The Follow-On Public Offering (FPO) of Adani Enterprises had got bids for 46.27 million shares against an offer size of 45.5 million shares, representing a 102 percent subscription, in the afternoon of January 31, the third and final day of bidding.

This excludes the anchor portion that was fully subscribed.

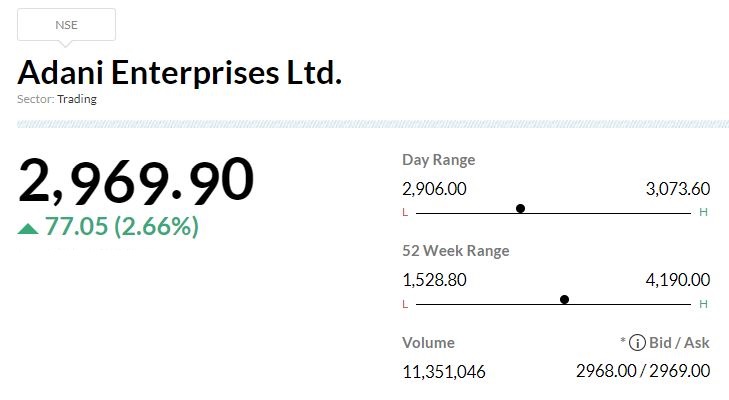

Retail investors have taken a backseat as the stock price slid below the FPO price band, bidding for only 11 percent of the shares set aside for them.

Qualified institutional buyers (QIB) are at the forefront. They have bid for 12.44 million shares of the 12.8 million shares set aside for them. This indicates 97 percent subscription.

Non-institutional investors have oversubscribed to 326 percent of the portion set aside for them. They have bid for 31.31 million shares against 9.6 million reserved. Meanwhile, employees have bid for 52 percent of the shares reserved for them.