October 13, 2021 / 16:25 IST

Mohit Nigam, Head - PMS, Hem Securities:

Indian Benchmark Indices rose for the fifth consecutive session and closed at record high levels today. Strong buying is seen in Auto, Metal and IT stocks while some selling pressure is seen in Realty stocks.

Tata Motors zoomed 20% today and was the top gainer in Nifty 50 today, this surge was majorly due to investment of Rs 7500 crore by the TPG group in Tata Motor’s EV subsidiary. Almost all the Tata Group Companies were on a roll today. Investors are expecting earnings today from big IT names such as Wipro and Infosys. These results will guide whether the bull-run in the IT sector would continue or we may witness some profit booking in this space.

On the technical front, Nifty 50 is able to sustain 18,000 levels and we may witness markets to touch 18,300 levels in the coming session. The 17,800 level is an immediate support in Nifty 50.

October 13, 2021 / 16:12 IST

Palak Kothari, Research Associate at Choice Broking:

On the back of SGX nifty, the Index opened on a positive note and showed an upside rally and made a new life-time high at 18197.80 level and closed the session at 18161.75 level with a gain of 169.80 levels. While Bank Nifty closed the session at 38635.75 levels with a gain of 114.25 points.

On the technical front, the Index has given a breakout of the rising trendline as well as given a close above the same, which points out buyers are active. A daily momentum indicator Stochastic and MACD both have shown positive crossover on the daily chart which adds more bullishness to the price.

The ADX indicator is reading at 38 with +DI trading above – DI, which points out strength in the counter. Furthermore, the price has also moved above the upper “Bollinger Band” formation, which suggests the bullish movement will continue further in the near term. At present, the Index has been trading at uncharted territory with immediate support at 18000 level while sustained above the same can show 18300-18400 levels.

October 13, 2021 / 16:07 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Markets witnessed a stellar rally as both Sensex and Nifty scaled to fresh record highs, largely dominated by auto and IT stocks. Benchmark Nifty maintained a strong breakout continuation formation which clearly suggests further uptrend from current levels.

We are of the view that the short term chart formation is still in to the long side but due to an overstretched intraday rally the bulls may take a caution stance between 18250-18275 levels.

For day traders, 18100 would act as a key support level. Above the same, the uptrend wave will continue up to 18200-18275 levels. On the other hand, dismissal of 18100 could possibly trigger a correction wave up to 18040-17980 levels.

October 13, 2021 / 15:58 IST

V K Vijayakumar, Chief Investment Strategist at Geojit Financial Services:

The hallmark of today's record breaking moves by the Sensex and Nifty is the surge in Tata stocks led by Tata Motors and strongly supported by Tata Consumer, Tata Chemicals and Tata Power. Surge in a heavy weight like Tata Motors by more than 20 percent in a day is extremely rare. But this surge is backed by positive news of massive investment of Rs 7500 crore by TPG. Another important feature is the good performance of HDFC Bank which is showing signs of coming back as a market leader.

October 13, 2021 / 15:45 IST

Vinod Nair, Head of Research at Geojit Financial Services:

The mood of the global market is muted by inflation fears & high bond yields ahead of the release of US inflation data. However, the Indian market is robust due to the festival season. Best performers are auto, metal and power sectors in expectation of high demand.

October 13, 2021 / 15:40 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed some positive movements after Nifty was able to sustain level of 18000. It is going to be crucial for the short-term market scenario to sustain above 18000 support zone.

If the market is able to sustain the level of 18,000, it can witness higher levels of 18250-18300. The momentum indicators like RSI and MACD indicating positive momentum is likely to continue.

October 13, 2021 / 15:36 IST

S Ranganathan, Head of Research at LKP securities:

Auto stocks led by Tata Motors propelled the Nifty to new highs of 18200 with good support from infra & metal stocks on the launch of the Master Plan for infrastructure development and multi- modal connectivity.

As the street awaits earnings today from big IT names, Tata Group stocks hogged the limelight despite profit taking in late afternoon trade.

October 13, 2021 / 15:35 IST

Market close:

Benchmark indices ended at fresh record closing high levels supported by the auto, IT, metal and infra stocks.

At close, the Sensex was up 452.74 points or 0.75% at 60,737.05, and the Nifty was up 169.80 points or 0.94% at 18,161.80. About 1602 shares have advanced, 1504 shares declined, and 118 shares are unchanged.

Tata Motors, M&M, Tata Consumer Products, Power Grid Corp and ITC were among the major gainers on the Nifty. Maruti Suzuki, ONGC, Coal India, SBI Life Insurance and HUL were among the big losers.

Among sectors, auto index added 3.5 percent, while energy, infra, IT, metal, power and capital goods indices up 1 percent each. The BSE midcap and smallcap indices added 0.6-1.5 percent.

October 13, 2021 / 15:24 IST

Prime Securities board approves issuing 45.5o lakh shares on preferential basis

The board of directors of Prime Securities at the meeting held on October 13, 2021, has considered and approved the issue of up to 45,50,000 equity shares of face value of Rs 5 each of the company, on a preferential basis, at a price of Rs 88.75 per equity share, aggregating Rs 40,38,12,500 to the investors including Meridian Investments, Anand Jain, Himanshi Kela, McJain Infoservices, Samir Arora and Latika Ahuja.

Prime Securities was quoting at Rs 110.05, up Rs 5.20, or 4.96 percent on the BSE.

October 13, 2021 / 15:20 IST

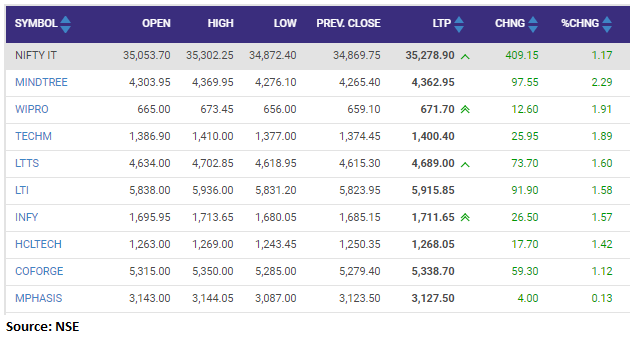

Nifty IT index added 1 percent led by the Mindtree, Wipro, Tech Mahindra

October 13, 2021 / 15:12 IST

Arun Agarwal, Deputy Vice President - Fundamental Research, Kotak Securities:

The TPG group will invest Rs 75 bn in Tata Motors EV subsidiary and the newly formed subsidiary will invest in expanding product offerings. Tata Motors will aggressively launch new products in EV space over the next five years.

Tata Motors would be looking at leveraging its group companies to accelerate EV adoption.

Favorable government policies and further decline in battery prices can rapidly accelerate electrification in the passenger vehicle industry. Tata Motors can establish itself as a formidable player in the EV space in India.

October 13, 2021 / 15:06 IST

Government cuts customs duty, agriculture cess on the edible oils

Government has cut customs duty and agriculture cess on the edible oils. Government has cut customs duty on crude sunflower oil to nil and cut customs duty on refined sunflower oil to 17.5 percent.

They also cuts customs duty on crude palm oil to nil, reported CNBC-TV18.