It’s a strong start to the week, with the Sensex ending over 300 points higher, while the Nifty surged past 10,750 on the back of intense buying.

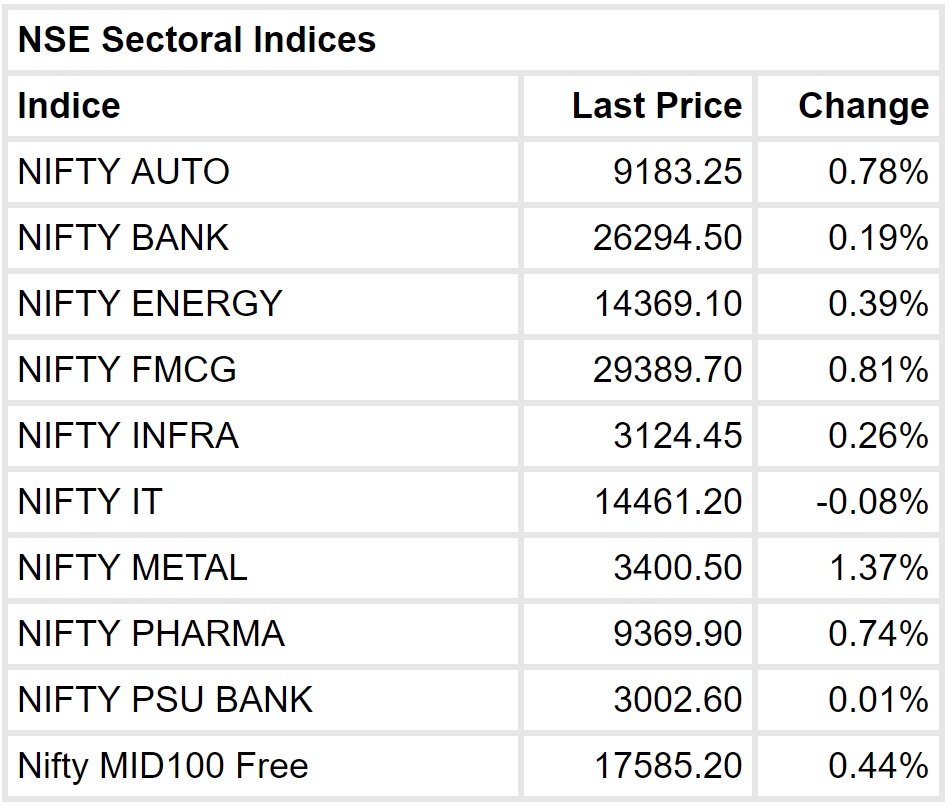

Buying counters were buzzing among sectors such as automobiles, consumption, energy, infrastructure, IT, metals and pharmaceuticals as well. In the broader markets, the Nifty Midcap index rose around half a percent.

Financials saw a rally as news reports indicated that the central bank was open to tweaking/review of PSU banks’ prompt corrective action (PCA) plan.

At the close of market hours, the Sensex closed up 317.72 points or 0.90% at 35774.88, while the Nifty was higher 81.20 points or 0.76% at 10763.40. The market breadth was narrow as 1,330 shares advanced, against a decline of 1,278 shares, while 160 shares were unchanged.

Yes Bank and ITC were the top gainers, while ONGC, ICICI Bank, Indiabulls Housing and GAIL lost the most.