in open interest.

No major Put writing was seen.

Put unwinding was seen at 11,000 strike price, which shed 1.21 contracts, followed by 11,500 strike that shed 84,000 contracts and 11,200 that shed 71,757 contracts.

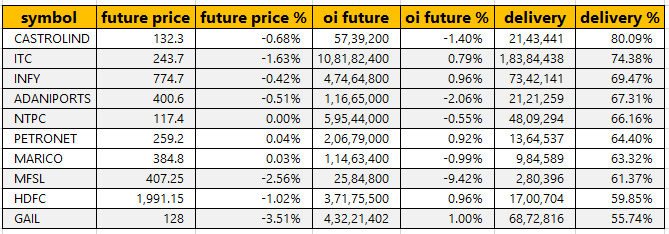

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

13 stocks saw long buildup

67 stocks saw long unwinding

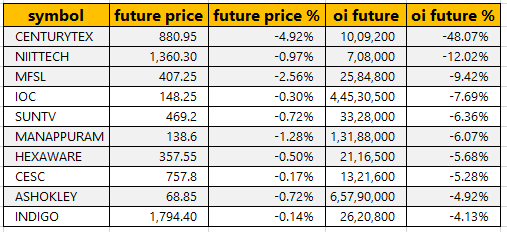

Based on the lowest open interest (OI) future percentage point, here are the top 15 stocks in which long unwinding was seen.

49 stocks saw short build-up

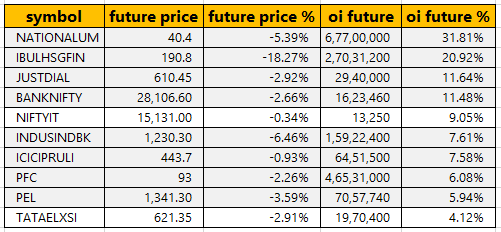

An increase in open interest, along with a decrease in price, mostly indicates a build-up of short positions. Based on open interest (OI) future percentage, here are the top 15 stocks in which short build-up was seen.

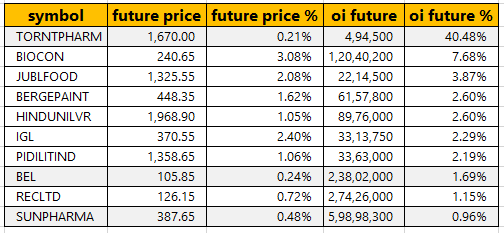

21 stocks witnessed short-covering

As per available data, 27 stocks witnessed short-covering. A decrease in open interest, along with an increase in price, mostly indicates a short covering. Based on the lowest open interest (OI) future percentage point, here are the top 15 stocks in which short-covering was seen.

Bulk Deals

(For more bulk deals, click here)

Upcoming analyst or board meetings/briefings

Security & Intelligence Services - board meeting on October 24 to consider and approve the financial results for the period ended September 30, 2019 and stock split of equity shares

Deepak Nitrite - board meeting on October 24 to consider and approve the financial results for the period ended September 30, 2019

Union Bank of India - board meeting on October 14, 2019 to consider, determine and approve the Issue Price of new equity shares proposed to be issued to the Government of India on Preferential Basis

Future Retail- board meeting on October 12 to consider Fund Raising

Mastek - board meeting on October 17 to consider and approve consolidated and standalone un-audited financial results for the second quarter and half year ended September 30, 2019 and consider the payment of interim dividend

Stocks in news

Biocon: Biocon Biologics & Just - Evotec Biologics enters into strategic licensing agreement for an early-stage, pre-clinical biosimilar asset

Indian Overseas Bank to cut lending rates by 25 bps effective November 1

Bank Of India cuts MCLR by 5-15 bps for some tenors effective October 10

ARSS Infrastructure Projects bags orders worth Rs 220.65 crore

NCC- India Ratings ard Research placed Long-Term Issuer Ratmg of IND A on rating watch negative

NCC- - ICRA assogned long-term rating as ICRA for Rs 2,300 crore Lines of Credit

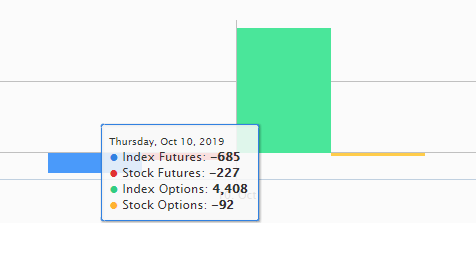

Fund flow

FII & DII data

Foreign institutional investors (FIIs) sold shares worth Rs 263.11 crore, while domestic institutional investors (DIIs) bought shares of worth Rs 502.67 crore in the Indian equity market on October 10, as per provisional data available on the NSE.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!