Taking Stock: Sensex Crosses 60K For The First Time Led By Realty, IT Stocks; Metals Drag

Broader market underperformed the benchmarks with BSE midcap index falling 1 percent and smallcap index declining 0.3 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,560.87 | -436.26 | -0.51% |

| Nifty 50 | 25,920.65 | -133.25 | -0.51% |

| Nifty Bank | 58,163.90 | -221.35 | -0.38% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Coal India | 386.25 | 4.25 | +1.11% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Dr Reddys Labs | 1,195.30 | -55.60 | -4.44% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 36402.80 | 54.90 | +0.15% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Metal | 10679.50 | -98.00 | -0.91% |

Trading was mostly range-bound with a positive bias but the highlight of the trade was Sensex breaching the psychological 60000-mark. Benchmark Nifty has formed a robust higher high and higher low formation which is broadly positive. The important point is the index successfully cleared the resistance of 17800 and is comfortably trading above the same.

For the index, 17775-17700 could be the important support levels. On the flip side, 18000 and 18200 could act as a major resistance level. Contra traders can take a long bet near 17700 with a strict 16650 support stop loss, while partial profit booking is advisable between 18100 to 18200 level. Meanwhile, the Bank Nifty has maintained a higher bottom formation. The key support levels are placed at 37200 followed by 36800. The structure suggests a further upside if it succeeds to trade above 37200.

Index closed a week at 17,853 zone with gains of one & half percent on weekly basis and formed a bullish candle on the weekly chart for a second consecutive week. For upcoming session, index has shifted its support zone to 17,750-17,650, so any dip near mentioned support zone will be again fresh buying opportunity with keeping stop out level below 17,650 zone & if said levels are held we may see the index march towards 18k mark, resistance is still placed around 17,900-18,000 zone where traders can lock some of their long gains.

Weak global market did not affect the upside momentum of the domestic market to hit record highs boosted by realty and IT stocks. India is seizing a sweet spot in the global equity market with the increase in domestic investors. However, profit-booking was noticeable in mid & small-cap stocks, which were under pressure and it can continue in the short-term. Realty stocks continued to outperform other sectors owing to an increase in property registrations, and cut in stamp duty (Karnataka) and home loan rates.

: Benchmark indices erased some of the intraday gains but manages to close in the positive territory with Sensex crossing 60,000 for the first time.

At close, the Sensex was up 163.11 points or 0.27% at 60,048.47, and the Nifty was up 30.20 points or 0.17% at 17,853.20. About 1286 shares have advanced, 1894 shares declined, and 152 shares are unchanged.

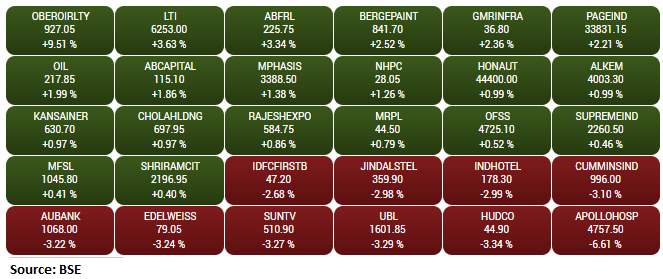

Asian Paints, Eicher Motors, M&M, HCL Technologies and HDFC Bank were among major gainers on the Nifty, while losers included Tata Steel, JSW Steel, SBI, Divis Labs and Axis Bank.

BSE midcap index fell 1 percent, while smallcap index was down 0.3 percent.

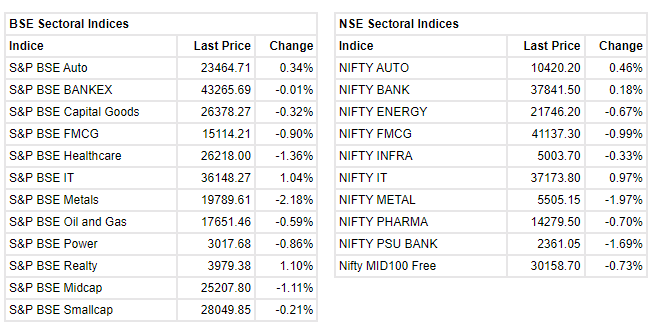

Except, IT, Auto and Realty all other sectoral indices ended in the red with Metal, FMCG, PSU Bank and Power indices down 1-2 percent.

The market witnessed some volatile movements after Nifty was able to breach the level of 17,850. Our research shows sustaining above 17850, we expect the market to gain momentum, leading to an upside projection till 18,000 level.

We have observed the momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening a short-term bullish outlook.

China Evergrande has left global investors guessing over whether it will make a key interest payment, adding to fears that Beijing will let overseas bondholders swallow large losses as a liquidity crisis deepens at the world’s most indebted property company.

Gayatri Projects has received an amount of Rs 49.74 crore along with future interest at 1O% p.a. till the date of payment in an arbitration award.

Gayatri Projects was quoting at Rs 52.25, up Rs 0.15, or 0.29 percent on the BSE.

Crossing the 60k mark is another milestone for the market. We could see many more positive surprises from the market in the next one-two years, as we are entering into a positive upcycle of earnings trajectory. The overall market trajectory continues to be positive, and dips should be utilized to build long-term positions in quality companies for more sustainable returns.

A quality theme is back in focus, and we continue to see the broader market doing well, as the visibility on broad-based earnings is still intact. A fully functional economy over the upcoming festival season and the sustenance of earnings momentum in Q2 FY22 are the near-term triggers for the market.

Indian benchmark indices erased some of the early gains but still holding in the green with Sensex above 60000.

The Sensex was up 231.15 points or 0.39% at 60,116.51, and the Nifty was up 47 points or 0.26% at 17,870. About 1165 shares have advanced, 1847 shares declined, and 112 shares are unchanged.

Sensex reaching 60,000 today first time ever on September 24, 2021 is an indicator of India's growth potential, as well as the way India is emerging as a world leader during COVID period in addition to worldwide monetary expansion and relaxed fiscal policies adopted by world powers.

Indian markets are considered the best performing markets world over in last 18 months of COVID period due to astute policies and implementation of government, private sector and every one else involved. Many more investors are also joining the stock markets directly or indirectly through Mutual funds, thanks to automation in the markets, new age brokerages and low interest rates in india. The increase in stock prices has been broad based in recent period. I take this opportunity to congratulate all Indians citizens and investors for this achievement.

Ramkrishna Forgings has won an export order worth USD 4 million per annum) from North American customer in oil & gas segment. The stock was trading at Rs 1,028.75, down Rs 7.80, or 0.75 percent. It has touched an intraday high of Rs 1,043.95 and an intraday low of Rs 1,022.