November 10, 2020 / 16:35 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets extended the prevailing momentum and gained nearly one and a half percent, tracking firm global markets. The news of the Covid-19 vaccine with high efficiency raised hopes of faster than expected recovery in the global economy boosted the sentiment. On the domestic front, buoyancy continued in the banking and financial majors which gradually pushed the index as the session progressed. Consequently, the Nifty ended at 12,631 levels, up by 1.4%. However, the broader market traded subdued and ended down in the range of 0.1- 0.5%.

Nifty is not showing any sign of slowing down and may take a breather around 12,800. Needless to say, the recent surge was largely driven by banking and financials while others are contributing selectively. Traders should align their positions accordingly and use dips to accumulate stocks that are participating in the rally.

November 10, 2020 / 15:57 IST

Vinod Nair, Head of Research at Geojit Financial services:

The global financial markets experienced a wave of euphoria over the potential breakthrough in the coronavirus vaccine development. Indian indices moved in sync with global peers touching fresh highs with continued support from banking stocks while IT and Pharma sectors witnessed heavy sell-offs. An uptick in beaten down stocks & sectors were visible today viewing hopes of recovery in business.

The existing momentum can sustain on vaccine development, domestic stimulus package, consistent FII inflows and bounce in globalization post the Biden victory. However, temporary correction due to profit booking cannot be ruled out because the market is highly optimistic that the vaccine development will rapidly improve the ground reality.

November 10, 2020 / 15:51 IST

Manish Hathiramani, proprietary index trader and technical analyst, Deen Dayal Investments:

We almost hit 12650 on the Nifty; if we are able to sustain the levels of 12650-12700, the index can move to 13000 levels. Hence 12700 might pose a resistance and some profit booking can be considered at these levels and thereafter a buy on dips strategy can be used to enter the Nifty on any dip or correction.

November 10, 2020 / 15:46 IST

Santosh Kumar Singh, Head of Research, Motilal Oswal Asset Management Company:

Markets are at all-time high, however they are driven by three news flows a) US elections uncertainty over b) COVID Vaccine may be much closer and c) India recovery has been faster. Hence, the markets may not see big correction from here and in the medium to long term we see markets doing well. In my view financials is still an area where good upside may be left with all the banks reporting better credit quality.

November 10, 2020 / 15:45 IST

S Ranganathan, Head of Research at LKP Securities:

Bulls went on a rampage today buoyed by positive global cues and the 1.5% rise in Indices reflected the buoyant mood ahead of the festive season. Financials went berserk well supported by heavy weights across sectors barring Pharmaceuticals which witnessed profit booking.

November 10, 2020 / 15:35 IST

Market Close

: Benchmark ended higher for the seven straight session on November 10 helping to close at record high levels on the back of progress in the development of a coronavirus vaccine.

At close, the Sensex was up 680.22 points or 1.60% at 43277.65, and the Nifty was up 170.10 points or 1.37% at 12631.10. About 1203 shares have advanced, 1457 shares declined, and 172 shares are unchanged.

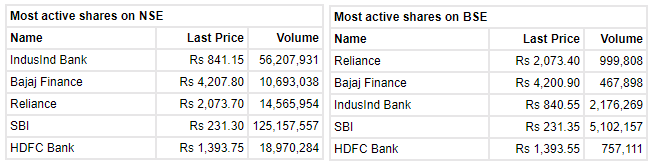

Bajaj Finance, IndusInd Bank, L&T, Bajaj Finserv and HDFC were among major gainers on the Nifty, while losers were Cipla, Tech Mahindra, HCL Tech, Divis Labs and Nestle.

On the sectoral front, except Nifty IT (down 3.8 percent) and Nifty Pharma (down 4.3 percent), other indices ended in the green led by the Nifty Bank (up 3.9 percent) followed by the Nifty Infra (up 2 percent).

November 10, 2020 / 15:30 IST

Navneet Damani, VP – Commodities Research, Motilal Oswal Financial Services:

Gold slumped more than 5% in the previous session as news of the first successful late-stage COVID-19 vaccine trials prompted investors to dump safe-haven bullion and flock to riskier assets. Pfizer and German partner BioNTech SE the first drug makers to show successful data from a large-scale clinical trial of a vaccine, said they expect to seek US emergency use authorization for the drug later this month.

The vaccine news was so sudden and out of the blue that there was no time to think and a quick reaction was seen in all asset classes, equities and yield surged whereas bullion's slipped. Apart from the vaccine news gold has some support amidst the hopes of Covid-19 relief bill under the Joe Biden's leadership, continuous rise in Covid cases globally and post US elections updates as President Trump knocking court's door at various states to prove that Joe Biden's victory is not real.

Economic data is muted on the US front although market participants will keep an eye on the unemployment rate expected from EU. Broader trend on COMEX could be in the range of $1860- 1915 and on domestic front prices could hover in the range of Rs 49,600-50,900.

November 10, 2020 / 15:27 IST

Tata Comm gets order from De Tune

De Tune has selected Tata Communications as the backbone of its next-generation broadcast viewing experience for live events produced virtually anywhere on the globe.

De Tune has been able to simplify its global production operations by consolidating multiple vendors into one cohesive media ecosystem with the help of Tata Communications’ end-to-end live video services.

November 10, 2020 / 15:21 IST

NCC Q2

Company posted 21.4 percent fall in its Q2 net profit at Rs 64.6 crore against Rs 82.2 crore and revenue was down 11.9% at Rs 1,708.3 crore versus Rs 1,938.3 crore, reported CNBC-TV18.

November 10, 2020 / 15:17 IST

Abhishek Bansal, Founder Chairman, Abans Group:

Gold prices dropped after the Dow Jones Industrials hit new record highs. Price of Gold and Silver dropped on vaccine optimism, which could allow the global economy to return to normal later next year.

However, gold is likely to receive support from the covid pandemic and dovish central bank policies. Central banks are unlikely to change their accommodative stance in the near to medium term.

Gold prices are likely to find support around $1,844 and $1,812 (200-days EMA). Meanwhile, a critical resistance is seen near $1,931-$2,007 levels. Optimism over a coronavirus vaccine was responsible for a sharp drop in prices, but global economic growth concerns, due to the rising number of covid cases, is likely to keep gold prices supported at lower levels.

November 10, 2020 / 15:10 IST

Keshav Lahoti Associate Equity Analyst, Angel Broking:

Multiplex stocks PVR, Inox Leisure has corrected ~40% due to disruption brought in the business by Covid-19. Because of fear brought on by the pandemic, people are hesitant to go to theatres to watch movies and the Central Government has also imposed extra restriction on the industry such as occupancy is capped at 50%.

Few state Governments have not given permission for the theatre industry to start their operation. Yesterday with Pfizer's announcing their Covid-19 vaccine is showing signs of 90% effectiveness is positive for the industry. If an effective vaccine comes to the country, the Government will reduce restrictions on occupancy, food & beverages so companies will be able report better revenue and profitability.

With this announcement, there is a possibility of Covid-19 vaccine in the near future, so investors will relook at multiplex stocks from an investment point of view. We are bullish on PVR and Inox Leisure as they are gaining market share and even after Covid-19 disruption yet long term fundamentals are intact for the company.

November 10, 2020 / 15:04 IST

Market Updates

Benchmark indices are trading at day's high level in the final hour of trading with Nifty above 12600 level.

At 15:00 IST, the Sensex was up 705.27 points or 1.66% at 43302.70, and the Nifty was up 176.70 points or 1.42% at 12637.70. About 1084 shares have advanced, 1424 shares declined, and 135 shares are unchanged.