LiveNow

Closing Bell: Nifty above 25,000, Sensex hits 82k on another record-breaking day; oil & gas gains

Market ends higher for the fifth straight session

Indian benchmark indices ended higher for the fifth straight session on August 1. At close, the Sensex was up 126.21 points or 0.15 percent at 81,867.55, and the Nifty was up 59.70 points or 0.24 percent at 25,010.90.

We wrap up today's edition of the Moneycontrol live market blog, and will be back tomorrow morning with all the latest updates and alerts. Please visit https://www.moneycontrol.com/markets/global-indices/ for all the global market action.

Rupak De, Senior Technical Analyst, LKP Securities

The Nifty remained range-bound during the day before closing above 25,000 for the first time. The sentiment remains positive as it closed above the short-term moving average. The RSI is in a bullish crossover while entering the overbought zone, indicating the possibility of profit booking. On the lower end, support is placed at 24,900. On the higher end, resistance is placed at 25,100/25,250.

Prashanth Tapse, Senior VP (Research), Mehta Equities

Overnight gains in the US markets and ongoing optimism over the strong corporate earnings aided benchmark indices to scale fresh all-time highs with Nifty clocking the milestone of 25k mark and Sensex entering the 82k zone. However, weak European market cues and mixed Asian indices tempered the domestic market gains at close. Overall trading session was skewed with most of the broader and sectoral indices faltering amid profit-taking whereas metals, oil & gas and power stocks notched up gains, indicating that investors are now getting into cherry picking of stocks instead of mounting full-fledged bullish bets.

Ajit Mishra – SVP, Research, Religare Broking

Markets edged higher amid a consolidation bias and closed slightly in the green. On the benchmark front, Nifty crossed a new milestone of 25,000 in early trading, followed by a range-bound move until the end. Meanwhile, the sectoral trend remained mixed, with energy and healthcare posting decent gains, while realty and auto saw declines. Additionally, profit-taking in the broader indices kept traders on their toes.

Nifty is now approaching its immediate hurdle at 25,100 and will need fresh triggers to surpass this level. While buoyancy in the global markets, particularly in the US, is encouraging, the underperformance of banking majors is limiting momentum. We continue to advocate a "buy on dips" strategy, emphasizing careful stock selection.

Jatin Gedia – Technical Research Analyst at Sharekhan by BNP Paribas

Nifty opened on gap up today and consolidated for the day to close with gains of ~60 points. On the daily charts we can observe that the Nifty has broken out of a sideways consolidation on the upside. This breakout suggests resumption of upmove after a brief pause. We expect the rally to continue towards 25330 – 25530 from short term perspective. Crucial support now stands at 24850 – 24800. Divergence between the daily and hourly momentum indicator can lead to a consolidation however price action is suggesting a breakout and hence we shall assign more weightage to the price action and continue to maintain our positive outlook on the Nifty.

Bank Nifty continued to witness rangebound price action. The consolidation has taken form of a symmetrical triangle pattern. A range breakout shall decide the further trend hereon. Thus, shall maintain our rangebound outlook for the Bank Nifty. The range of consolidation for the Bank Nifty is likely to be 51300 – 52000.

Vinod Nair, Head of Research, Geojit Financial Services

The benchmarks started positive taking cues from the global market following the Fed Chair’s indication that a rate cut might be considered at the September meeting due to easing inflationary pressures. However, the broader market closed on a negative bias due to escalating geopolitical tensions in the Middle East leading to rising crude oil prices. Sector-wise, capital goods and realty were impacted by profit-booking coupled with auto sectors owing to below-expected monthly auto sales figures.

Aditya Gaggar Director of Progressive Shares

Indian bourses began the August month on a strong note above the psychological barrier of 25,000. But, negative divergence in RSI pulled the Index lower to settle the trade at 25,010.90 with gains of 59.75 points.

Among the sectors, Energy was the top gainer while Media and Realty corrected the most. Broader markets underperformed the Frontline Index as Mid and Smallcaps corrected by 0.85% & 0.98% respectively.

The Index has formed a Spinning Top candlestick pattern which represents indecisiveness where the downside seems to be protected at 24,930 while the immediate resistance is placed at 25,100.

Currency Check | Rupee closes flat

Indian rupee ended flat at 83.72 per dollar on Thursday versus Wednesday's close of 83.72.

Market Close | Nifty above 25,000, Sensex hits 82k on another record-breaking day; oil & gas gains

Indian benchmark indices ended higher for the fifth straight session on August 1.

At close, the Sensex was up 126.21 points or 0.15 percent at 81,867.55, and the Nifty was up 59.70 points or 0.24 percent at 25,010.90. About 1237 shares advanced, 2181 shares declined, and 78 shares unchanged.

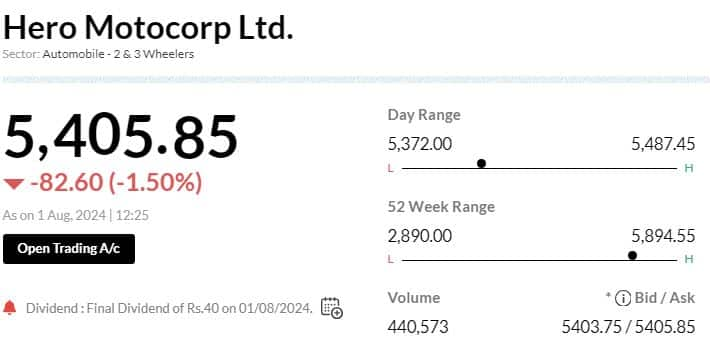

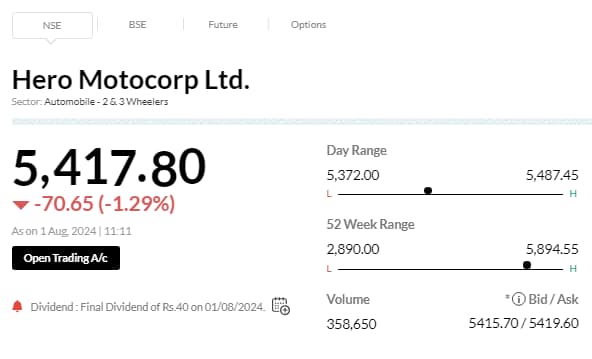

Coal India, Power Grid Corp, Shriram Finance, Dr Reddy's Labs and ONGC were among the top gainers on the Nifty, while losers were M&M, Hero MotoCorp, Tata Steel, Bajaj Finserv and SBI.

Among sectors, auto, capital goods, IT, media, telecom, PSU Bank and realty down 0.5-2 percent, while buying was seen in the metal, oil & gas, power and energy.

The BSE midcap and smallcap indices shed nearly 1 percent each.

Sensex Today | NMDC July production down 11%, sales jump 5%

#1 Production down 11% at 2.17 mt Vs 2.44 mt, YoY

#2 Sales up 5% at 3.1 mt Vs 2.9 mt, YoY

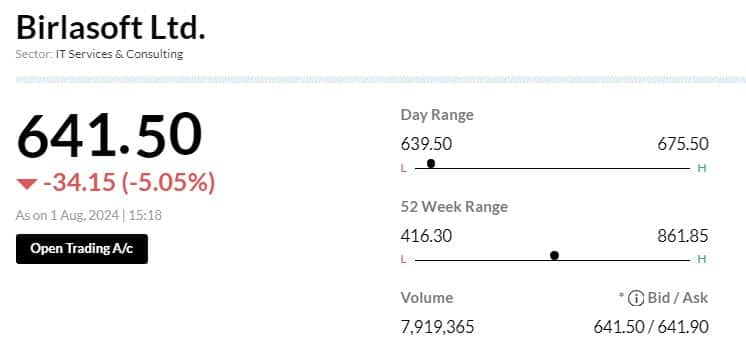

Brokerage Call | Nomura keeps 'buy' rating on Birlasoft, target Rs 800

#1 Delay in ramp-up of deal wins & discretionary slowdown hurt growth

#2 Q1 revenue & margin below estimates

#3 Margin disappointment driven by delay in ramp-up

#4 Cut FY25-26 EPS by 7-9 percent

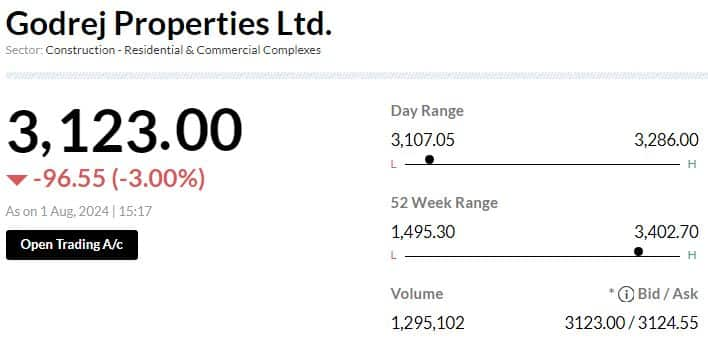

Brokerage Call | Morgan Stanley keeps 'overweight' rating on Godrej Properties, target Rs 3,200

#1 Company achieved 32 percent of FY25 pre-sales guidance in Q1

#2 Results suggest upside to full-year numbers, with embedded margin being higher than FY24

#3 Strong launch pipeline should support growth

Sensex Today | TVS Motor July total sales at 3.54 lakh units

Sensex Today | Sun Pharmaceutical shares trade flat ahead of Q1 earnings

Earnings Watch | Zomato Q1 net profit at Rs 253 crore Vs Rs 2 crore, YoY

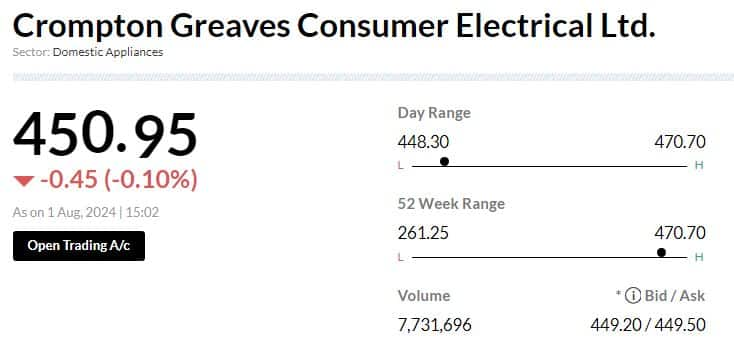

Brokerage Call | Nomura keeps 'buy' on Crompton Greaves Consumer Electrical, target Rs 498

#1 Q1 EBITDA above estimates

#2 Expect revenue growth momentum to normalise to 12-13 percent YoY

#3 Rising share of premium products across categories can support growth

#4 Success in solar/agri pumps & appliances, & recovery in butterfly can support growth

#5 Price hikes & operating leverage should drive EBITDA margin from 11 percent in FY24 to 11.8 percent by FY27

#6 EPS estimate slightly revised up by 2-3 percent over FY25-26

Markets@3 | Sensex, Nifty marginally higher

The Sensex was up 71.01 points or 0.09 percent at 81,812.35, and the Nifty was up 44.40 points or 0.18 percent at 24,995.60.

Sensex Today | 3.2 million shares of Tata Steel traded in another block: Bloomberg

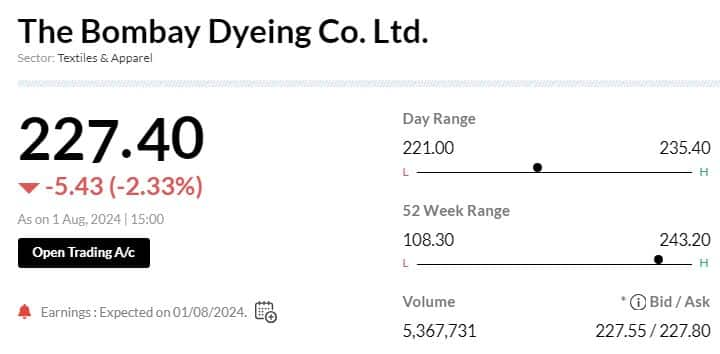

Earnings Watch | Bombay Dyeing Q1 net profit at Rs 15.4 crore Vs loss of Rs 119.8 crore, YoY

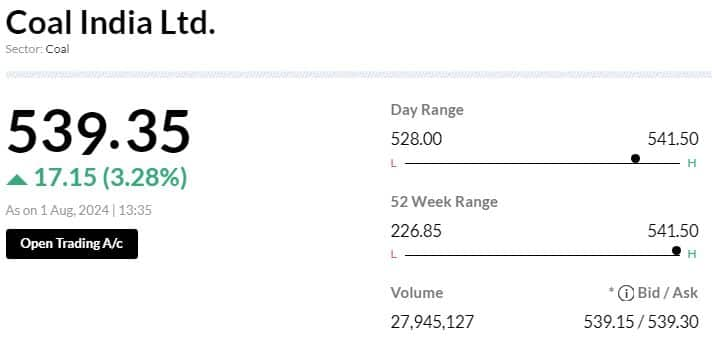

Stock Market LIVE Updates | Coal India shares gain post July business update

#1 July production up 2.5 percent at 55 mt vs 53.7 mt, YoY

#2 July offtake up 0.2 percent at 59.6 mt vs 59.5 mt, YoY

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Suzlon Energy | 67.10 | -3.24 | 8.49m |

| Lakshmi Machine | 15,143.00 | -3.14 | 633 |

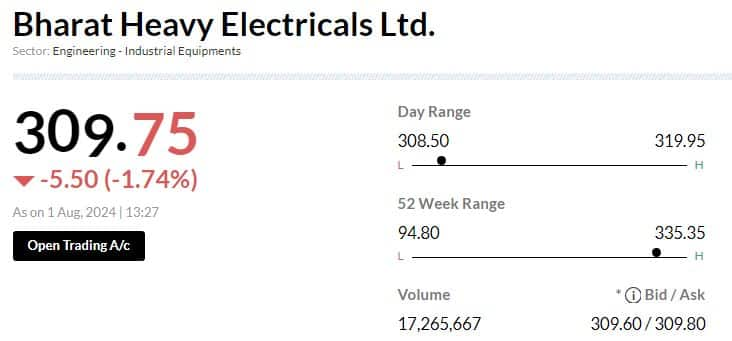

| BHEL | 306.20 | -2.95 | 1.68m |

| Schaeffler Ind | 4,163.55 | -2.44 | 3.91k |

| Bharat Elec | 308.50 | -2.37 | 1.04m |

| AIA Engineering | 4,522.10 | -2.26 | 2.15k |

| Hindustan Aeron | 4,812.60 | -2.23 | 53.59k |

| ABB India | 7,750.40 | -1.78 | 3.24k |

| CG Power | 723.35 | -1.75 | 101.28k |

| Siemens | 7,009.80 | -1.68 | 12.08k |

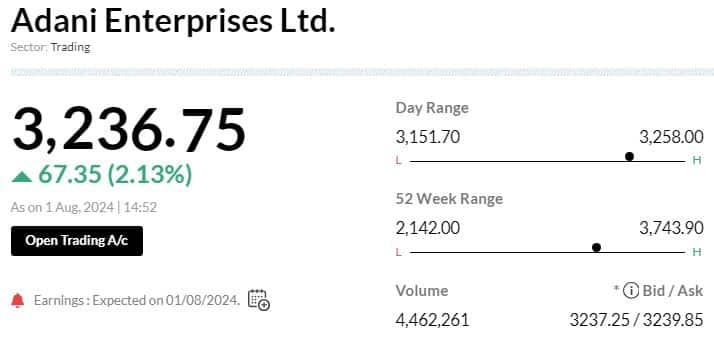

Earnings Watch | Adani Enterprises Q1 net profit at Rs 1,455 crore Vs Rs 674 crore, YoY

The company board approves demerger of food FMCG business

Above 25,000, Nifty may further rise to 25,200-25,400: Mandar Bhojane, Equity Research Analyst at Choice Broking

Nifty has hit the 25,000 mark for the first time, reaching a high of 25,078.30 before experiencing sharp selling at these all-time high levels. The 24,950 level is expected to act as immediate support. If the price closes above the 25,000 level, it could further rise to the 25,200 and 25,400 levels. Every dip presents a buying opportunity, especially near the 24,800 and 24,600 levels. The market is anticipated to remain strongly bullish above 24400 levels.

The Relative Strength Index (RSI) is trading at 73, indicating a strong bullish trend. However, since it is near the overbought zone, caution is advised.

By the end of this year, levels of 25,600 and 26,000 are expected to be reached. Investors are advised to hold and trail their positions. Those participating in Systematic Investment Plans (SIP) can also continue their investments for the long run, as every dip will be a buying opportunity in case of any correction.

Earnings Watch | Prince Pipes Q1 net profit jumps 25.5% at Rs 24.6 crore Vs Rs 20 crore, YoY

Earnings Watch | Hikal Q1 net profit down 26%a t Rs 5.1 crore Vs Rs 7 crore, YoY

Earnings Alert | Escorts Kubota Q1 net profit up 2% to Rs 289.50 crore

#1 Net Profit up 2.4% at Rs 289.5 crore Vs Rs 283 crore (YoY)

#2 Revenue up 1.5% at Rs 2,292.5 crore Vs Rs 2,327.7 crore (YoY)

#3 EBITDA Flat at Rs 327 crore (YoY)

#4 Margin at 14.3% Vs 14% (YoY)

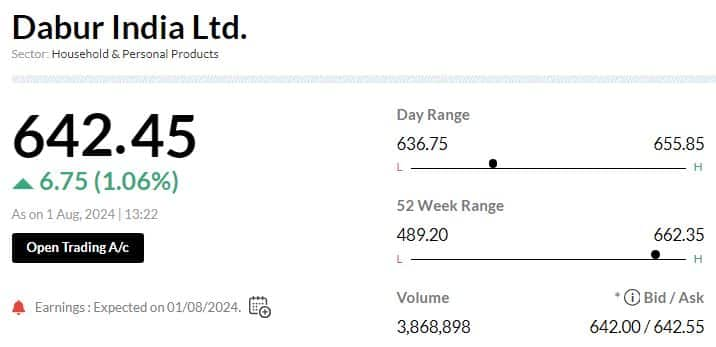

Earnings Alert | Dabur India Q1 net profit at Rs 500 crore

#1 Net Profit up 7.8% at Rs 500 crore vs Rs 464 crore (YoY)

#2 Revenue up 7% at Rs 3,349 crore vs Rs 3,130.5 crore (YoY)

#3 EBITDA up 8.3% at Rs 655 crore vs Rs 604.7 crore (YoY)

#4 Margin at 19.6% vs 19.3% (YoY)

Earnings Alert | Sun Pharma Q1 net profit surges 40%, revenue rises 6%

#1 Net Profit up 40.2% at Rs 2,835.6 cr vs Rs 2,022.5 cr (YoY)

#2 Revenue up 6% at Rs 12,652.7 cr vs Rs 11,941 cr (YoY)

#3 EBITDA up 8.3% at Rs 3,607.5 cr vs Rs 3,331.7 cr (YoY)

#4 Margin at 28.5% vs 27.9% (YoY)

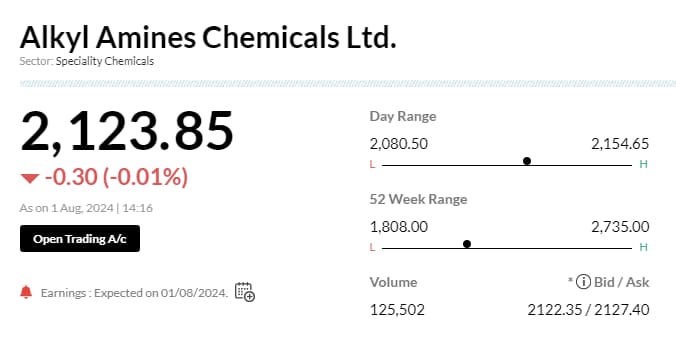

Earnings Alert | Alkyl Amines Q1 net profitt, revenue down 2%

#1 Net Profit down 2% at Rs 49 cr vs Rs 50 cr (YoY)

#2 Revenue down 2.4% at Rs 400 cr vs Rs 410 cr (YoY)

#3 EBITDA up 7.2% at Rs 79.4 cr vs Rs 74 cr (YoY)

#4 Margin at 20% vs 18% (YoY)

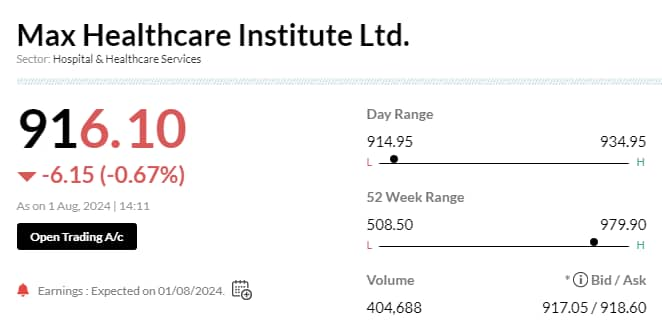

Earnings Alert | Max Healthcare Q1 net profit falls marginally, revenue up 20%

#1 Net Profit down 1.5% at Rs 236.3 cr vs Rs 240 cr (YoY)

#2 Revenue up 20.1% at Rs 1,543 cr vs Rs 1,285 cr (YoY)

#3 EBITDA up 14.8% at Rs 387.5 cr vs Rs 337.4 cr (YoY)

#4 Margin at 25.1% vs 26.3% (YoY)

Markets@2 | Sensex, Nifty erase gains, trade flat

The Sensex was up 30.12 points or 0.04 percent at 81,771.46, and the Nifty was up 30 points or 0.12 percent at 24,981.20. About 1350 shares advanced, 2055 shares declined, and 77 shares unchanged.

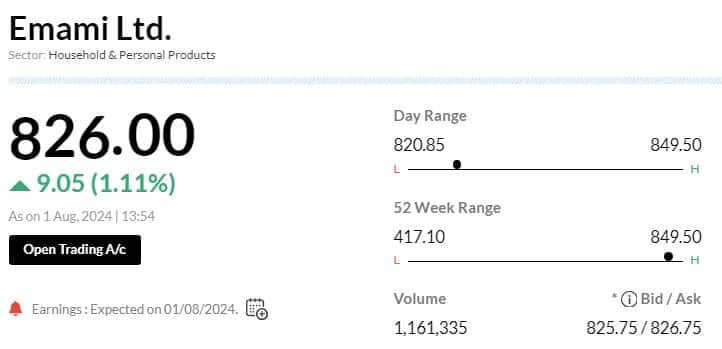

Earnings Watch | Emami Q1 net profit up 11% at Rs 152.6 crore Vs Rs 137.7 crore, YoY

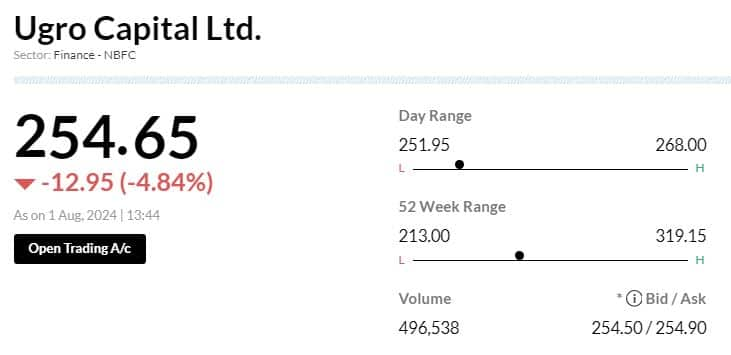

Stock Market LIVE Updates | Ugro Capital shares fall post Q1 results

#1 Net Profit up 20.6 percent at Rs 30.4 crore versus Rs 25 crore, YoY

#2 Net Income up 38.2 percent at Rs 301.6 crore versus Rs 218 crore, YoY

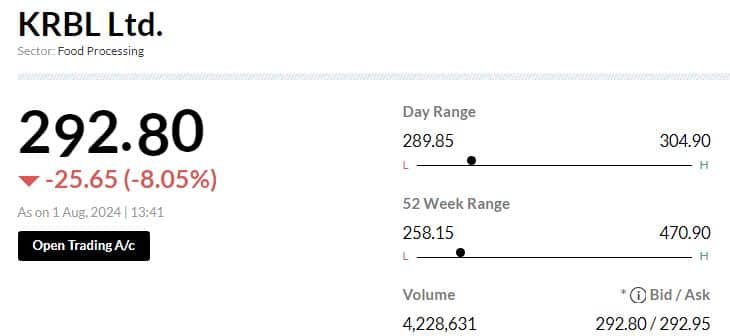

Stock Market LIVE Updates | KRBL shares fall 8% as Q1 profit declines 54%

#1 Net Profit down 54.8 percent at Rs 87 crore versus Rs 191.7 crore, YoY

#2 Revenue down15.2 percent at Rs 1,199.2 crore versus Rs 1,414.2 crore, YoY

Brokerage Call | Jefferies keeps 'buy' rating on Maruti Suzuki, target raises to Rs 15,200

#1 Q1 EBITDA & recurring PAT rose 36-39 percent YoY & were 11-12 percent above estimates

#2 EBITDA & recurring PAT growth led by better-than-expected ASP and margin

#3 PV Industry growth has moderated from 27 percent YoY in FY23 to 8 percent in FY24 & to just 3 percent in Q1

#4 Company’s CNG portfolio is performing well

#5 Company continues to face headwind of industry demand shifting to SUVs

#6 Raise FY25-27 EPS by 1-3 percent; tax cut on hybrids is an upside risk

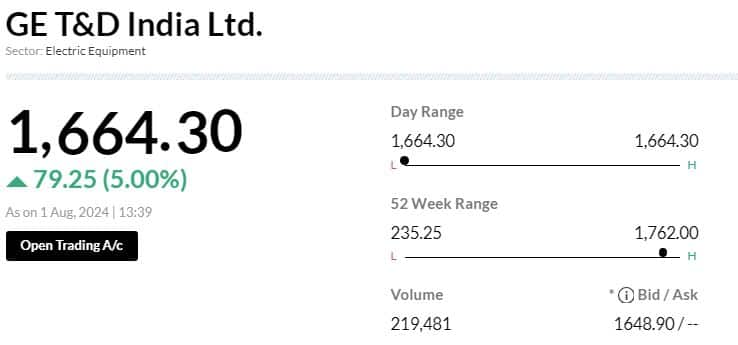

Stock Market LIVE Updates | GE T&D India shares gain 5% post Q1 profit rises

#1 Net profit at Rs 134.5 crore versus Rs 28 crore, YoY

#2 Revenue up 33.5 percent at Rs 958.3 crore versus Rs 717.6 crore, YoY

Earnings Watch | Arvind Fashions reports 14 crore profit in Q1 against loss of Rs 450 crore, YoY

Stock Market LIVE Updates | Coal India shares gains post Q1 earnings

#1 Net profit up 4.2 percent at Rs 10,943.5 crore versus Rs 10,498.4 crore, YoY

#2 Revenue up 1.3 percent at Rs 36,464.6 crore versus Rs 35,983.2 crore, YoY

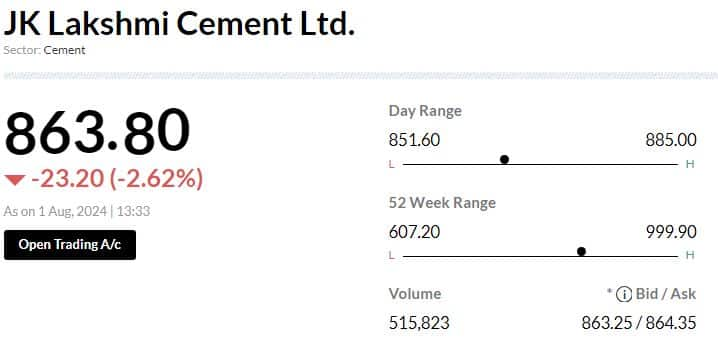

Stock Market LIVE Updates | JK Lakshmi Cement Q1 profit rises; stock trades lower

#1 Net profit at Rs 156.3 crore versus Rs 74.9 crore, YoY

#2 Revenue down11.6 percent at Rs 1,444.5 crore versus Rs 1,633.3 crore, YoY

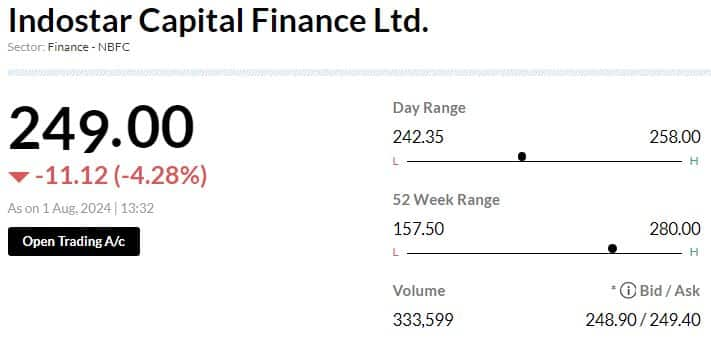

Stock Market LIVE Updates | Indostar Capital Finance shares down 4% after Q1 profit dips 65%

#1 Net profit down 65.1 percent at Rs 10.8 crore versus Rs 31 crore, YoY

#2 Revenue up 27.1 percent at Rs 137.4 crore versus Rs 108.1 crore, YoY

Earnings Watch | Datamatics Global Services Q1 profit at Rs 44 crore versus RS 53 crore, QoQ

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on BHEL, target Rs 220

#1 Q1 was a weak set

#2 Q1 key takeaways include power & industry segment EBIT margin

#3 Adjusted, PAT loss of Rs 210 crore was higher than estimates

Sensex Today | Dabur India shares trade higher ahead of Q1 earnings

Brokerage Call | Nomura maintains 'buy' rating on M&M, target Rs 3,417

#1 SUV growth to be well ahead of industry

#2 Q1 average selling prices miss but better margin versus consensus

#3 Success of Thar Roxx + BEVs & rural revival, key catalysts

#4 Current valuation at 14x FY26 EV/EBITDA (adjusted for subsidiaries), versus peers at 15-22x

#5 Current valuation appears attractive given 16 percent core EPS CAGR over FY24-27F

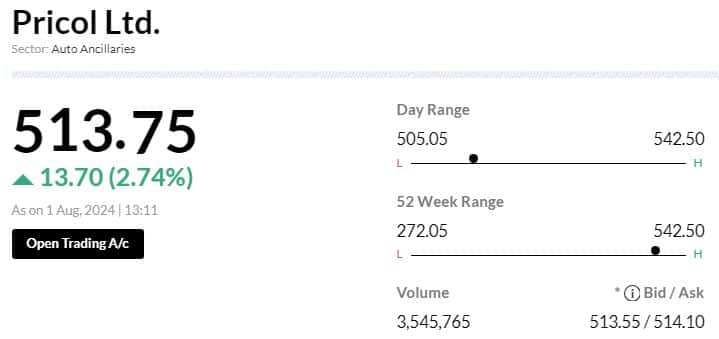

Stock Market LIVE Updates | Pricol shares gain 2% after Q1 profit jumps 42%

#1 Net profit up 42.7 percent at Rs 46 crore versus Rs 32 crore, YoY

#2 Revenue up 15.4 percent at Rs 620 crore versus Rs 537.2 crore, YoY

Brokerage Call | HSBC maintains 'buy' rating on GAIL, target raises to Rs 285

#1 Q1 beat consensus, led by robust marketing profitability, which can surpass full-year guidance

#2 Global supply increasing should support domestic gas demand

Brokerage Call | CLSA keeps 'hold' rating on Zee Entertainment, target Rs 150

#1 Q1 consol revenue of up 7 percent YoY, was above estimates

#2 Ad revenue declined 3 percent YoY due to cricket and the elections

#3 Company’s India subscriptions was up 10 percent YoY, with positive surprise led by movies revenue

#4 OTT/ZEE5 revenue was up 15 percent YoY & EBITDA loss diluted its consolidated margin

Stock Market LIVE Updates | Relaxo Footwears shares fall post Q1 results

#1 Net profit down21.1 percent at Rs 44.4 crore versus Rs 56 crore, YoY

#2 Revenue up 1.3 percent at Rs 748.2 crore versus Rs 738.8 crore, YoY

Markets@1 | Sensex, Nifty trade higher

The Sensex was up 103.12 points or 0.13 percent at 81,844.46, and the Nifty was up 51.10 points or 0.20 percent at 25,002.30. About 1363 shares advanced, 2005 shares declined, and 91 shares unchanged.

Stock Market LIVE Updates | Sonata Software shares down 7% after Q1 profit declines

#1 Net profit down 4.4 percent at Rs 105.6 crore versus Rs 110.4 crore, QoQ

#2 Revenue up 15.3 percent at Rs 2,527.4 crore versus Rs 2,191.6 crore, QoQ

Earnings Watch | GE Shipping Q1 profit at Rs 812 crore VS Rs 576 crore, YoY

Earnings Watch | M&M Total July auto sales up 0.5% at 66,444 units Vs 66,124 units, YoY

Stock Market LIVE Updates | Tata Motors shares fall ahead of June quarter earnings

Sun Pharma Q1 Preview: Strong US, domestic sales to aid profit growth but high R&D to drag margins

Sun Pharma's performance in the US market will be driven by ramp-up of Revlimid, resumption of supplies from Mohali unit and growth in its specialty portfolio. Back home, its robust foothold in the chronic segment promises to fuel double-digit growth....Read More

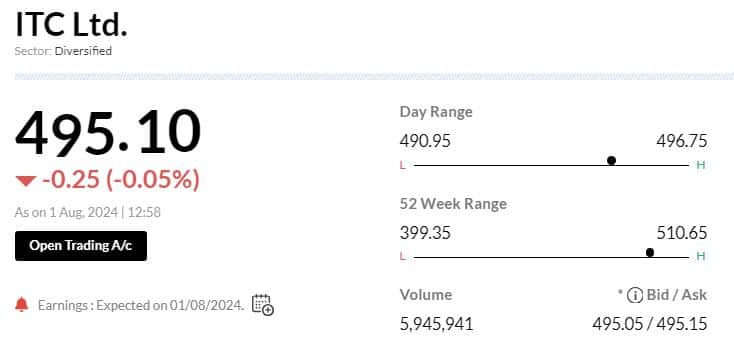

Stock Market LIVE Updates | ITC shares trade flat ahead of Q1 earnings

Sensex Today | Tata Motors, Zomato, Emami, Dabur, among others to declare earnings today

Aditya Birla Capital, Adani Enterprises, Alkyl Amines Chemicals, Arvind Fashions, Allcargo Terminals, Bharat Wire Ropes, Bombay Dyeing, Dabur India, Datamatics Global Services, Prataap Snacks, Emami, Escorts Kubota, Great Eastern Shipping, Godrej Agrovet, G R Infraprojects, Hikal, Hind Rectifiers, HPL Electric & Power, ITC, Kalyan Jewellers India, NIIT Learning Systems, Patel Integrated Logistics, Punjab Chemicals And Crop Protection, RailTel Corporation of India, RattanIndia Power, Rushil Decor, Sun Pharmaceutical Industries, Suryoday Small Finance Bank, Tata Motors, Tata Motors – DVR, Thermax, Tube Investments of India, Triveni Engineering & Industries, TV Today Network, UFO Moviez India, Welspun Enterprises, Zomato, among other to announce their June quarter earnings today.

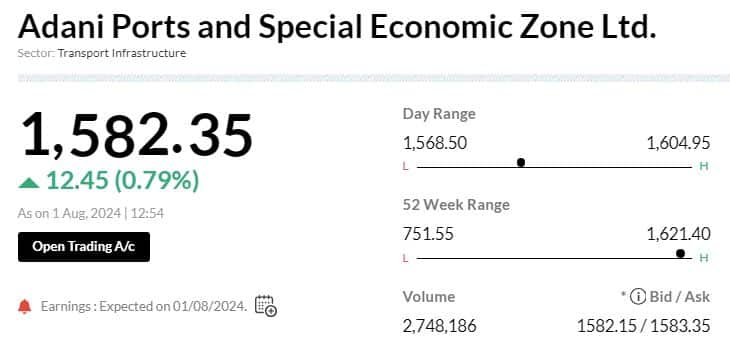

Earnings Watch | Adani Ports Q1 net profit at up 47% at Rs 3,113 crore Vs Rs 2,119 crore, YoY

Stock Market LIVE Updates | Thomas Cook shares decline 10% post Q1 results

#1 Net profit up 3.1 percent at Rs 73.1 crore versus Rs 70.9 crore, YoY

#2 Revenue up 10.9 percent at Rs 2,105.9 crore versus Rs 1,899 crore, YoY

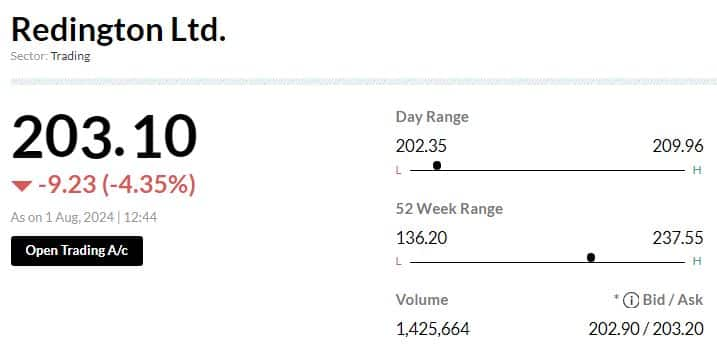

Stock Market LIVE Updates | Redington shares down 4% post Q1 earnings

#1 Net profit down 15 percent at Rs 217 crore versus Rs 255.2 crore, YoY

#2 Revenue up 0.5 percent at Rs 21,283.3 crore versus Rs 21,187.2 crore, YoY

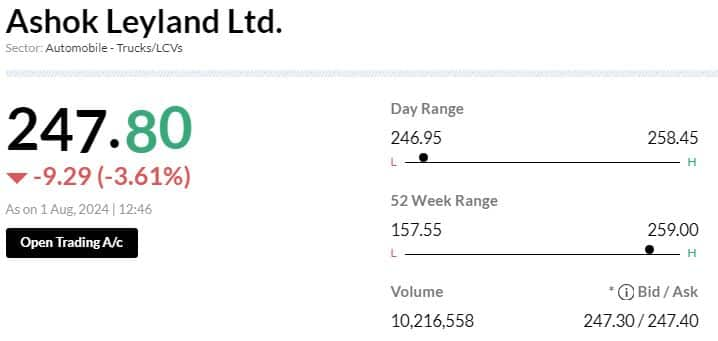

Sensex Today | Ashok Leyland total sales down 8% at 13,928 units Vs 15,068 units, YoY

Sensex Today | Nifty Midcap 100 index sheds 750 points from day's high

Brokerage Call | Morgan Stanley maintains 'overweight' rating on Maruti Suzuki, target raises to Rs 15,145

#1 In a tough quarter, company posted impressive results

#2 Trailing underperformance versus Nifty Auto, relatively lower multiples

#3 Consensus earnings estimate upgrades to drive outperformance

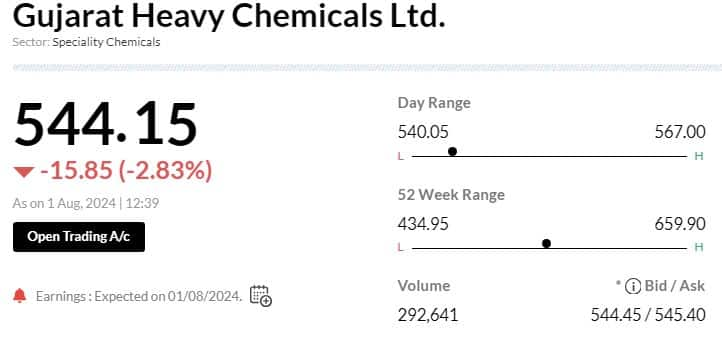

Earnings Watch | GHCL Q1 net profit down 64.7% at Rs 150.6 crore Vs Rs 426.3 crore, YoY

Stock Market LIVE Updates | Tata Investment shares fall post Q1 results

#1 Net profit up 1.4 percent at Rs 112.8 crore versus Rs 111 crore, YoY

#2 Revenue up 15 percent at Rs 141 crore versus Rs 122.6 crore, YoY

Earnings Watch | Clean Science Q1 net profit up 12% at Rs 66 crore vs Rs 59 crore, YoY

Brokerage Call | Morgan Stanley keeps 'overweight' call on M&M, target raises to Rs 3,304

#1 SUV orderbook is coming off & company won't disclose same going forward

#2 Strong product traction will keep company the fastest-growing PV play in India

#3 Farm outlook also appears to be improving

Stock Market LIVE Updates | IIFL Securities shares gain post Q1 results

#1 Net profit at Rs 182.2 crore versus Rs 75 crore, YoY

#2 Revenue up 56.4 percent at Rs 639.9 crore versus Rs 409.1 crore, YoY

Sensex Today | Hero MotoCorp commences operations in Philippines

Sensex Today | VST Tillers July total sales up 1% at 5,543 units Vs 5,506 units, YoY

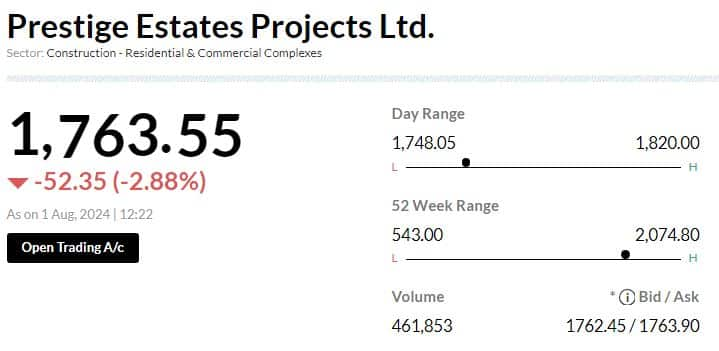

Stock Market LIVE Updates | Prestige Estates shares fall post Q1 profit declines

#1 Net profit down 3.4 percent at Rs 307 crore versus 317.8 crore, YoY

#2 Revenue up 10.8 percent at Rs 1,862.1 crore versus Rs 1,680.9 crore, YoY

Sensex Today | Bharat Forge arm Kalyani Strategic Systems (KSSL) granted defence licence from Department for Promotion of Industry & Internal (DPIIT)

Stock Market LIVE Updates | Fitch assigns first-time 'BBB-' IDR to Bank of Maharashtra; outlook stable

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Power Grid Corp | 358.45 | 2.83 | 694.68k |

| NTPC | 421.90 | 1.41 | 712.77k |

| HDFC Bank | 1,634.45 | 1.08 | 348.46k |

| Nestle | 2,482.55 | 1.07 | 91.04k |

| Bharti Airtel | 1,506.00 | 0.88 | 54.72k |

| Asian Paints | 3,102.60 | 0.66 | 31.24k |

| SBI | 877.80 | 0.58 | 243.80k |

| IndusInd Bank | 1,435.00 | 0.48 | 111.40k |

| Axis Bank | 1,170.50 | 0.37 | 90.38k |

| Reliance | 3,018.10 | 0.26 | 35.95k |

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| M&M | 2,828.50 | -2.71 | 63.81k |

| Tata Steel | 161.90 | -2.09 | 5.10m |

| Sun Pharma | 1,700.30 | -1.02 | 29.30k |

| Tata Motors | 1,144.95 | -0.99 | 463.10k |

| Kotak Mahindra | 1,790.80 | -0.88 | 30.97k |

| Infosys | 1,855.60 | -0.67 | 146.68k |

| Larsen | 3,795.00 | -0.46 | 43.25k |

| ITC | 492.95 | -0.42 | 185.78k |

| UltraTechCement | 11,837.85 | -0.38 | 2.01k |

| Bajaj Finserv | 1,648.20 | -0.31 | 26.03k |

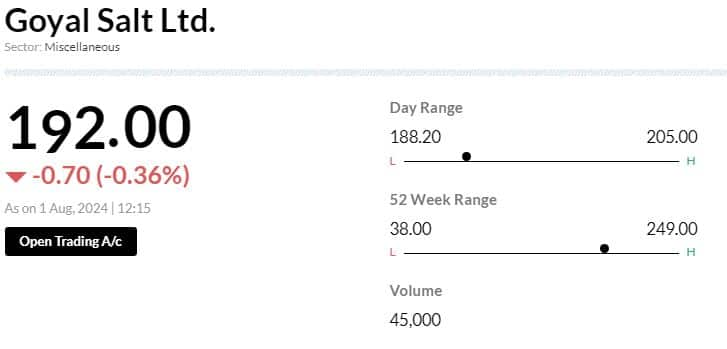

Stock Market LIVE Updates | Goyal Salt receives a work order of Rs 21.86 crore

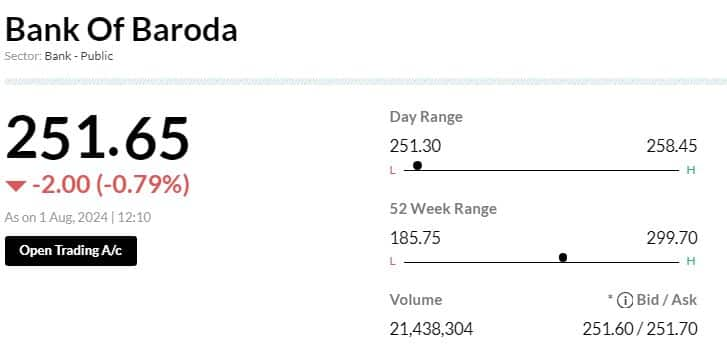

Brokerage Call | Morgan Stanley keeps 'equal-weight' call on Bank of Baroda, target Rs 280

#1 Q1 showed slow balance sheet growth amid high LDR

#2 Q1 asset quality trends in retail were slightly weak – both remain key to monitor

#3 Positives were good profitability and improved balance sheet strength

#4 Valuation at 0.9x FY26 book keeps us equal-weight

Stock Market LIVE Updates | Indian Overseas Bank sanctions One Time Settlement with PC Jeweller

Stock Market LIVE Updates | Kalpataru Projects arm gets Arbitration Award

Wainganga Expressway, wholly owned subsidiary of Kaplataru Power has received an Arbitration Award dated 31st July, 2024, wherein the Arbitral Tribunal by way of a majority award has allowed certain claims of WEPL,

against National Highways Authority of India (NHAI).

Sensex Today | Exicom Tele-Systems arm acquires stake in Tritium Power Solutions

Exicom Power Solutions B.V, a wholly-owned subsidiary of Exicom Tele-Systems has acquired 12,000 ordinary shares of USD 0.01 per share of Tritium Power Solutions Pty Ltd., Queensland from Mr. Raj Kumar, at a consideration of USD 120 representing 100% paid up share capital of Tritium Power Solutions Pty Ltd.

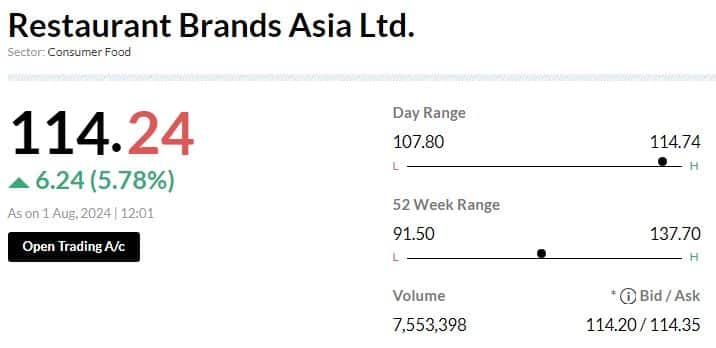

Sensex Today | 13.9 million shares of Restaurant Brands Asia traded in a block: Bloomberg

Stock Market LIVE Updates | Steel Strips Wheels net turnover rises 1.5% in July 2024

Steel Strips Wheels has achieved net turnover of of Rs 362.64 crore in July 2024 versus Rs 357.09 crore in July 2023, recording a growth of 1.55% YoY and achieved gross turnover of Rs 441.08 crore in July 2024 versus Rs 434.35 crore in July 2023, there by recording a growth of 1.55% YoY.

Sensex Today |ITC, Tata Motors, Zomato, Adani Ports, Emami, Dabur, among others to declare earnings today

Aditya Birla Capital, Adani Enterprises, Adani Ports And Special Economic Zone, Akzo Nobel India, Alkyl Amines Chemicals, Arvind Fashions, Allcargo Terminals, Bharat Wire Ropes, Bombay Dyeing, Dabur India, Datamatics Global Services, Prataap Snacks, Emami, Escorts Kubota, Great Eastern Shipping, GHCL, Godrej Agrovet, G R Infraprojects, Hikal, Hind Rectifiers, HPL Electric & Power, ITC, Kalyan Jewellers India, NIIT Learning Systems, Patel Integrated Logistics, Punjab Chemicals And Crop Protection, RailTel Corporation of India, RattanIndia Power, Rushil Decor, Sun Pharmaceutical Industries, Suryoday Small Finance Bank, Tata Motors, Tata Motors – DVR, Thermax, Tube Investments of India, Triveni Engineering & Industries, TV Today Network, UFO Moviez India, Welspun Enterprises, Zomato, among other to announce their JUne qurter earnings today.

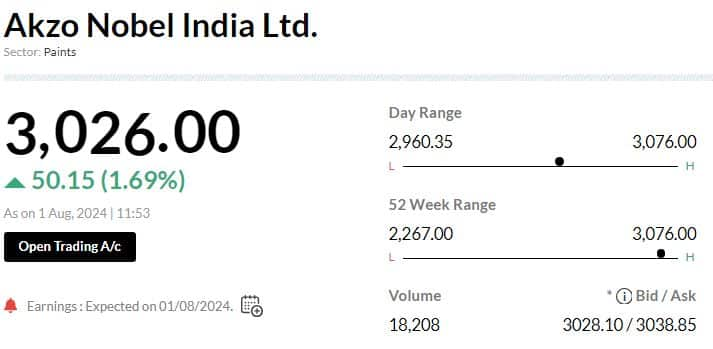

Earnings Watch | AkzoNobel Q1 net profit up 4.3% at Rs 114.6 crore Vs Rs 110 crore, YoY

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Prestige Estate | 1,778.80 | -2.04 | 357.07k |

| Equinox India | 133.50 | -1.73 | 2.01m |

| Hemisphere | 213.79 | -1.72 | 459.78k |

| Phoenix Mills | 3,540.05 | -1.59 | 219.94k |

| Godrej Prop | 3,168.45 | -1.59 | 599.22k |

| Oberoi Realty | 1,835.25 | -1.46 | 320.31k |

| DLF | 877.45 | -1.32 | 3.70m |

| Sobha | 1,787.00 | -0.73 | 58.09k |

| Sunteck Realty | 598.05 | -0.42 | 126.92k |

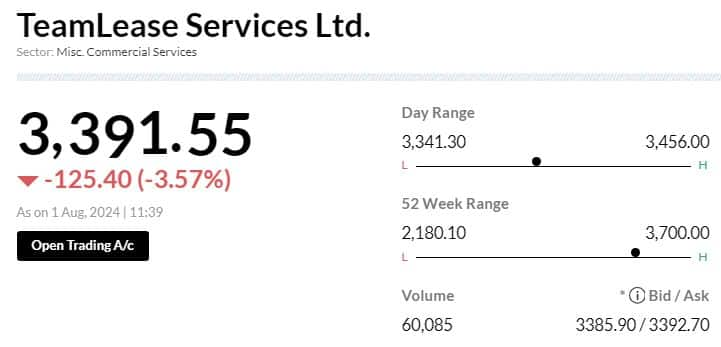

Stock Market LIVE Updates | TeamLease Services shares down 3.5% post Q1 earnings

#1 Net Profit down 21.2 percent at Rs 20.8 crore Versus Rs 26 crore, YoY

#2 Revenue up 18.8 percent at Rs 2,579.9 crore Versus Rs 2,171.6 crore, YoY

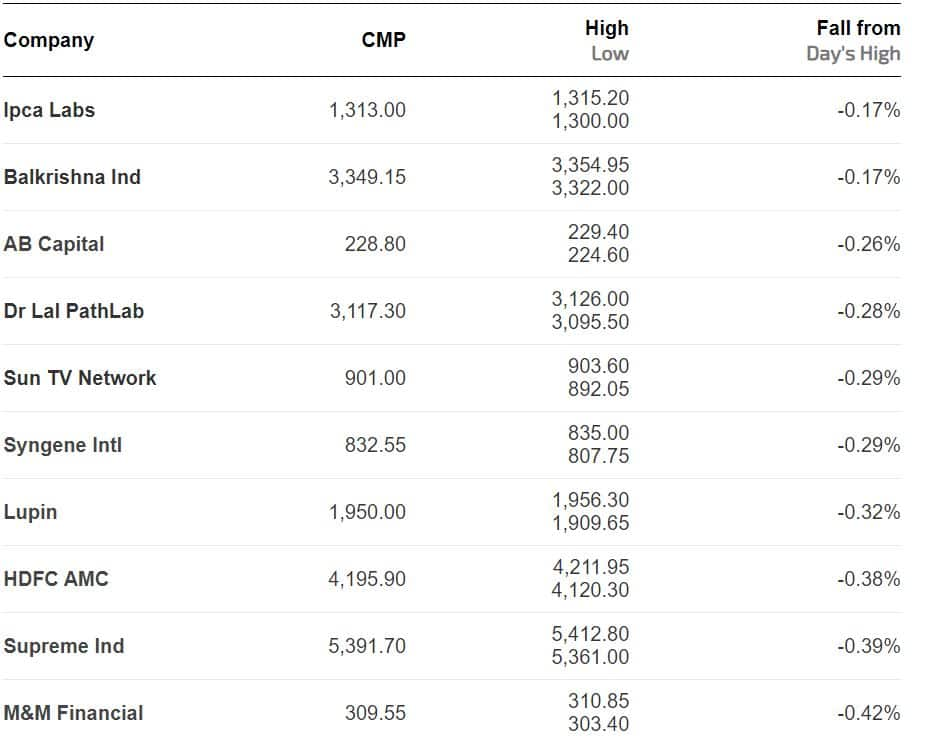

Sensex Today | Nifty Midcap 100 stocks fall from day's high

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY AUTO | 26483.70-0.76 | 42.253.34 | 4.5868.81 |

| NIFTY IT | 40824.70-0.06 | 14.951.92 | 10.7334.79 |

| NIFTY PHARMA | 21726.05-0.23 | 29.082.94 | 9.9644.83 |

| NIFTY FMCG | 61996.05-0.14 | 8.79-0.23 | 8.4718.09 |

| NIFTY PSU BANK | 7411.650.2 | 29.723.64 | 1.3961.25 |

| NIFTY METAL | 9610.350.28 | 20.465.05 | -2.7641.95 |

| NIFTY REALTY | 1082.30-1.05 | 38.221.59 | -1.7094.41 |

| NIFTY ENERGY | 44741.801.49 | 33.694.61 | 7.6367.05 |

| NIFTY INFRA | 9537.950.41 | 30.603.81 | 4.4556.96 |

| NIFTY MEDIA | 2130.80-0.88 | -10.784.38 | 4.423.50 |

| Index | CMP Chg(%) | YTD(%) 1 Week(%) | 1 Month(%) 1 Year(%) |

|---|---|---|---|

| NIFTY 50 | 25020.750.28 | 15.142.52 | 3.6426.79 |

| NIFTY BANK | 51750.900.38 | 7.161.69 | -1.5713.51 |

| NIFTY Midcap 100 | 58952.15-0.07 | 27.653.90 | 4.7256.23 |

| NIFTY Smallcap 100 | 19125.55-0.06 | 26.292.42 | 2.8662.32 |

| NIFTY NEXT 50 | 74545.20-0.32 | 39.743.23 | 3.2564.69 |

RBI issues ‘fit & proper’ certificates to potential IDBI Bank suitors: Report

The Reserve Bank of India (RBI) has granted ‘Fit & Proper’ certificates to three potential suitors for IDBI Bank, paving the way for their possible acquisition of the bank, CNBC-TV18 reported quoting sources. The candidates include Fairfax Financial, Emirates NBD, and Kotak Mahindra Bank. READ MORE

Stock Market LIVE Updates | Hero MotoCorp expands global presence, starts operations in Philippines

After over a decade, India Inc tunes up IPO route to fund growth

After a gap of more than a decade, India Inc appears to be raising more money through initial public offers (IPOs) to fund capex and expansion plans rather than just coming to the market to give an exit option for their investors, including the PE/VC community. In the current year till date, the majority share of the cumulative IPO fund raising has happened through issue of fresh shares with the offer for sale (OFS) component playing second fiddle. READ MORE

Sensex Today | Hero Fincorp looks to raise Rs 3,668 crore through IPO

| Company | CMP | Chg(%) | Volume |

|---|---|---|---|

| Ashok Leyland | 249.35 | -3.01 | 526.97k |

| M&M | 2,846.70 | -2.08 | 39.86k |

| Hero Motocorp | 5,403.55 | -1.64 | 9.25k |

| Cummins | 3,800.00 | -1.37 | 5.54k |

| Bosch | 34,541.10 | -1.23 | 304 |

| Apollo Tyres | 549.75 | -1.09 | 41.45k |

| Tata Motors | 1,144.10 | -1.06 | 347.81k |

| MRF | 140,949.60 | -0.96 | 233 |

| Eicher Motors | 4,921.00 | -0.96 | 6.76k |

| Sundram | 1,395.15 | -0.58 | 2.38k |

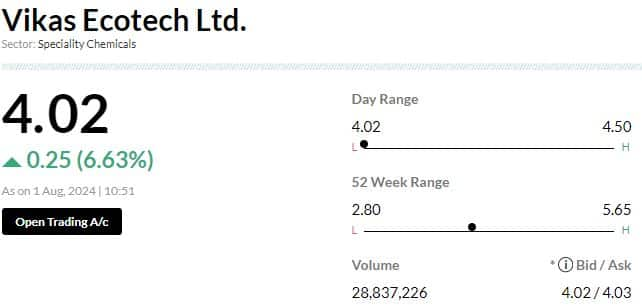

Stock Market LIVE Updates | Vikas Ecotech shares gain 7% post Q1 profit rises

c#1 Net profit at Rs 10.4 crore versus Rs 1.6 crore, YoY

#2 Revenue up 57.7 percent at Rs 101.1 crore versus Rs 57.7 crore, YoY