October 17, 2022 / 16:49 IST

Kunal Shah, Senior Technical & Derivative Analyst at LKP Securities

The Bank Nifty index surpassed the initial trough of 39,500 and managed to close above it. The index remains in buy mode with strong support at the 39,000-38,800 zone. The immediate upside hurdle is visible at 40,000 where the highest open interest is built up on the call side and once breached will see a short covering towards 41,000-41,500 levels.

October 17, 2022 / 16:46 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

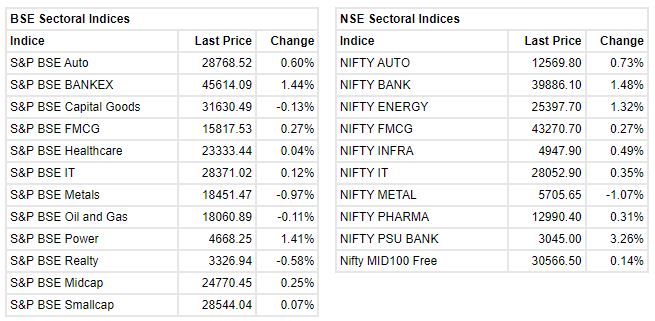

Nifty rose for the second consecutive session on Oct 17. Volumes on the NSE were on the lower side. Among sectors, power & banking indices rose the most while metals and realty indices fell the most. Broad markets continued to underperform with Smallcap and Midcap indices rising less than the Nifty and advance decline ratio closing at 0.83:1.

Nifty continues to show mild strength and the next resistance could come in at 17348-17429 band while support could come in at 17142-17170 band.

October 17, 2022 / 16:44 IST

Vinod Nair, Head of Research at Geojit Financial Services

Domestic market started weak in-line with a volatile global market. However, due to buying on dips strategy, the domestic market is recovering well supported by a good start to Q2 earnings season by IT & Banks. Broadly, even though the Q2 preview analysis forecast a muted outlook, it is fairly factored-in considering the consolidation of the last one month. While outlook for Q3 results has been enhanced due to moderation in operation cost, forecasting a QoQ improvement in profitability and reducing risk of earnings downgrade.

October 17, 2022 / 16:41 IST

Ajit Mishra, VP - Research, Religare Broking Ltd

Markets shrugged off global weakness and started the week on a positive note. After the initial downtick, Nifty gradually inched higher as the day progressed and finally settled around the day’s high to close at 17,311.80 levels. Though most sectors participated in the move, banking and energy majors played a crucial role in the surge. The broader indices too ended with modest gains.

Markets have made several attempts to move higher in the recent past but a lack of sustainability on the global front has derailed all the attempts. We thus recommend waiting for further clarity and limiting positions in the meanwhile. The banking and financial pack look strongest to us while others are seeing a mixed trend. Participants should align their positions accordingly.

October 17, 2022 / 15:35 IST

Market at close: Sensex was up 491.01 points or 0.85% at 58410.98, and the Nifty gained 126.10 points or 0.73% at 17311.80.

October 17, 2022 / 15:16 IST

GSK Pharma: Bhushan Akshikar to replace Sridhar Venkatesh as Managing Director

October 17, 2022 / 15:12 IST

Praveen Singh – AVP, Fundamental currencies and commodities analyst at Sharekhan by BNP Paribas

:

Currently, USD-INR pair is trading with a gain of 5 paise at Rs 82 level continues to serve as a strong support for the pair. RBI’s September monetary policy’s minutes were out Friday. As per the minutes, the members of the monetary policy committee (MPC) remain divided over the course of action on interest rates in coming months. Some of the members call for a calibrated, data dependent, and prudent rate hike, while some of the members were concerned that pushing interest rates much beyond neutral level will not be good when growth is fragile. Some of the members still call for front-loaded rate hikes to control inflation. As such divided opinions don’t bode well for the domestic currency when the US Federal Reserve is firm on path of steep rate hikes.

The USD-INR pair may slide to 81.50 level in near-term on markets embracing risk, however overall outlook for the domestic currency remains bearish. India’s WPI inflation in September, though edged lower to 10.70% (forecast 11.50%) from 12.41% in August, it remained in double digits for 18th month in a row. USD-INR near 83 level is seeing supply. In the near-term, USD-INR is expected to trade between Rs 81.50 and Rs 83.

October 17, 2022 / 15:07 IST

RBI likely to shift focus towards growth slowdown in 2023, says HSBC Securities’ economist

October 17, 2022 / 15:00 IST

Market update at 3 PM

Sensex is up 498.39 points or 0.86 percentat 58,418.36. Nifty jumped 133.40 points or 0.78 percentat 17,319.10.

October 17, 2022 / 14:50 IST

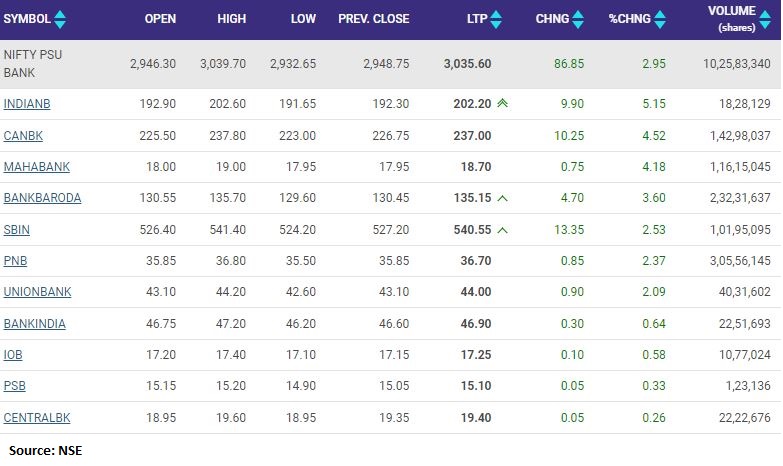

Nifty PSU Bank adds 3 percent

State Bank of India, Indian Bank, Canara Bank and Bank of Baroda are among the top sectoral gainers. In fact, with over 3 percent gain, SBI is also the top Nifty and Sensex gainer.

October 17, 2022 / 14:46 IST

China delays release of Q3 GDP data

:

China said Monday it would delay the release of growth figures for the third quarter along with a host of other economic indicators expected this week, as the country's leadership gathers for a meeting set to hand President Xi Jinping a historic third term in office. Beijing's National Bureau of Statistics announced that the release of the economic data would be "postponed", without specifying a reason.

October 17, 2022 / 14:37 IST

Air passenger traffic volume likely to recover to pre-pandemic level: Report

Air passenger traffic volume is expected to recover to the pre-pandemic level, implying a robust 75 percent year-on-year growth this fiscal, a report said on Monday. The pick-up in traffic volume is expected to be led by domestic traffic as slots and routes on the international front are still opening up, domestic credit rating agency Crisil said in its report.

It also said that the airport operators are expected to see their traffic volume recover to the pre-pandemic (fiscal 2020) level this fiscal, spurring a recovery in revenue, supported by an increase in tariffs. In FY23, with the pandemic impact seemingly behind us, air traffic volume is expected to increase to the fiscal 2020 level of around 340 million passengers.

October 17, 2022 / 14:29 IST

V-Mart Retal enters into business transfer agreement with AM Marketplaces

: V-Mart Retail has entered into a business transfer agreement dated October 17, 2022 with A.M. Marketplaces and certain other parties for the acquisition of its LimeRoad Business (as defined below in Annexure I), as a going concern, on a slump sale basis, for a lump sum consideration. The consummation of the transaction is subject to certain conditions precedent and closing conditions, as agreed under the terms of the Business Transfer Agreement. The stock was trading at Rs 2,730.05, down Rs 35.25, or 1.27 percent on BSE. It has touched an intraday high of Rs 2,819.00 and an intraday low of Rs 2,686.85. It was trading with volumes of 1,891 shares, compared to its five day average of 922 shares, an increase of 105.14 percent.