Taking Stock: Market Puts A Break To 5 Straight Days Of Losses, Ends Flat Amid High Volatility

Nifty Metal index rose nearly 4 percent, while energy and infra indices added 1-2 percent.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,186.47 | 513.45 | +0.61% |

| Nifty 50 | 26,052.65 | 0.00 | +0.00% |

| Nifty Bank | 59,216.05 | 0.00 | +0.00% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Max Healthcare | 1,164.40 | 47.70 | +4.27% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| TMPV | 360.85 | -10.45 | -2.81% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 37044.70 | 1069.50 | +2.97% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 36132.30 | -91.50 | -0.25% |

Fitch Ratings sees the proposed reorganisation plan by India's Reliance Industries Ltd (RIL, BBB-/Stable) to transfer its refining, marketing and petrochemical (oil-to-chemicals) businesses to a wholly owned subsidiary, Reliance O2C Limited (O2C), as a step towards facilitating participation by strategic investors in its O2C businesses. We anticipate the reorganisation will have a neutral impact on RIL's credit metrics and rating.

Index managed to hold above 14,700 zone and closed a day with small gains forming a Doji candle pattern on the daily chart after consecutive five bearish candle. The index has good support near 14,630 zone and immediate resistance is coming near 14,800 zone, so index may show some sort of consolidation in the same range and final direction will be clear once we see either side breakout from the mentioned range.

Indian rupee ended with marginal gains at 72.46 per dollar, amid volatile trading saw in the domestic equity market.

It opened higher by 14 paise at 72.36 per dollar against previous close of 72.50 and traded in the range of 72.30-72.47.

Benchmark indices ended flat in the highly volatile session on February 23.

At close, the Sensex was up 7.09 points or 0.01% at 49,751.41, and the Nifty was up 32.10 points or 0.22% at 14,707.80. About 1657 shares have advanced, 1213 shares declined, and 158 shares are unchanged.

Tata Steel, Tata Motors, ONGC, Hindalco Industries and UPL were among major gainers, while losers were Kotak Mahindra Bank, Maruti Suzuki, Bajaj Auto, Adani Ports and Divis Labs.

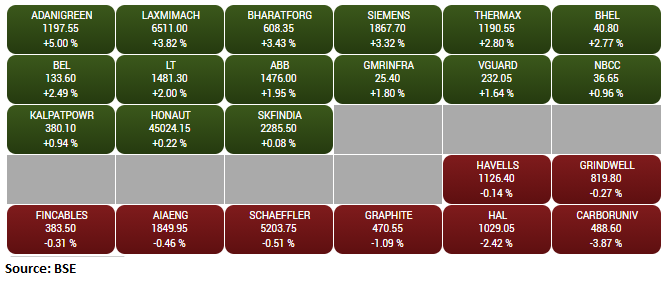

Nifty Metal index rose nearly 4 percent, while energy and infra indices added 1-2 percent. However, some selling seen in the pharma and banking names. BSE Midcap and Smallcap indices rose 0.7-1 percent.

Gayatri Projects has received Letter of Award (LOA) worth Rs 1323.52 crore from National Highways Authority of India, New Delhi for the development of six lane access controlled in Uttar Pradesh portion of Delhi Saharanpur Highway on EPC mode.

Gayatri Projects was quoting at Rs 42.55, up Rs 3.85, or 9.95 percent on the BSE. There were pending buy orders of 19,897 shares, with no sellers available.

The market continued to witness a lack of momentum and stayed between 14,650 to 14,850 (Nifty 50 Index). As of now, the market's technical condition appears like a short-term correction is in the process. While it is subject to further price action evolution, it is prudent to wait for a decisive breakout above 14,850 before considering the short-term correction has over.

Once this level is met, the market is expected to gain momentum, leading to an upside projection till the 15,250 levels.

Indian rupee is trading higher at 72.37 per dollar, amid buying seen in the domestic equity market.It opened higher by 14 paise at 72.36 per dollar against previous close of 72.50.

IndiGo and Dubai Aerospace Enterprise signed long term lease agreements for 7 Airbus A321neo aircraft. All 7 aircraft will be scheduled to be delivered in 2021, reported CNBC-TV18.

Reliance Industries (RIL) has initiated process to carve out their Oil to Chemical (O2C) business into a subsidiary for attracting strategic partners and capital.

The move is in line with RIL strategy to create three business verticals-O2C, digital and retail- to drive growth.

The company remains very well placed to monetize its world class assets at right value with global majors. Our valuation of O2C business of USD 73.3bn, based on 8.5x EV/E FY23E, fully captures the near term growth opportunities.

Maintain earnings estimates and price target. Reiterate buy as RIL remains an enviable company with multiple world class assets.

Bitcoin dropped below $50,000 on Tuesday, as investors began to get a little nervous about the digital currency’s lofty valuation and some leveraged players took profit.

The cryptocurrency dropped more than 10%, its largest daily drop in a month, to hit $48,575. That extends a sharp withdrawal of more than 16% from a record high hit on Sunday, although bitcoin remains up around 75% for the year.