October 06, 2022 / 16:54 IST

Manish Shah, Independent Technical Analyst

Nifty gapped higher for the day but it closed at the low of the day giving us a red candle. There was little vertical movement in Nifty during the day. Nifty has now moved above the previous swing low. A breakout below the previous swing low has failed. What we can now expect is a very volatile sideways movement between 18000-17000 for some more time.

Major support in Nifty is at 17200-17100, any short-term decline to 17200-17100 is a buying level for Nifty. On the upside, Nifty has major resistance at 17550-17600. There should be selling pressure at this level. Expect Nifty to be very volatile in the next couple of days.

Bank Nifty saw a bit of a decline from the highs and the price action shows a bearish shooting star pattern BNF shows selling pressure from the resistance at the Gap area between 39200-39400. Index could get vulnerable to selling pressure intensifying if it starts to trade below 39100. Below 39100 it has support at 38750. A drop to 38750 will be a safe buying area. On the upside, a break above 39600 will mean a rally to 40100-40500.

October 06, 2022 / 16:22 IST

Gaurav Ratnaparkhi, Head of Technical Research, Sharekhan by BNP Paribas

Continuing with the positive momentum from the last session, the Nifty opened gap up on October 06. It attempted to stretch higher, however faced resistance near the 50% retracement of the entire September decline. The index stumbled near 17400-17500 & ended near the low point of the day. 20 DMA is also present in this zone, which is adding to the downside pressure.

Thus, the index looks set to move down to test its key hourly moving averages near 17200. Overall structure shows that the Nifty is poised to form a consolidation in the range of 17000-17500.

October 06, 2022 / 16:02 IST

Rupak De, Senior Technical Analyst at LKP Securities

The Nifty started to gap up and remained volatile during the day. On the daily chart, a bullish island reversal pattern has been formed.

The trend is likely to remain positive over the short term. On the lower end, 17,250 may act as crucial support. On the higher end, the index may extend its rally till 17,600-17,700.

October 06, 2022 / 15:59 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

Weakness in European indices and SGX Nifty slipping into the red prompted investors to cut their bullish bets. But key domestic benchmarks still ended in the green thanks to traders betting big on IT, metals & realty stocks. However, the inflationary concerns worldwide and central banks hiking interest rates persistently has spooked markets and kept investors on tenterhooks on worries of a global slowdown.

On daily charts, the Nifty has formed a small bearish candle, which is indicating temporary weakness. However, the medium term sentiment is still bullish.

A fresh uptrend is possible only after the breakout of 17,425 level and above the same, the index could hit 17,500-17,550 levels. On the flip side, below 17,425 the index could slip till 17,200-17,150.

October 06, 2022 / 15:52 IST

Vinod Nair, Head of Research at Geojit Financial Services

The Indian market is maintaining its resilience despite mixed cues from global equities and surging oil prices. Both domestic and foreign investors are supporting the rally.

The market was also bolstered by expectations on Q2 results session, with improvement in sectors like Metal, IT, and Realty. However, the decision of OPEC to significantly reduce output has increased oil prices, which is slightly unfavourable for importers like India.

October 06, 2022 / 15:36 IST

S Ranganathan, Head of Research at LKP securities

Markets exhibited resilience amidst optimism and continued its upward momentum from where it left off in the previous session. In a VUCA world, India stands out as a growth market given the incremental momentum witnessed amidst festivities even as we come to an end of Durga Puja. Metals, Media & IT lent good support even as we saw a bout of profit booking in the late afternoon session.

October 06, 2022 / 15:35 IST

Rupee Close:

Indian rupee closed 37 paise lower at 81.89 per dollar against Tuesday's close of 81.52.

October 06, 2022 / 15:30 IST

Market Close:

Indian benchmark indices ended on positive note in the volatile session with Nifty above 17,300.

At Close, the Sensex was up 156.63 points or 0.27% at 58,222.10, and the Nifty was up 57.50 points or 0.33% at 17,331.80. About 2302 shares have advanced, 1054 shares declined, and 126 shares are unchanged.

JSW Steel, Hindalco Industries, Coal India, Tata Steel and Larsen and Toubro were among the top Nifty gainers. Bharti Airtel, HUL, HDFC, IndusInd Bank and Britannia Industries were the top losers.

Among sectors, FMCG and pharma ended marginally lower, while metal, realty, capital goods up 2-3 percent.

BSE midcap and smallcap indices up 1% each.

October 06, 2022 / 15:24 IST

Morgan Stanly View On Bajaj Finance

Morgan Stanly has kept overweight rating on Bajaj Finance with a target at Rs 8,500 per share.

The company is back to 30% loan growth and customer franchise up 19% YoY. It has achieved significant ground in deposits, up 15% QoQ, reported CNBC-TV18.

Bajaj Finance was quoting at Rs 7,406.90, down Rs 82.35, or 1.10 percent on the BSE.

October 06, 2022 / 15:19 IST

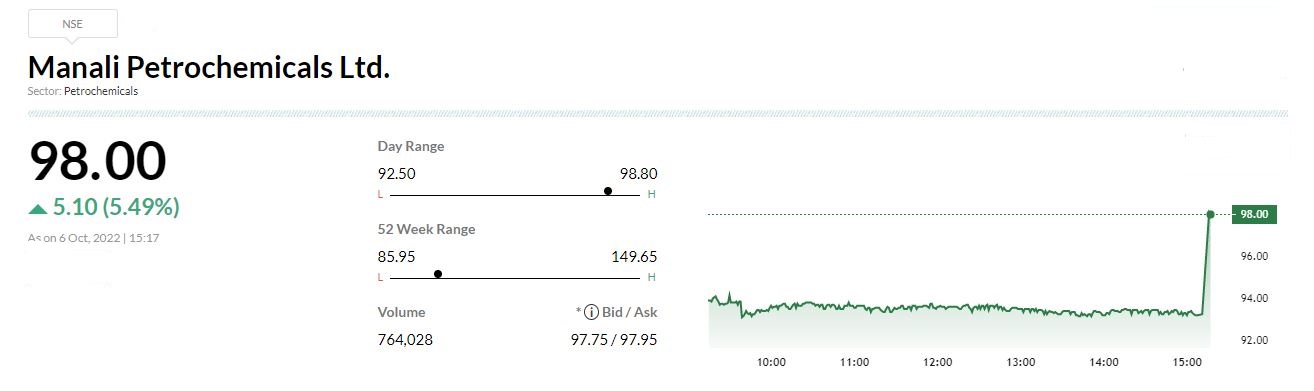

Manali Petrochemicals gets environmental nod for Propylene Glycol plant

Environmental Clearance has been granted by the Ministry of Environment, Forest, and Climate Change, Government of India for the project for augmentation of Propylene Glycol capacity in Plant 2 of Manali Petrochemicals.

The project would be implemented in two phases and the first phase would be completed within 18-21 months of receipt of the other regulatory approvals, such as Consent To Establish from the State Pollution Control Board.

October 06, 2022 / 15:16 IST

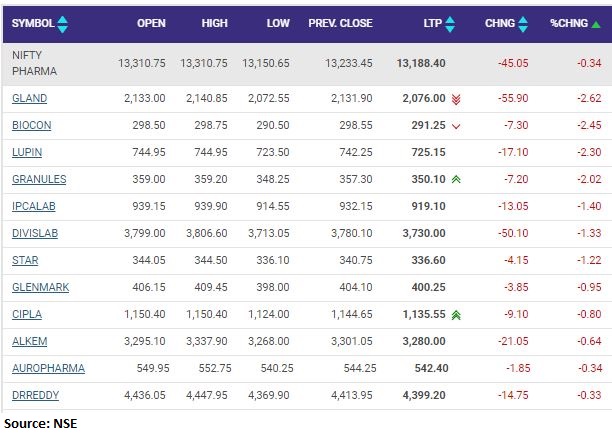

Nifty Pharma index in the red, with Gland Pharma, Biocon, Lupin and Granules India down 2 percent each

October 06, 2022 / 15:14 IST

BSE Smallcap index added 1.3 percent supported by the Xelpmoc Design and Tech, Everest Industries, Greenlam Industries

October 06, 2022 / 15:08 IST

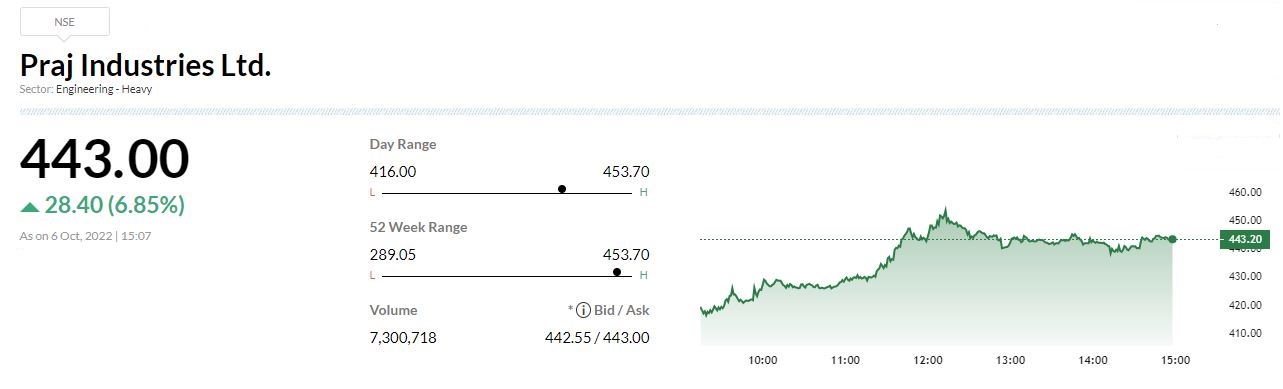

Prabhudas Lilladher View on Praj Industries

We reiterate our positive stance on PRAJ given, 1) its strong leadership in domestic ethanol plants (~60-65% market share), 2) prominent global presence in more than 100 countries and 3) significant focus on future-ready technologies like 2G ethanol (orders for three 2G based ethanol plants), Compressed Bio Gas (CBG) (opportunity of 5,000 CBG plants) & Sustainable Aviation Fuel (SAF) and 4) diversification in Wastewater Treatment (ZLD), Critical Process Equipment’s & System (CPES) & HiPurity business.

At stock is currently trading at PE of 33.6x/24.6x/23.5x FY23/24E/25E. We have Buy rating on stock with Target Price of Rs 507 valuing it at PE of 30x FY24E.