February 24, 2022 / 16:30 IST

Oil rises above $105 after Russia attacks Ukraine

Oil prices jumped on Thursday, with Brent rising above $105 a barrel for the first time since 2014, after Russia's attack on Ukraine exacerbated concerns about disruptions to global energy supply.

Russia launched an all-out invasion of Ukraine by land, air and sea in the biggest attack by one state against another in Europe since World War Two.

The United States and Europe have promised the toughest sanctions on Russia in response.

Brent crude rose $8.24, or 8.5%, to $105.08 a barrel at 1045 GMT. U.S. West Texas Intermediate (WTI) crude jumped $7.78, or 8.5%, to $99.88.

Brent and WTI hit their highest since August and July 2014 respectively.

February 24, 2022 / 16:29 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets witnessed a sharp sell-off and lost nearly 5% as escalating tensions between Russia and Ukraine spooked sentiments. Investors chose to move out of risky assets and preferred safe haven like gold.

The Nifty index drifted gradually lower and finally settled around the day’s low to close at 16,247 levels. In line with the benchmark, all the sectoral indices and broader indices ended with deep cuts.

Markets are rattled with the news of Russia’s attack on Ukraine and it may cascade further citing the further news updates. This fall has resulted in the breakdown of the consolidation range in the Nifty index and it might find support around the 15900-16,000 zone.

Traders should align their position accordingly and prefer trading through options strategies.

February 24, 2022 / 16:21 IST

Vinod Nair, Head of Research at Geojit Financial Services:

It was a big surprise for the world market as it was not anticipating a war. It was expecting a diplomatic meet between Biden & Putin.

Markets around the globe plunged deep in red as the Ukraine crisis intensified with Russia’s invasion into Eastern Ukraine. Crude oil prices crossed USD 100 per barrel and elevated inflation risk.

February 24, 2022 / 16:16 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Investors turned jittery and pressed the panic button after reports emerged that Russia has taken military action against Ukraine. As the mood was sombre across the global equity markets, traders back home also followed suit and pressed the sell button, resulting in across-the-board selling. Also, the F&O expiry pressure also gave investors the reason to cut their position further due to escalating geo-politicial tensions.

Technically, after a long time, benchmark Nifty closed below the 200-day SMA and has also formed a long bearish candle on daily charts, which suggests further weakness from the current levels.

Considering the uncertainties hovering around, the index may trade lower between the highs of 16800 and 16,000. The market is in corrective mode and it would complete its corrective pattern between 16200 and 16000. For the traders, 16400 and 16500 could act as intraday resistance while 16100-16000 could be the immediate support zone.

February 24, 2022 / 15:45 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

Nifty has broken significant support level 16600 and witnessed significant selling pressure in line with global markets. We believe volatility will remain elevated on account of an external shock and expect March series to witness further negative bias.

Though the bias is negative, we await derivatives data to establish objective levels before taking a strong positional stance from here on. Investors can use further deep corrections to buy/average and traders to define risk in uncertain times.

February 24, 2022 / 15:42 IST

Shivam Bajaj, Founder & CEO at Avener Capital:

Prolonged Geo-political tensions between Russia - Ukraine could lead to further inflationary pressure, compelling policy makers globally to accelerate raising interest rates at the cost of economic growth. From an Indian economy standpoint, the economic impact is likely to be more short term in nature as its economy will continue to be driven by its long-term fundamental growth prospects.

In 2020, India imported only $7.3 billion of all products from Russia (less than 2% of India’s total imports) and exported $3.9 billion of all products from Russia (less than 2% of India’s total exports).

February 24, 2022 / 15:40 IST

S Ranganathan, Head of Research at LKP securities:

With Brent crude breaching the USD 100 mark for the first time in 7 years post the Russian military operation in Ukraine, both the benchmark Indices wilted with a 5% cut as the volatility index rose 30% today with all sectoral indices ending deeply in the red wiping out over Rs 10 lakh crores of investor wealth.

A peep into the advance-decline ratio said it all as the carnage together with the volatility witnessed today was painful for both investors and traders.

February 24, 2022 / 15:36 IST

Market Close

Indian benchmark indices registered seventh straight session fall on February 24 with Nifty breaching 16,300 amid escalating Russia-Ukraine crisis.

At close, the Sensex was down 2,702.15 points or 4.72% at 54,529.91, and the Nifty was down 815.30 points or 4.78% at 16,248.00. About 240 shares have advanced, 3084 shares declined, and 69 shares are unchanged.

All stocks on Nifty50 ended in the red with Tata Motors, IndusInd Bank, UPL, Grasim Indusries and Adani Ports were the biggest losers.

All the sectoral indices ended with a loss of 3-8 percent, while BSE midcap and smallcap indices shed over 5 percent each.

February 24, 2022 / 15:25 IST

Norbert Rücker, Head of Economics & Next Generation Research, Julius Baer

The Ukraine crisis seems to have escalated to crucial tipping points and appears at the brink of turning from a sentiment to an economic shock. Oil and gas prices are the crisis fear barometer given their supplies vulnerability to sanctions or damage.

Today’s situation involves lots of noise and uncertainty, bringing a new level of dynamics. Given all these uncertainties, we revise our price targets. That said, oil prices are at economically burdensome levels already, and this usually meant lower prices longer term.

The war drums are pounding ever louder in Europe. The Ukraine crisis seems to have escalated to crucial tipping points. This brings the economy and markets to the brink of a worst-case scenario, where the crisis begins to turn into an economic shock, not only a sentiment shock.

Center stage of such an outcome are energy markets, where oil and natural gas prices have become the crisis’ fear barometer. Any disruption of flows between Russia and Europe, due to damage or sanctions, would drastically add to the already present supply scarcity. Situations as today’s entail lots of noise and uncertainty, and things could shift into different types of new dynamics.

February 24, 2022 / 15:22 IST

BSE Power index fell over 5 percent dragged by the Adani Power, BHEL, Tata Power

February 24, 2022 / 15:19 IST

Ashoka Buildcon gets Letter Of Acceptance for a project worth Rs 692 crore

Ashoka Buildcon has received Letter of Acceptance for the Project viz. 'Electrification of Railway Lines in the State of Assam.

The accepted offer of the project is Rs 692.50 crore and the contract period is 900 days.

Ashoka Buildcon was quoting at Rs 80.95, down Rs 11.15, or 12.11 percent on the BSE.

February 24, 2022 / 15:14 IST

Vijay Chandok - MD & CEO, ICICI Securities:

While the escalated war situation between Russia/Ukraine has led to sharp cut in key equities across the globe, we believe crude trajectory will the key to watch out for going ahead.

We don’t expect major sanctions which may drive big spike in crude, equally harming Europe and US, or even in terms of aggressive rate hike leading to slower economic growth. We, thus, believe that market stabilization is likely in the short term. Nonetheless, medium to long term thesis on Indian equities remain intact amid economic recovery as reflected by key macroeconomic indicators, strong capex spends and robust corporate earnings (Nifty earnings growth likely at 21.5 % CAGR over FY21-24).

We continue to see this correction as an opportunity for the investors to add on the companies with sustainable growth visibility.

February 24, 2022 / 15:09 IST

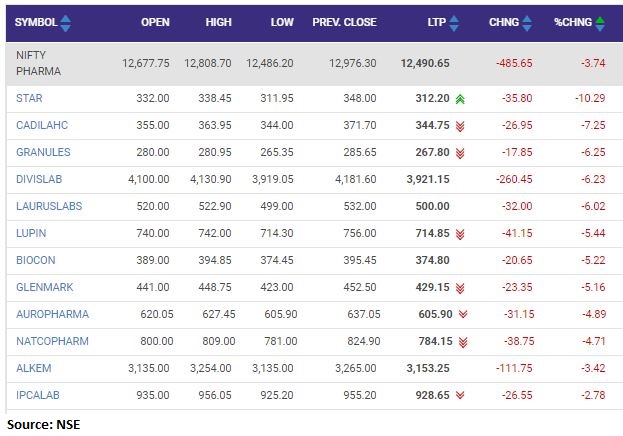

Nifty Pharma index shed 3.7 percent dragged by the Strides Pharma Science, Cadila Healthcare, Granules India