An analysis of Google Trends suggests that over the past five years, whenever interest in the term 'multibagger' hits a peak, it spells a weak spell for Indian markets.

A multibagger is a term used for a stock that has at least doubled in value over any time period. So a stock that has clocked 100 percent returns is a 1-bagger, a stock that has returned 200 percent is a 2-bagger and so on.

If you input a keyword into Google Trends, it would show you the historical interest in the term on a scale of 0 to 100, relative to the highest point on the chart for a given region and time.

A value of 50 means that the term is half as popular. Likewise, a score of 0 means the term was less than 1 percent as popular as the peak.

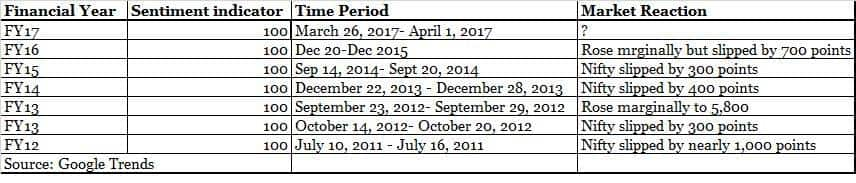

In the last five financial years, whenever this indicator hit the 100 mark with respect to the popularity of the searched item which is, in this case, ‘Multibagger’, it led to a sharp fall in the Nifty by 300 to nearly 1,000 points.

In the financial year 2017, Multibagger keyword hit the important 100 mark in March when benchmark indices hit a record high and it remains to be seen what happen next.

In the last financial year, this sentiment indicator hit 100 in the week of December 20, 2015, to December 27, 2015. The Nifty index rose marginally but slipped nearly 700 points thereafter to make a low of 7,200.

This indicator could be taken as the first clue that euphoria is at its peak and traders should tread with caution. Every stock can’t become a multibagger and to find one requires time and patience.

Retail investors do not understand the difference between a quality and a junk stock. They mostly take calls recommended by their brokers, who might be using them to earn a higher commission on small and midcap space.

"Generally, retail investors take calls from their brokers and sometimes in the race of generating higher returns retail investors end up investing on illiquid and punt calls; and the blame directly goes to the overall equity market," Anil Rego, CEO & Founder of Right Horizons told Moneycontrol.com.

“Euphoria is good in the market which leads to such searches; however, one should have the quality filter ready to identify fundamentally sound stocks, which comes with 1) daily reading of business newspapers, 2) shortlisting of companies/sectors on the basis of good fundamentals and 3) technical analysis to get the point of entry,” he said.

The term was searched the most from Mumbai, followed by Bangaluru, Ahmedabad, Pune and Hyderabad.

People also searched other keywords such as multibagger stocks for 2017, multibagger stocks India 2017, 16 tricky ways to identify and pick multibaggers etc.

Expert advises investors not to get swept away in the euphoria and use filters to identify the right quality of stocks according to your risk profile. Rego further added that ‘Euphoria’ is good, but it should have boundaries and filters to remove dirt.

Multibaggers in the makingMultibagger stock selection requires an investment horizon of 3-5 years, which is a challenging proposition. ICICI Securities introduced a segment by the name of "Nano Nivesh" wherein they recommend midcap and small cap stocks companies with good and scalable business models, dependable management and sound financials.

"Our earlier recommendation such as Atul Auto, Siyaram Silk, Wim Plast, D-link, Apcotex Industries, CCL Products have been multibaggers turning 2-9x over 4-5 years," Pankaj Pandey, Head of Research, ICICI Securities told Moneycontrol.com.

"Our recent Nano Nivesh picks with scalable opportunities include Kanpur Plastipack, Prima Plastics, Bhartiya International, NCL Industries, Linc Pen & Plastics and Shree Pushkar Chemicals," he said.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.