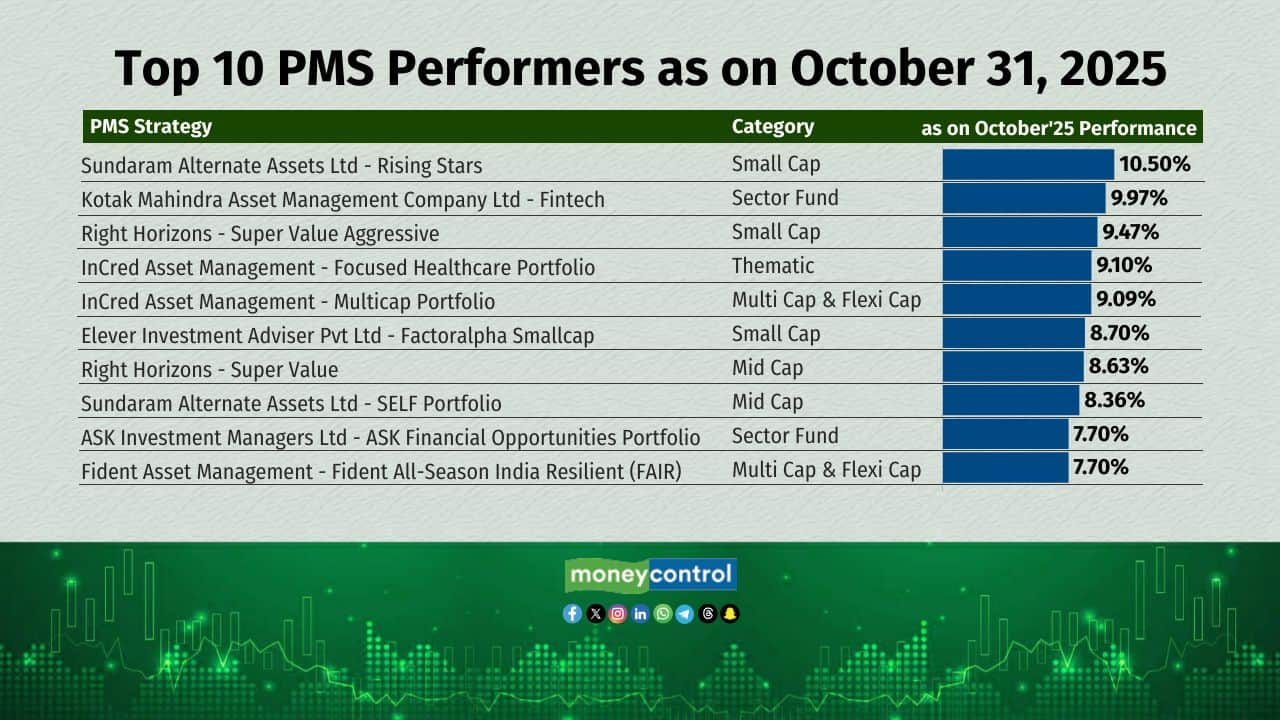

October saw a wide divergence in equity PMS performance, with a handful of high-beta strategies driving the month’s gains while several niche themes slipped into the red.

(Source: PMS Bazaar)

Sundaram Alternates’ Rising Stars emerged as the strongest performer with 10.5% gains, followed by Kotak’s Fintech PMS at 9.97% and Right Horizons’ Super Value Aggressive at 9.47%, reflecting how sharply the small- and mid-cap rebound lifted managers positioned in emerging, digital and deep-value names. In contrast, Maxiom’s GEM strategy delivered the weakest return at –2.79%, while Green Portfolio’s MNC Advantage (–2.21%) and Brightseeds’ Xylem Maverick (–2.06%) also ended negative, suggesting that global-tilted, MNC-heavy and contrarian portfolios failed to participate in the month’s risk-on rally.

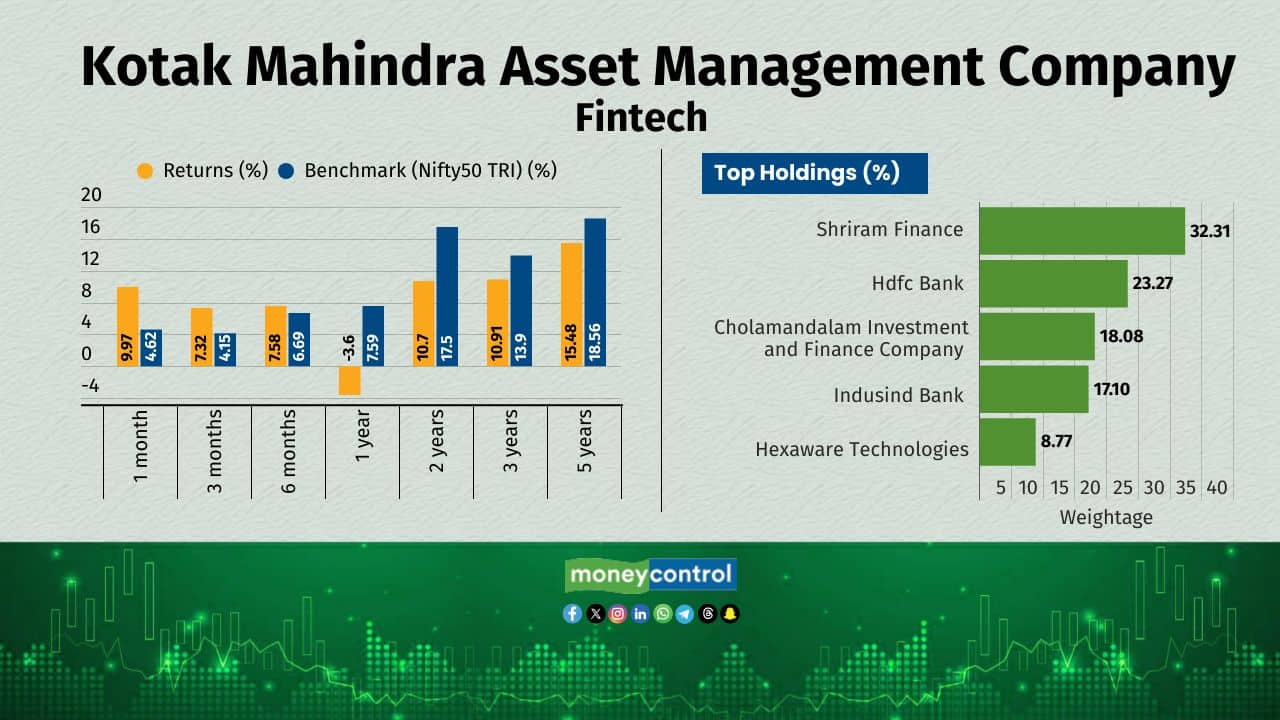

2. Kotak Mahindra Asset Management Company - Fintech

Clocked 10.15% in November 2025, riding digital economy waves. Thematic dive into fintech disruptors like payments and lending platforms, using benchmark-agnostic, growth-oriented selections.

3. InCred Asset Management - Focused Healthcare Portfolio

Delivered 9.85% in November 2025, thriving on aggressive positioning. High-conviction mid/small/micro-cap value hunt for multibaggers with 3-5 year earnings doublers. Bottom-up in overlooked pockets for contrarian edges.

4. InCred Asset Management - Multicap Portfolio

Rose 9.42% in October 2025, extending its sectoral dominance. Concentrated multicap tilt toward healthcare (pharma, hospitals, medtech), zeroing in on global inflection points for thematic growth.

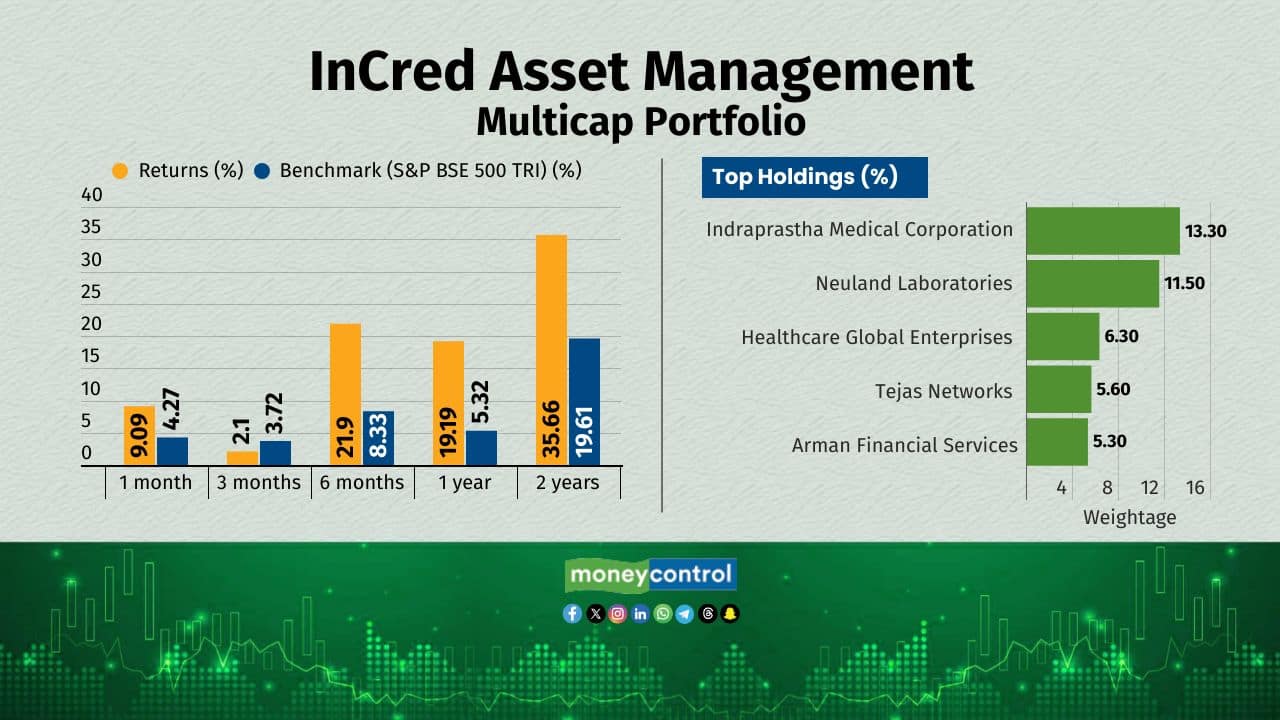

5. InCred Asset Management - Multicap Portfolio

Gained 9.28% in October 2025, mirroring September's strength. Flexible multicap across caps, favoring quality businesses at fair valuations via sector-agnostic, low-churn bottom-up.

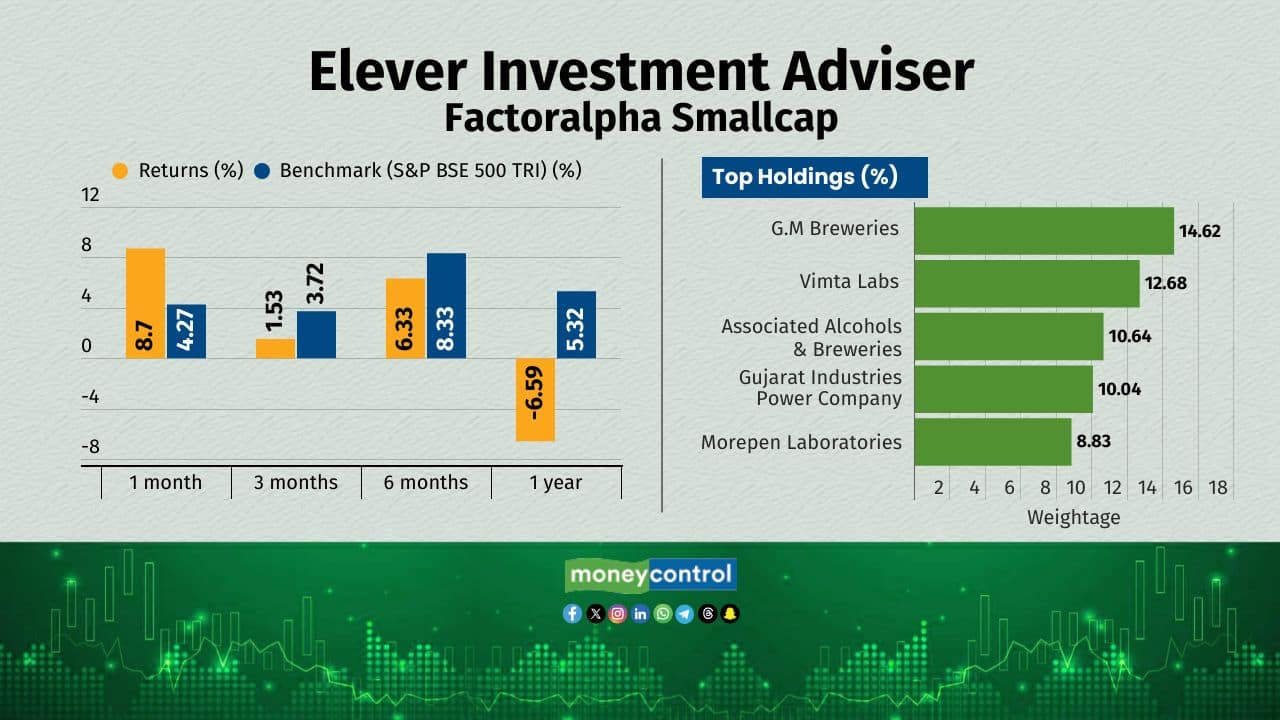

6. Elever Investment Adviser Pvt Ltd - Factoralpha Smallcap

Posted 8.92% in October 2025, capitalising on factor rotations. Pure quant small-cap engine blending global factors like value, momentum, and quality for dynamic, data-led alpha generation. Low-discretion model.

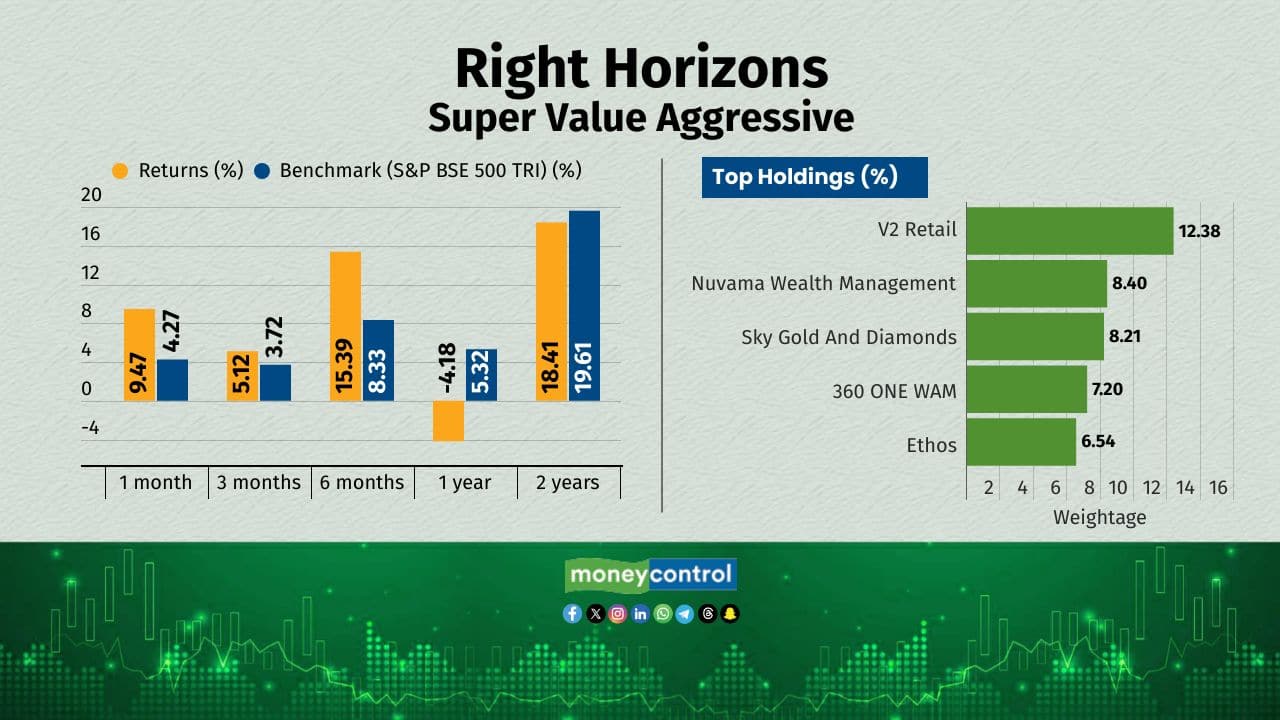

7. Right Horizons - Super Value

Achieved 8.75% in October 2025, aligning with its aggressive sibling's success. Value-growth fusion in mid/small-caps, targeting moats and contrarian setups in downcycles for diversified, risk-mitigated returns.

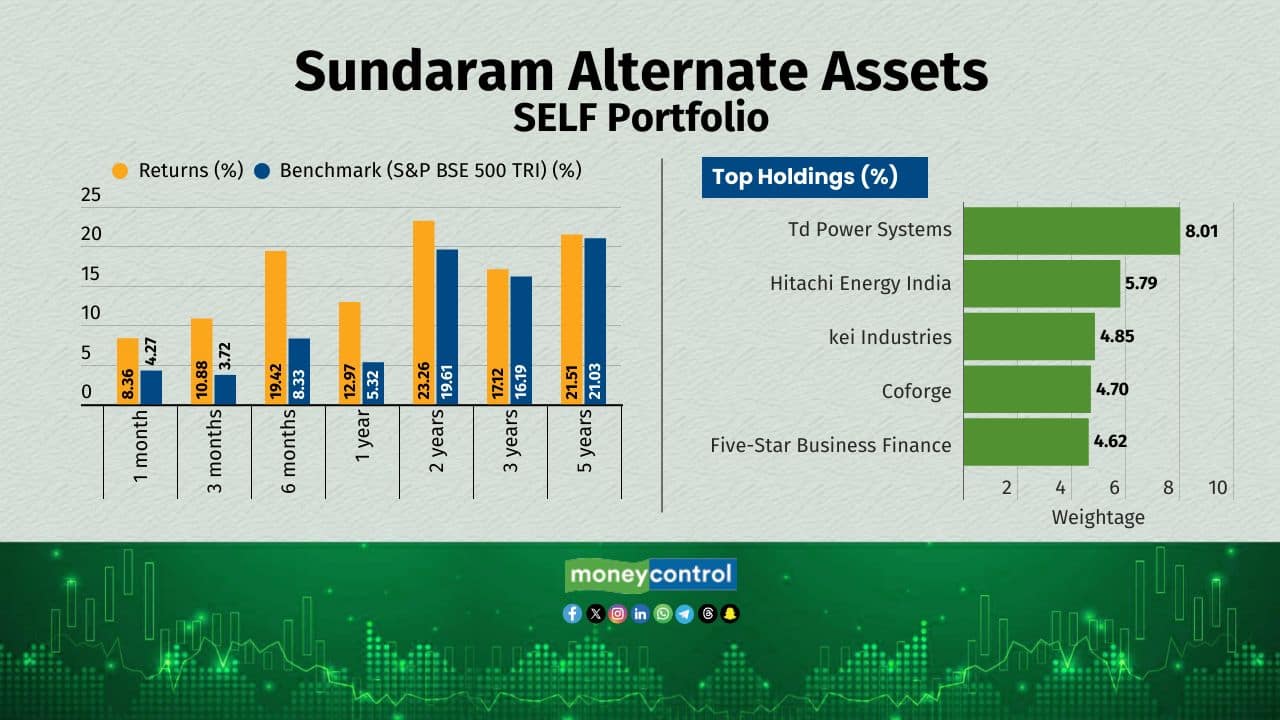

8. Sundaram Alternate Assets Ltd - SELF Portfolio

Climbed 8.58% in October 2025, complementing the Rising Stars' lead. Mid/small-cap emerging leaders via research-heavy theme scans, governance checks, and profitability modeling.

9. ASK Investment Managers - ASK Financial Opportunities Portfolio

Added 7.92% in October 2025, tapping financial recovery. Deep sectoral play in financials (banks, NBFCs, wealth managers), betting on AUM expansion and capex/export synergies.

10. Fident Asset Management - Fident All-Season India Resilient (FAIR)

Rounded out at 7.88% in October 2025, holding firm in turbulence. Multicap resilience via bottom-up growth picks in structurally sound firms with top-tier governance. Thematic on India's mega-trends.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.