Taking Stock: Sensex Down 355 Points, Nifty Below 15,700; Metal, Financial Stocks Take A Hit

More than 400 stocks, including Vimta Labs, Mastek, Grasim Industries and JSW Energy, hit a fresh 52-week high on the BSE... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,706.67 | -13.71 | -0.02% |

| Nifty 50 | 26,202.95 | -12.60 | -0.05% |

| Nifty Bank | 59,752.70 | 15.40 | +0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| M&M | 3,757.30 | 76.10 | +2.07% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| SBI Life Insura | 1,966.00 | -38.50 | -1.92% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Auto | 27774.60 | 170.90 | +0.62% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 35548.30 | -207.90 | -0.58% |

The markets have been able to close above the 15,600 support which is heartening for the time being. The short term trend gets threatened if we break this level on a closing basis.

If a reversal in trend happens from the current juncture, the Nifty can scale up to 16,000-16,100. It is better to wait for a clean direction to emerge as the current risk is to reward ratio is skewed in favor of the risk.

Indian rupee ended near the day's high at 74.61 per dollar, amid sellingwas seenin the domestic equity market.It opened lower at 74.95 per dollar against previous close of 74.87 and traded in the range of 74.54-74.95.

Bajaj Finance has reported 4.2 percent jump in its Q1 net profit at Rs 1,002.4 crore versus Rs 962.3 crore and net interest income (NII) was up 8% at Rs 4,489 crore versus Rs 4,152 crore, (YoY).

Bajaj Finance ended at Rs 5,962.00, down Rs 50.75, or 0.84 percent on the BSE.

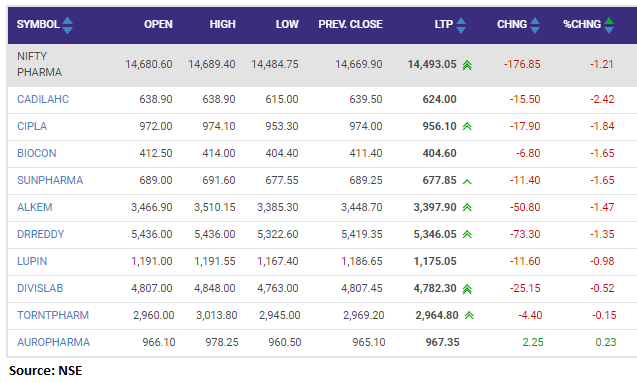

Benchmark indices ended lower for the third consecutive session on July 20 dragged by the metal, realty and financial names.

At close, the Sensex was down 354.89 points or 0.68% at 52198.51, and the Nifty was down 120.30 points or 0.76% at 15632.10. About 1109 shares have advanced, 2056 shares declined, and 107 shares are unchanged.

Hindalco, IndusInd Bank, Tata Steel, NTPC and Bharti Airtel were the top lowers on the Nifty. While top gainers included Asian Paints, UltraTech Cement, HUL, Grasim and Maruti Suzuki.

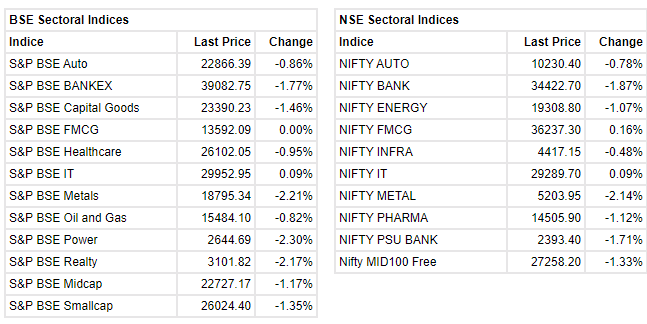

Among sectors, except FMCG all other indices ended lower. BSE Midcap and Smallcap indices fell over 1 percent each.

More than 400 stocks hits 52-week high;

The market witnessed the continuation of correction for the second consecutive day after it failed to hold the support level near 15650. 15650 will be an important support level from a short-term perspective. If the market closes below 15650, market might see the correction extend till the level of 15500.

The technical indicator suggests, a volatile movement in the market in a small range. As such the traders are advised to refrain from building a fresh buying position, until market sees further decisive movement.

Newgen Software Technologies has posted 59 percent fall in its Q1FY22 net profit at Rs 21.6 crore versus Rs 52.7 crore and revenue was down 20.2% at Rs 159.5 crore versus Rs 200 crore, QoQ.

Newgen Software Technologies was quoting at Rs 662.60, down Rs 34.85, or 5 percent on the BSE.

he Rs 500-crore IPO of Tatva Chintan Pharma Chem is witnessing an overwhelming response from investors as it is oversubscribed by 138.5 times so far, on July 20, the final day of bidding.

Investors have put in bids for 45.16 crore equity shares against offer size of 32.61 lakh equity shares, the subscription data available on the exchanges showed. The offer size mentioned above was reduced as the company raised Rs 150 crore from anchor investors on July 15. Read More

Reliance Industrial Infrastructure Q1 profit was at Rs 2.40 crore against Rs 2.05 crore. Its total income was at Rs 19.77 crore.

Reliance Industrial Infrastructure was quoting at Rs 754, down Rs 27.05, or 3.46 percent on the BSE.

Indian benchmark indices were trading lower in the final hour of the trade with Nifty below 15,650.

The Sensex was down 329.54 points or 0.63% at 52223.86, and the Nifty was down 110.60 points or 0.70% at 15641.80. About 970 shares have advanced, 2004 shares declined, and 94 shares are unchanged.

ISGEC Heavy Engineering has recently secured a prestigious order for two sets of Carbonation Columns, one set of Gas Scrubber Columns, and one set of Distillation Columns, company said in its release.

This order has been received from one of the world's most prominent soda ash manufacturing companies based in Russia, it added.

ISGEC Heavy Engineering was quoting at Rs 792.10, up Rs 4.95, or 0.63 percent on the BSE.