January 16, 2019 / 15:33 IST

Market at close:

Benchmark indices ended the volatile day on flat note with Nifty closed below 10,900, while Sensex finished near day's lowpoint.

The Sensex was up 2.96 points at 36321.29, while Nifty was up 3.50 points at 10890.30. About 1208 shares have advanced, 1345 shares declined, and 144 shares are unchanged.

Indiabulls Housing, Yes Bank, Wipro, IndusInd Bank and BPCL are the top gainers on the Nifty, while JSW Steel, Bharti Infratel, Bajaj Finance, UPL and Vedanta are the top losers on the Nifty.

January 16, 2019 / 15:18 IST

JUST IN

|OnMobile Global announced the renewal of its contract with Telefonica Moviles Espana, SAU (Telefonica) for another five years.

January 16, 2019 / 14:42 IST

JUST IN |

DCB Bank Q3 net profit at Rs 86.1 crore, NII at 293.6 crore. Net NPA at Rs 163.4 crore.

January 16, 2019 / 14:23 IST

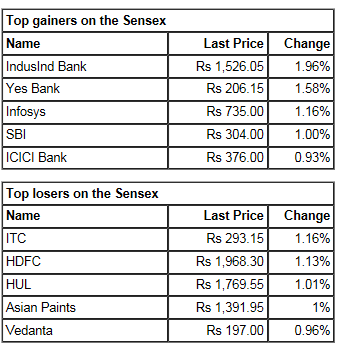

Top gainers and losers on the Sensex:

January 16, 2019 / 13:57 IST

HT Media Q3:

Consolidated net profit was down 68.7% at Rs 42.9 crore, revenue was down 3.3% at Rs 589 crore.

January 16, 2019 / 13:38 IST

Rupee Update

The Indian rupee is trading near the day's low at 71.15 per dollar. It touched 71.24 intraday Wednesday.

January 16, 2019 / 13:21 IST

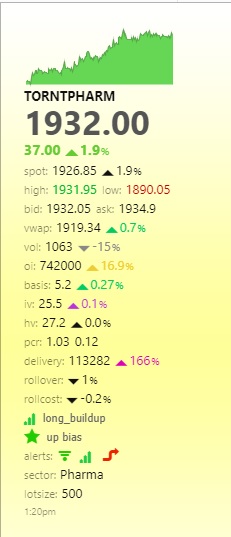

Long buildup is visible on the stock of Torrent Pharma.

January 16, 2019 / 13:04 IST

JUST IN |

According to reports by CNBC-TV18, SBI has put loans of Essar Steel, worth Rs 15,400 crore, on the block.

January 16, 2019 / 12:35 IST

Indiabulls Integrated Services Locked in Upper Circuit

Indiabulls Integrated Services shares were locked in 5 percent upper circuit at Rs 332.05 after receiving R1 acceptance from the insurance regulator for its life insurance business.

"Company's wholly owned subsidiary Indiabulls Life Insurance Company Limited has received regulatory R1 acceptance from Insurance Regulatory and Development Authority of India (IRDAI) for its proposed life insurance business," the Indiabulls Group company said in its filing.

Therefore, the company is in the process of putting in place the necessary systems and move ahead with the next step of filing its application for registration (R2) with IRDAI to undertake life insurance business in India.

January 16, 2019 / 11:49 IST

RIL Q3 PREVIEW

Oil-retail-to-telecom conglomerate Reliance Industries is expected to report strong set of earnings for the quarter-ended December 2018 driven by retail, telecom and petrochemical businesses. But slightly weak performance in refining segment may impact profitability.

The country's largest company by market capitalisation will announce its December-quarter earnings on January 17. The key data points to look at in results would be the growth in retail, telecom and petrochemical businesses.

"Petrochemical segment is expected to do better due to healthy deltas and strong volume growth in the segment. Positive developments in the telecom and retail segments should drive growth further for the company," Motilal Oswal said.

Antique Stock Broking said consolidated profit could be marginally higher QoQ (and up 3 percent YoY) on robust profitability in retail segment, coupled with healthy earnings in Jio, lower interest cost and higher other income. This could offset weakness in refining and petrochemical margins.