Indian markets broke the 6-week losing streak in the holiday-shortened week ended August 14. On the broader indices front, BSE mid and smallcap indices snapped the 3-week losing streak, while largecap indices also broke the 6-week losing streak following positive data points from the US and India, including CPI data, inline earnings, rupee appreciation, and falling oil prices.

For the week, BSE Large-cap and Mid-cap indices added 1 percent each, and the BSE Small-cap index rose 0.4 percent.

For the week, the BSE Sensex index added 739.87 points or 0.92 percent to close at 80,597.66, and Nifty50 rose 268 points or 1.10 percent to end at 24,631.30.

The Foreign Institutional Investors (FIIs) continued their selling in the 7th week, as they sold equities worth Rs 10,172.64 crore. On the other hand, Domestic Institutional Investors (DII) extended their buying in the 17th week, as they bought equities worth Rs 18,999.76 crore.

On the other hand, Domestic Institutional Investors (DII) extended their buying in the 16th week, as they purchased equities worth Rs 33,608.66 crore.

In this month of August so far, FII offloaded equities worth Rs 24,191.51 crore and DII purchased equities worth Rs 55,795.28 crore.

On the sectoral front, Nifty Healthcare and Pharma indices rose 3.5 percent each, Nifty Auto index rose 2.7 percent, and Nifty PSU Bank index gained 2 percent. On the other hand, Nifty Consumer Durables and FMCG indices shed 0.5 percent each.

"In the last truncated week, the benchmark indices witnessed a pullback rally. The Nifty ended up by 1.1 percent, whereas the Sensex gained 748 points. Among sectors, almost all the major sectoral indices traded in positive territory, but the Pharma and Healthcare indices outperformed, both rallied over 3 percent. Meanwhile, profit booking was seen in selective FMCG and Consumer stocks," said Amol Athawale, VP Technical Research, Kotak Securities.

"Technically, on daily and intraday charts, the market has formed reversal patterns, which are largely positive. Additionally, a bullish candle was formed on the weekly charts, indicating the continuation of the pullback in the near future."

"We believe that 24,500/80300 will act as a key support zone for short-term traders. As long as the market trades above this level, the bullish sentiment is likely to continue. On the higher side, 24,700/80900 would be the immediate resistance zone for the bulls. A successful breakout above 24,700/80900 could push the market towards 24,900-25,000/81500-81800," he said.

"However, below 24,500/80300, market sentiment could turn negative. The index could then retest levels around 24,350/79800. Further downside may also continue, potentially dragging the index to 24,200-24,150/79300-79100," Athawale added further.

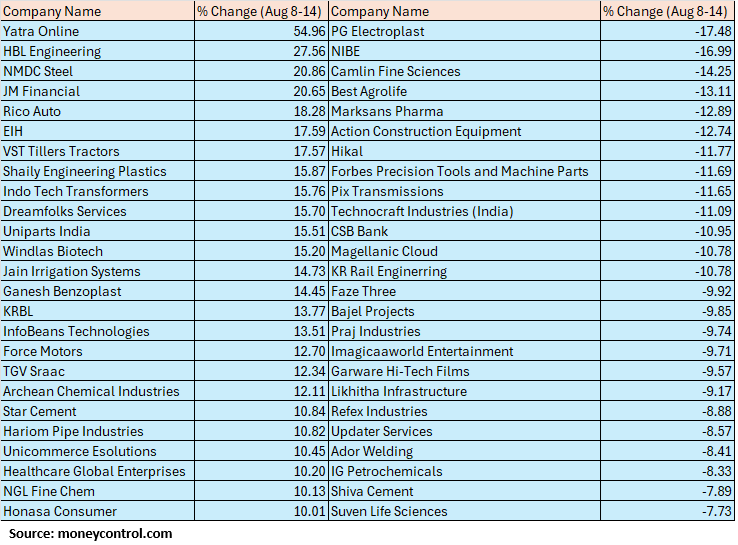

The BSE Small-cap index ended with o.4 percent gain, led by Yatra Online with a 55 percent gain, following HBL Engineering, NMDC Steel, JM Financial, Rico Auto, EIH, and VST Tillers Tractors. However, major losers losers PG Electroplast, NIBE, Camlin Fine Sciences, Best Agrolife, Marksans Pharma, and Action Construction Equipment.

Technically, the market action signals range-bound action and awaits a geopolitical event during the long weekend.

Nifty on the weekly chart formed a reasonable positive candle that reversed the previous six losing weeks. Placement of cluster supports around 24300-24200 levels could offer strong support on any weakness from here. However, a sustainable upmove above the hurdle of 24700 could open further upside towards the 25,000 mark in the near term.

Rupak De, Senior Technical Analyst at LKP SecuritiesThe overall sentiment is likely to favour bullish trades as long as the index holds above 24,337.

On the higher side, resistance is placed at 24,660 and 24,850, while a fall below 24,337 could trigger a resumption of the bearish trend.

Ajit Mishra – SVP, Research, Religare BrokingThe prevailing consolidation suggests that markets have largely digested recent negatives and are now awaiting a trigger for recovery. Additionally, oversold positions in heavyweights across sectors are further supporting this possibility.

Going forward, a decisive break above 24,800 on the Nifty could spark fresh momentum; otherwise, consolidation may persist. Participants should maintain a stock-specific trading approach with a focus on risk management.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.