Latest mutual fund trend for July has shown a strong growth of 81 percent in net equity inflow at Rs 42,702.35 crore compared to Rs 23,568 crore a month ago, data released by AMFI on August 11 has shown, which is a record high.

The inflows have been broad-based across most equity categories, signalling renewed investor appetite after a relatively moderate June.

This marks the 53rd straight month of positive flows into equity schemes. On the back of mark-to-market (MTM) gains in equities, the mutual fund industry’s overall net assets under management (AUM) hit an all-time high of Rs 75.35 lakh crore in July, up from Rs 74.41 lakh crore in June, Rs 72.20 lakh crore in May, and Rs 69.99 lakh crore in April.

“The total Assets under Management grew by 1.3% to Rs 75.36 Lakh Crores, despite pressures from strong US Dollar and persistent foreign fund outflows. This is a testament to sustained investor confidence and disciplined participation,” said Venkat N Chalasani, Chief Executive, AMFI.

Retail participation saw growth with total mutual fund folios rose to 24.57 crore in July from 24.13 crore in June. A total of 30 schemes were launched in the month of July 2025, all open-ended and across categories, raising a total of Rs 30,416 crores

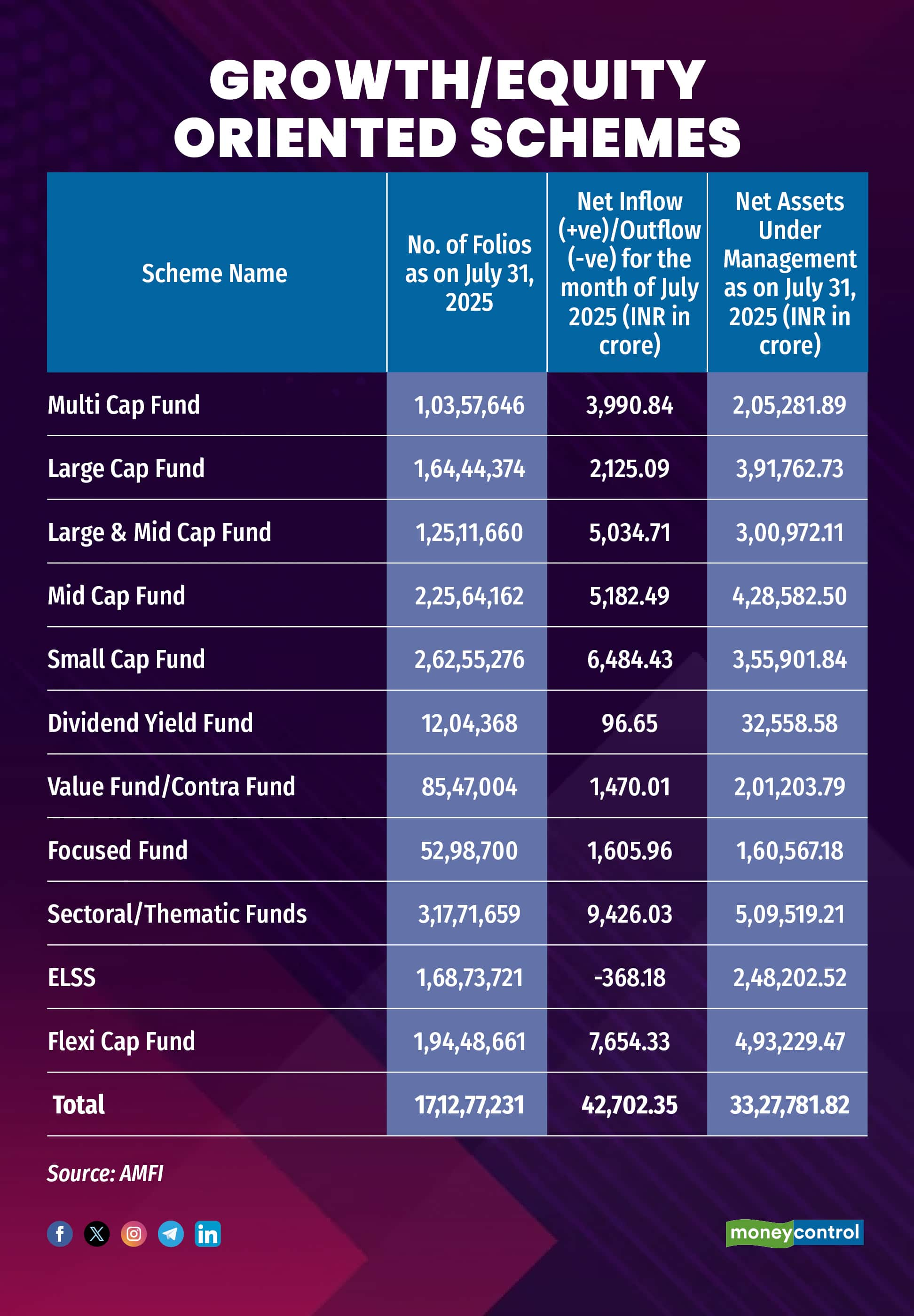

Equity Funds

In June, equity mutual fund inflows had risen 24% to Rs 23,587 crore after a sharp 22 percent decline in May. The rise in equity flows reflect a steady investor sentiment despite global uncertainties.

“Equity (including hybrid) net sales zoomed to more than Rs 45000 crores in July, 2025. Series of new fund offers and SIP inflows lead to this high number. Domestic investors continue to keep their faith in mutual fund schemes and SIPs. The distribution community continue to educate the investors on long term benefits of staying invested in mutual funds and use SIPs as an effective medium of equity investing," says Manish Mehta, National Head - Sales, Marketing & Digital Business, Kotak Mahindra AMC.

Small-cap schemes led the increase with Rs 6,484.43 crore in July inflows, compared to Rs 4,024 crore in June, an increase of around 61 percent. Flexicap funds saw Rs 7,654.33 crore in net investments, up 33 percent from Rs 5,733 crore. Midcap funds attracted Rs 5,182.49 crore, which is 38 percent higher than June’s figure of Rs 3,754 crore.

Large and midcap funds saw inflows of Rs 5,034.71 crore, more than doubling from Rs 3496 crore in June. Largecap funds rose modestly to Rs 2,125.09 crore from Rs 1,694 crore, up 30 percent over the month.

Sectoral and thematic funds registered the largest gain, pulling in Rs 9,426.03 crore in July versus Rs 474 crore in June.

ELSS schemes continued to record net outflows, but the Rs 368.18 crore withdrawn in July was an improvement over an outflow of Rs 556 crore seen in June.

Retail AUM (Equity + Hybrid + Solution Oriented Schemes) stood at Rs 43.90 lakh crore for July 2025 while the May 2025 AUM was Rs 43.99 crore.

Hybrid funds

Hybrid funds saw inflows of Rs 20,879 crore in July vs Rs 23,223 crore in June and Rs 20,765 crore in May. Arbitrage funds showed Rs 7,295 against 15,584 crore inflows in June.

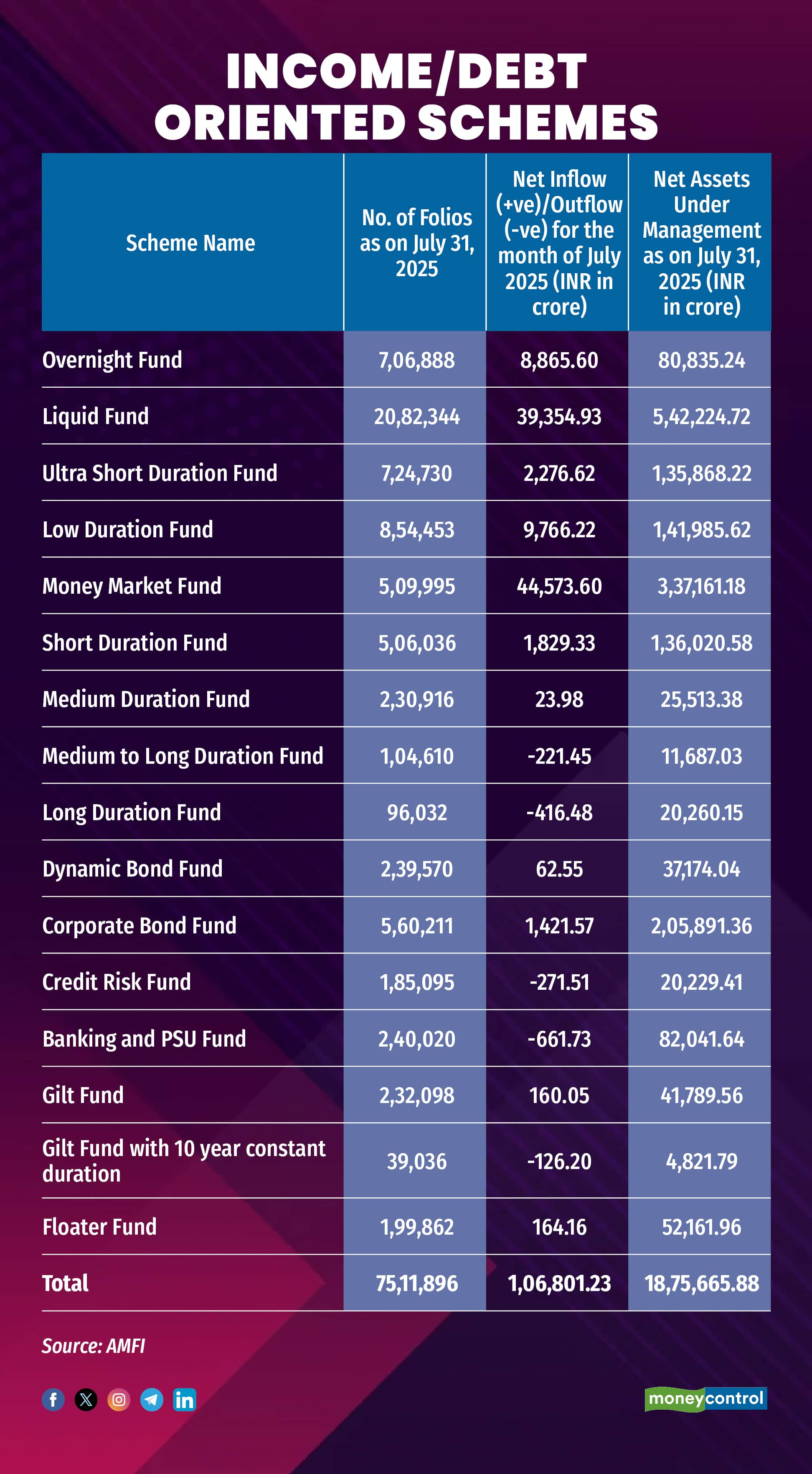

Debt funds

Open-ended debt funds posted net inflows of Rs 1,06,801 crore in July. Liquid Funds saw inflow of Rs 39,354 crore vs outflow of Rs 25,196 crore in June.

Debt Funds

Debt Funds

Short Duration Fund saw an inflow of Rs 1,829 compared to Rs 10,277 crore in June. Money Market Fund saw an inflow of Rs 44,573 crore vs Rs 9,484 crore in June. Similarly, Corporate Bond Funds witnessed Rs 1,421.57 crore against Rs 7,124 crore in June.

Gold ETFs and other ETFs

Gold ETFs recorded inflows of Rs 1,256 crore in July vs Rs 2,080.9 crore in June. Other ETFs saw inflows of Rs 4,476 crore from Rs 844 crore in June.

SIP Book

The SIP AUM was at Rs 15.19 lakh crore for the month of July 2025 with SIP contribution for July 2025 stood at Rs 28,464.03 crore. The number of contributing SIP accounts stood at 9,11,18,391 crores in July 2025.

“SIP contributions hit a new record of Rs 28,464 crore, and contributing accounts grew 5.4% to 9.11 crore — clear evidence of disciplined investing even amid volatility,” said Chalasani

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.