The Union Budget is a closely watched event by the stock markets in India. Unlike elsewhere in the world, in India, the Budget presentation is not just as a statement of the government finances. Here, tweaks in taxes and government spending can often direct the growth trajectory, especially in years when private investments and consumption are weak.

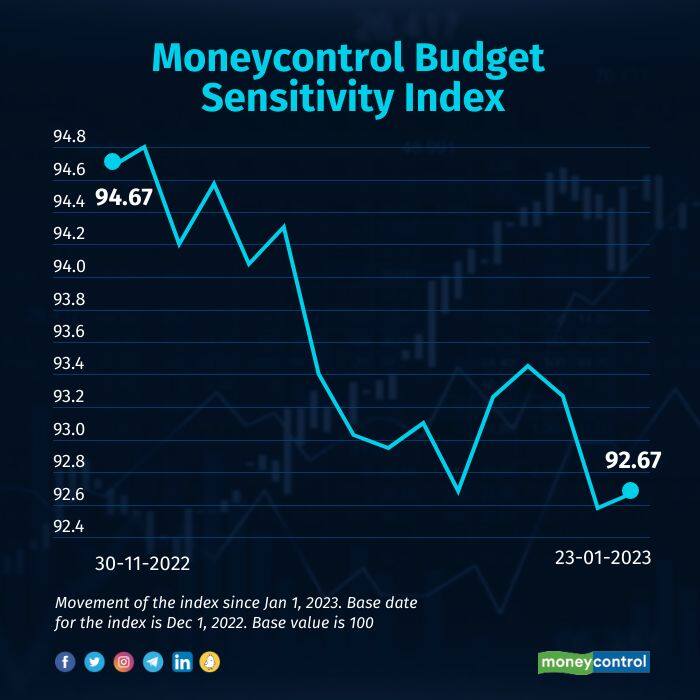

Many would argue that stock markets are only a small part of the Indian economy and that, many a time, the forces that govern stock-market performance are far removed from the real economy and that it is not impacted by what the government may or may not do. But, in the short-term, the Union Budget continues to be a big event for which traders position themselves, building in expectations from the Finance Minister’s announcements into stock prices. The post-Budget reaction is therefore a commentary on what is factored into stock prices prior to the Budget. To track this market behaviour, Moneycontrol brings to you a novel barometer--the Moneycontrol Budget Sensitivity Index.

Check out Moneycontrol's Budget Blog here

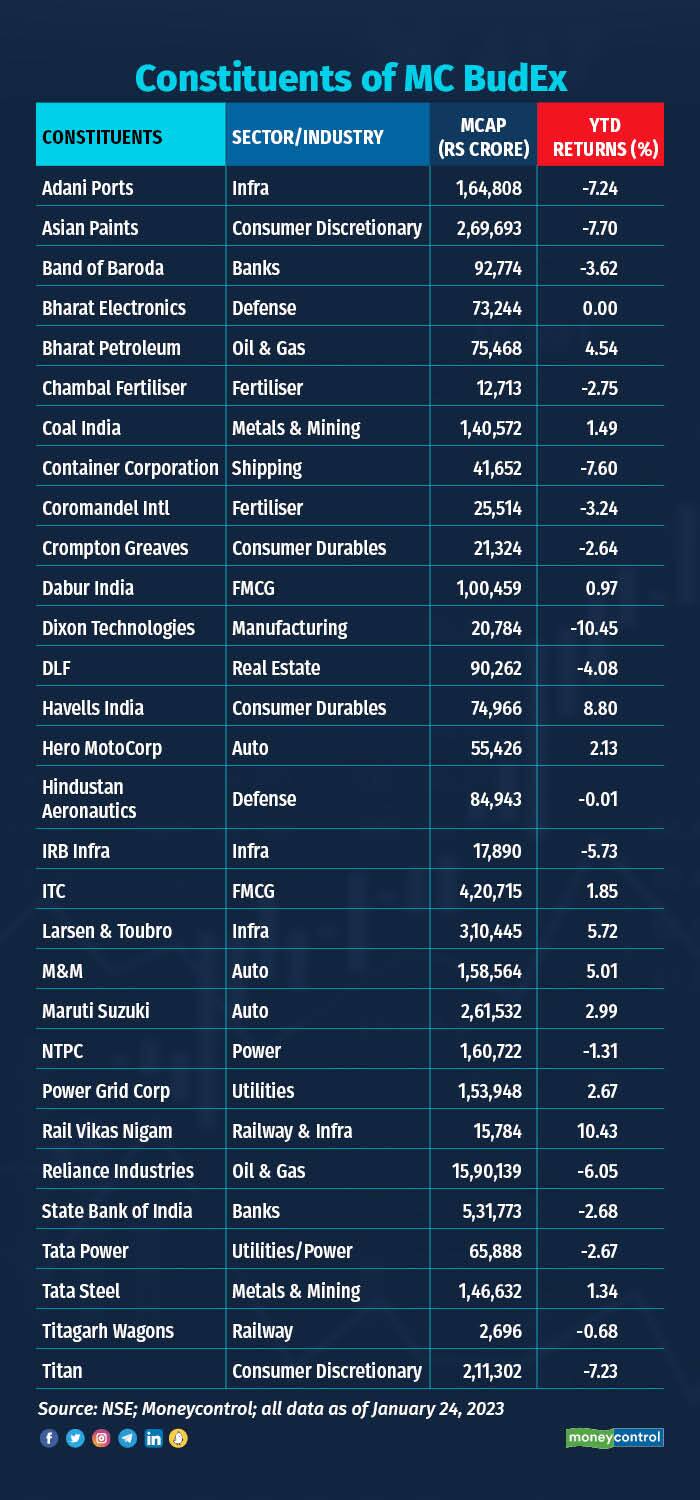

The barometer will capture how expectations from the Budget are getting priced into the stock market. The index constituents have been picked after many conversations with dozens of stock-market participants, and after back-testing data for the past seven years to see how sensitive stocks were to the Budget relative to the rest of the market. The index has a sprinkling of stocks from the infrastructure universe including defence and railways; public sector undertaking including some divestment candidates; banks; consumer staples and discretionary spends; and agriculture and fertiliser industries.

The stocks in the index are sensitive to the Budget either because policy changes and tax tweaks can significantly and directly impact their financial performance, or can significantly and indirectly impact their financial performance by way of an uptake in consumption or investment activity in the economy, and the overall business environment.

We have constructed this index giving equal-weights for the 30 chosen stocks to ensure that the index is not skewed by mega-cap and large-cap companies. Instead, the index captures the broad market action, be it driven by small stocks or big ones.

Methodology

As stated earlier, we back tested the data for last seven Union Budget. Why seven? Since the the government shifted the date of Budget to Feb 1, we have seen seven budgets.

We saw how how each S&P BSE thematic and sectoral index performed in 35-day period and 50-day period beginning January. We tried to find out which sectors and indices were the most sensitive towards the Budget.

After discussing our findings internally and with market experts, we picked 30 stocks from these indices that broadly capture the market movement ahead of and after the Budget.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.