Taking Stock: Market takes a breather; Nifty holds 11,200 levels

On the broader market front – the S&P BSE Mid-cap index fell 0.16 percent, and the S&P BSE Small-cap index was down 0.01 percent.... Read More

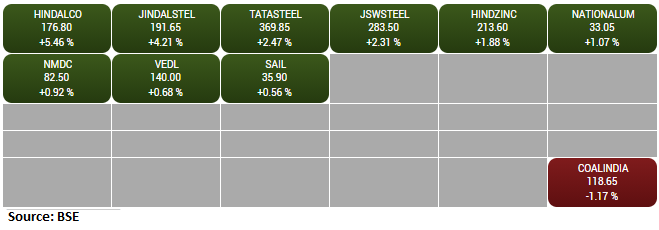

Markets ended almost unchanged in a range-bound session, taking a breather after the recent bounce. Extending yesterday’s up move, the benchmark opened higher however profit booking at higher levels dragged the index lower in no time and it remained sideways thereafter. Finally, the Nifty index ended flat at around 11,222 levels. The broader markets ended in red while mixed performance was witnessed on the sector front. FMCG, Banks and PSU ended as laggards while Consumer Durables, Metals and Energy posted decent gains.

The pause was on the expected lines after the recent bounce and existence of hurdle at 11,300 in Nifty. Going ahead, the upcoming auto sales numbers will be closely watched by the participants. Meanwhile, global cues will continue to dictate the trend. Traders should limit their leveraged positions and maintain positions on both sides.

: Benchmark indices ended flat in the highly volatile session on September 29.

At close, the Sensex was down 8.41 points or 0.02% at 37,973.22, and the Nifty was down 5.10 points or 0.05% at 11,222.40. About 1170 shares have advanced, 1406 shares declined, and 168 shares are unchanged.

Hindalco Industries, UltraTech Cement, JSW Steel, Hero MotoCorp and TCS were among major gainers on the Nifty, while losers included ONGC, IndusInd Bank, UPL, Power Grid Corp and Axis Bank.

Buying witnesses in the metal, IT and auto sectors, while bank, FMCG, infra, pharma and energy indices ended in the red.

KNR Constructions has transferred 100% stake of its subsidiary company i.e. KNR Walayar Tollways Private to Cube Highways and Infrastructure III Pte. Ltd.

The enterprise value of the assets for this transaction is Rs 511.78 crore excluding claims receivable from NHAI and other governmental instrumentalities, which would be passed through to the company as and when realised.

BLS International Services announced its most recent contract win from the Republic of Estonia.

As per the terms of the contract, BLS is contracted to provide services with regards to issuance of digital ID to e-residents granted by the Estonian Police and Border Guard Board (PBGB) at 5 (five) newly added locations. The locations mandated by the contract are Japan, Thailand, Singapore, Brazil and South African Republic.

Shree Cement has approved setting up of a Clinker Unit at Baloda Bazar, Raipur in Chhattisgarh with capacity upto 12,000 Tons Per Day (TPD) for an investment of around Rs 1,000 crore.

SBI Card and American Express have entered a strategic partnership to offer a powerful mix of global benefits and exclusive privileges for discerning consumers in India.

The unitholders of India Grid Trust (IndiGrid) have approved the induction of Esoteric II Pte. Ltd., an affiliate of KKR & Co. Inc as a sponsor with special majority.

The special resolution to induct Esoteric II as a sponsor was passed with a special majority in the 3rd Annual General Meeting of IndiGrid held on September 28th, 2020.

All regulatory approvals including the board’s assent are in place for Esoteric II ‘s induction as a co-sponsor. This move marks an extension of IndiGrid’s strategic relationship with KKR and underscores IndiGrid as a compelling investment opportunity for long-term investors.

Gold prices edged higher, erasing early losses as the dollar retreated from a two-month peak ahead of the U.S. presidential debates scheduled later today and progress on the new coronavirus relief bill although a stock market rebound capped gains in bullion.

President Donald Trump and former Vice President Joe Biden will square off in their first presidential debate later in the day, with five weeks to go until the November 3 general election, based on the comments from both this could bring in volatility in the market.

U.S. House of Representatives Speaker Nancy Pelosi that Democratic lawmakers unveiled a new, $2.2 trillion coronavirus relief bill, which she said was a compromise measure that reduces the costs of the economic aid.

Market participants will focus on the important consumer confidence data expected from US which will throw further light on the consumers perspective on the economic activity; if reported less than expectations it could support bullion's on lower levels.

Broader trend on COMEX could be in the range of $1865- 2000 and on domestic front prices could hover in the range of Rs 50,050-50,500.

Footfalls have improved in both smaller towns & larger cities. In the online grocery retail space, competitive intensity remains high, said Morgan Stanley, reported CNBC-TV18.

DMart is ready now allowing users to place two top-up orders within a month, while the delivery fee for the top-up order remains high, it added.

The Rs 2,160-crore initial public offering of UTI Asset Management Company, the second-largest AMC in India in terms of total AUM, is subscribed 15.77 percent so far on September 29, the first day of bidding.

The IPO has received bids for 43.54 lakh equity shares against offer size of 2.73 crore equity shares, the data available on the exchanges showed. The offer size excluded anchor book which received strong response on September 28 as the company has garnered Rs 645 crore.

The portion set aside for retail investors is subscribed 30 percent, while the reserved portion of non-institutional investors witnessed 5 percent subscription and that of employees 11.66 percent. Bidding by qualified institutional buyers has not started yet.

Indian rupee ended lower by 4 paise at 73.82 per dollar,amid volatile trade in the domestic equity market.

It opened flat at 73.77 per dollar versus previous close of 73.78 and remained in the range of 73.76-73.91.