September 22, 2021 / 16:25 IST

Anindya Banerjee, DVP, Currency Derivatives & Interest Rate Derivatives at Kotak Securities:

The spot rupee closed 26 paise higher at 73.87 against the dollar on the back of lumpy corporate outflows. Hopes of a hawkish Fed is pushing the rupee higher. Chinese financial stress is an added positive factor. Tonight's Fed meeting will be watched closely. The market is expecting US Fed to announce a timeline on taper, issue an inflation forecast, and update its interest rate projection via dot plot. We expect USDINR to remain within a range of 73.40-74.20 over the near term.

September 22, 2021 / 16:14 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

After a robust pullback rally, benchmark Nifty witnessed a narrow range activity near the 17600 resistance level. On Wednesday, post muted opening the Nifty hovered in the range of 17525-17610 levels. It made a couple of attempts to clear the resistance of 17600 but failed to clear the hurdle due to tepid global cues and lack of follow-through buying activity.

The intraday trading setup suggests 17600-17625 levels would act as a key resistance level for the day traders and below the same, a quick intraday correction till 17500-17450 is not ruled out. On the flip side, 17625 could be the range breakout level for the day traders and above the same, the breakout continuation formation is likely to continue up to 17665-17700-17725 levels.

September 22, 2021 / 16:11 IST

S Hariharan, Head- Sales Trading, Emkay Global Financial Services:

Macro factors have dominated flows this week, with ongoing newsflow about a large potential bankruptcy in China causing worries of contagion. Further, global markets are also awaiting comments from US FOMC with regard to plans for tapering monthly bond purchases. Dollar index is also poised for a potential technical breakout to multi-month highs, which might have adverse impact on flows to risk assets.

As a result, Nifty has traded largely range-bound after a breakout to new highs in the first fortnight of September. Domestic retail sentiment remains relatively subdued on account of these macro headlines. Bank Nifty & Auto indices remain the major laggards, while IT & FMCG sectors further built on relative strength in the last week.

September 22, 2021 / 16:03 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

Nifty remains in a medium-term uptrend for targets of 18,000 and above; any meaningful correction is a good opportunity to buy. Support for the September series is seen at 17,325 while resistance is expected at 17,600-17,770 levels.

Breach of 17,325 on the closing basis is expected to result in selling pressure to sub 17,000 levels. Auto and Energy stocks trade with a positive bias, while Metals are expected to consolidate before resuming uptrend.

September 22, 2021 / 16:00 IST

Vishal Wagh, Research Head, Bonanza Portfolio

Indian equity benchmarks made a cautious start on Wednesday tracking weakness in global peers. Markets managed to trade in the green territory in the late afternoon session. Traders were seen piling up positions in Realty, Consumer Discretionary, and Metal sectors while selling was witnessed in Bankex, Utilities, and FMCG sector stocks.

Sentiments remained positive even after Asian Development Bank (ADB) has revised down India's Gross domestic product (GDP) growth forecast to 10 percent for the current fiscal (FY22) from 11 percent predicted earlier, citing the adverse impact of the second wave of the pandemic. Also, investors are waiting for the end of this week's Fed meeting that may shed light on when its massive purchase of government debt will begin to ease.

September 22, 2021 / 15:54 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Despite hopeful signs in the global markets, domestic main indices traded in a narrow range to give away its early gains in today’s volatile session. However, the broad market was robust barring banks, all major sectors were in demand and media, metals and realty outperformed.

Realty stocks were in focus owing to an increase in property registrations in September while easing jitters over the Chinese economy bolstered metal stocks. Investors traded cautiously awaiting the outcome of the FOMC meeting that will clear the air regarding Fed’s tapering plans.

September 22, 2021 / 15:49 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index showed a very narrow range for a day and closed a day at 17,547 with minimal loss forming a small bearish candle on the daily chart. The index has same support zone around 17,500-17,430 and any dip near said levels will be again buying opportunity with keeping immediate stop out level below 17450 zone and resistance is coming near 17600-17660 zone.

Also one can lock their trading long gains around said levels. The overall range is still in between 17,300-17,800 zone & either side breakout will decide the final direction.

September 22, 2021 / 15:39 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some lackluster movement and an attempt to hold the level around the Nifty 50 Index level of 17,500. The market research shows that it is going to be crucial for the short-term market scenario to sustain above the 17,450-17,500 support zone.

If the market is able to sustain the level of 17,450-17,500, it can witness higher levels of 17,850. The momentum indicators like RSI and MACD to stay positive and market breadth to improve, further strengthening a short-term bullish outlook.

September 22, 2021 / 15:34 IST

Market Close

: Indian benchmark indices ended marginally lower in the volatile session on September 22.

At close, the Sensex was down 77.94 points or 0.13% at 58,927.33, and the Nifty was down 15.30 points or 0.09% at 17,546.70. About 2047 shares have advanced, 1113 shares declined, and 162 shares are unchanged.

Coal India, Tech Mahindra, Tata Motors, Hindalco Industries and M&M were the top Nifty gainers. HDFC, Nestle, HDFC Bank, ICICI Bank and Kotak Mahindra Bank were among the top losers.

Except bank and FMCG, all sectoral indices ended in the green, with realty index rising over 8 percent. The BSE midcap and smallcap indices rose 1 percent each.

September 22, 2021 / 15:34 IST

Oil prices rise on expected U.S. stocks draw:

Oil prices climbed more than $1 on Wednesday, extending overnight gains after industry data showed U.S. crude stocks fell more than expected last week in the wake of two hurricanes, highlighting tight supply as demand improves.

September 22, 2021 / 15:19 IST

Paras Defence IPO: Public offer subscribed 34.19 times:

The initial public offering of Paras Defence and Space Technologies continues to see strong demand, with issue being subscribed 34.19 times by the morning of September 22, the second day of bidding.

The portion set aside for retail investors has been subscribed 60 times and that of non-institutional investors 16.90 times. Qualified institutional investors have put in bids 1.5 times of their reserved portion.

September 22, 2021 / 15:12 IST

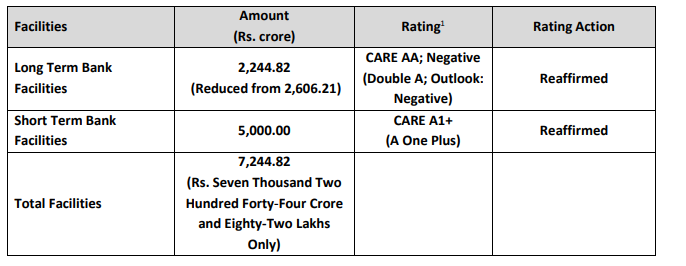

CARE Ratings reaffirmed credit rating for bank facilities of Jindal Saw: