November 19, 2020 / 16:21 IST

Abhishek Bansal, Founder Chairman, Abans Group:

Crude oil prices are trading firm, on the back of optimism over a coronavirus vaccine, and the crude inventory report, which was below market expectations. WTI Crude oil prices are currently trading in the green from the previous day, near $42 per barrel.

As per the weekly inventory report from EIA for the week ended November 13, US commercial crude inventories rose 770,000 barrels, to 489.48 million barrels, and were now 6.4% above the five-year average.

Crude oil also received support from the OPEC+ technical meeting on Tuesday. Members have not made any formal recommendations, ahead of the Group’s full ministerial meeting on November 30 and December 1 to discuss the policy. As per a Reuters report, OPEC+ members are leaning towards delaying a previously agreed plan to boost output in the new year by 2 million barrels per day (bpd), or 2% of global demand.

WTI crude oil prices are likely to find stiff resistance near $43.77-46.02 per barrel, while key support levels are found near $37.18-34.22 per barrel. The short-term trend is likely to remain firm, on the back of vaccine optimism, and OPEC+ talks of keeping oil production static.

November 19, 2020 / 16:14 IST

Keshav Lahoti, Associate Equity Analyst, Angel Broking:

Indian market corrected by 1.3% on the back of weak global cues. Correction was led by banking stocks due to profit booking. Nifty Midcap 100 today also outperformed Nifty but closed down by 0.6%. Top gainers of the Nifty were Power Grid Corp (2.4%), ITC (2.1%) and NTPC (1.7%). Top losers of the Nifty were SBI (4.9%), Coal India (4.8%) and Axis Bank (3.9%).

Global market was in a negative zone: Dow Futures, Nasdaq Futures and FTSE were down by 0.4%, 0.5% and 1.0% respectively. After the sharp rally in the market from the last few days, we are a bit cautious on the market. We advise investors to have quality stock in their portfolio with strong revenue visibility at reasonable valuation.

November 19, 2020 / 16:09 IST

Vinod Nair, Head of Research at Geojit Financial services:

The increasing virus infections raised fears of additional restrictions and considering its impact on global economic activity, global market sentiments turned negative. This was in spite of the optimism surrounding the advanced stages of vaccine development. Indian markets also witnessed profit booking from recent highs, as investors turned cautious.

Financials led the losses while defensive sectors such as FMCG and Pharma fared better. The positivity in Auto sales numbers continued and could be an indicator of economic recovery. However, increasing virus infections, which is again being reported in some parts of India, can offset this nascent recovery. We can expect short term volatility in the markets and investors are advised to remain cautious.

November 19, 2020 / 15:53 IST

Rebounding Real Estate Sector: CRISIL

New home sales have seen a surprise surge in the last couple of months, making the pandemic-led disruption look like a mere blip. Indeed, units sold in Mumbai and the rest of Maharashtra are 1.1 - 1.3 times higher compared with January this year.

The spurt rides on supportive measures from governments of key states. Maharashtra, for instance, has reduced stamp duty from 5% to 2% up to December 2020 and to 3% for January-March 2021. Karnataka, too, has reduced stamp duty from 5% to 3% for properties priced between Rs 21 lakh and Rs 35 lakh.

November 19, 2020 / 15:36 IST

Market Close:

Benchmark indices broke the 4-day gaining momentum on November 19 on the back of profit booking seen in the IT and Financials name.

At close, the Sensex was down 580.09 points or 1.31% at 43,599.96, and the Nifty was down 166.60 points or 1.29% at 12,771.70. About 1179 shares have advanced, 1384 shares declined, and 156 shares are unchanged.

SBI, Coal India, Axis Bank, ICICI Bank and JSW Steel were among major losers on the Nifty, while gainers were Power Grid Corporation, ITC, NTPC, Tata Steel and Titan Company.

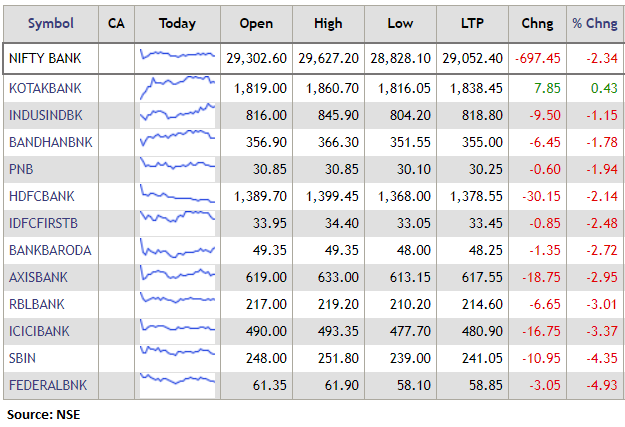

Nifty Bank index shed nearly 3 percent, while Infra and IT indices fell 1 percent each. However, Energy and FMCG indices ended in the green.

November 19, 2020 / 15:30 IST

Buzzing

Bharat Petroleum Corporation (BPCL) share price rose 3 percent on November 19 on the report of Vedanta submitting the EoI to buy stake in the company.

Vedanta Group on Wednesday confirmed putting in a preliminary expression of interest (EoI) for buying government's stake in Bharat Petroleum Corp Ltd (BPCL). The government is selling its entire 52.98 percent stake in BPCL and last date of putting EoI was November 16, said PTI.

November 19, 2020 / 15:25 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

After a gap down, the Nifty turned positive but was unable to sustain that for very long. It went back into negative territory but has not broken the support of 12,500 which means the trend continues to remain bullish. 13,100 still remains an open target which the index can achieve by the end of the November series.

November 19, 2020 / 15:19 IST

GE Shipping takes delivery of LR2 Product Carrier:

The Great Eastern Shipping Company took delivery of a secondhand LR2 Product Carrier “Jag Lara” of about 105,258 dwt. The company had contracted to buy the vessel in Q3 FY21.

Including this vessel, the Company’s current fleet stands at 47 vessels, comprising 34 tankers (11 crude carriers, 18 product tankers, 5 LPG carrier) and 13 dry bulk carriers with an average age of 12.48 years aggregating 3.80 mn dwt. The company has also contracted to buy a Capesize Bulk Carrier which is expected to be delivered in H2FY21.

November 19, 2020 / 15:14 IST

Titan Company hits 52-week high

Titan Company share price touched a 52-week high of Rs 1,345.60, rising 5 percent on November 19 after the company saw good traction across all its businesses in the festive season.

The jewellery business witnessed a mid-teens growth (around 15%) for the 30-day festive season starting from Dussehra till Diwali over the corresponding period last year, with a decent recovery in studded jewellery sales.

The watches and wearables business also did quite well in the festive season with recovery close to last year levels. Its eyewear business has also witnessed good traction.

November 19, 2020 / 15:06 IST

Yash Gupta Equity Research Associate, Angel Broking:

Dr. Reddy's stock opened negative on news of detailed investigation in Ukraine and other countries but then recovers. Company has informed that it has commenced a detailed investigation into an anonymous complaint. The complaint alleges that healthcare professionals in Ukraine and potentially in other countries were provided with improper benefits in violation of US laws.

The investigation is being carried out by a reputed independent US law firm. Stock is not reacting to the investigation but if any negative development from this investigation may hurt the stock in the short term.

November 19, 2020 / 14:59 IST

Nifty Bank Index fell over 2 percent dragged by the Federal Bank, SBI, ICICI Bank:

November 19, 2020 / 14:36 IST

Buzzing

Hero MotoCorp share price rose 7 percent on November 19 after the company reported improved sales during the festival season.

The company sold more than 14 lakh units of motorcycles and scooters during the just concluded festive season, the company said in the release.

The sales were 98 percent of the festival season volumes sold by the company in the previous year (2019) and 103% compared to the same period in 2018.