Global economy must start bracing for low inflation, says Raghuram Rajan

Central banks must ask themselves if their policies were nimble enough when inflation shifted from low to a high regime, said Rajan.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 84,785.70 | -115.01 | -0.14% |

| Nifty 50 | 25,933.70 | -25.80 | -0.10% |

| Nifty Bank | 58,773.90 | -61.45 | -0.10% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| Bharat Elec | 409.35 | 5.55 | +1.37% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| Adani Enterpris | 2,355.60 | -43.60 | -1.82% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty PSU Bank | 8414.30 | 48.55 | +0.58% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty IT | 36751.10 | -286.80 | -0.77% |

Domestic equities witnessed some pressure amid weak global cues, mixed November auto sales number and investor’s cautious approach ahead of release of US monthly jobs data. Nifty ended its eight-day streak after witnessing rally of 4%. The index finally close with loss of 116 points (-0.6%) at 18696 levels.

Broader market however outperformed and were up +0.6%. Realty and Metals continued to see traction. Niche sectors likely defence, pipes and beverage companies were in flavour on back of news flows.

After rallying 4%, market seems to have taken a pause and is likely to consolidate for next few days. However, overall trend remains positive with Nifty headed towards 19K zones.

Next week, markets will take cues from RBI’s policy meeting and we expect them to tone down their stance given positive macro data and dovish commentary from Jerome Powell. Also investors would keenly watch for outcome of Gujarat state election that is due next week.

Result in favour of BJP would add to continued momentum as it would mean stability and set the stage for 2024 election. Other key data lined up to release next week are OPEC meeting, US & India Service PMI, Europe Q3 GDP and US Jobless claim data.

Bears remained at the helm throughout the day as the benchmark index couldn't pare the morning loss. However, the correction was limited to 0.62% by the end of the session.

Over the near term, sentiment is likely to remain sideways, with 18,500-18,800 to be the crucial range. A decisive breakout from either band may induce a clean directional move in the market.

As the market was in an overbought zone after the recent upsurge, correction was due for sometime and hence investors booked profit in a trading session marked by weak Asian and European cues.

The recent GDP numbers and GST collections came in line with expectations, but global newsflow will continue to dictate the market trend going ahead.

The two immediate triggers - RBI's credit policy next week and the US Fed meeting in mid December on rate front would determine the investors' mood in the near term

Nifty snapped an 8-day rally on Dec 02 and closed 0.62% or 116.4 points lower at 18696.1. However, it did not close at the intraday low.

Global stocks were cautious on Friday, after recent sharp gains as traders awaited the monthly US jobs report for clues on the Federal Reserve’s next policy steps and worries about economic growth resurfaced in Europe.

Gains over the past few days are being digested and markets are looking at fresh data points to decide the further direction.

Realty stocks performed well in India due to a broker upgrade. Auto stocks came under profit taking post the monthly sales numbers. Over the week, Nifty gained 0.99%.

Nifty could face resistance in the 18,758-18,888 band while 18,462-18,529 band could offer support in the near term.

Markets witnessed profit-taking and lost over half a percent, taking a breather after the recent surge. After the flat start, the Nifty index gradually inched lower in the first half, followed by range-bound movement till the end. Consequently, the Nifty index settled at 18,695; down by 0.62%.

Meanwhile, sectoral pack traded mixed wherein realty and metal counters were in the limelight while auto and energy traded subdued. Amid all, the buoyancy on the broader front kept the traders busy till the end.

Indications are in the favour of further consolidation in the index but the tone would remain positive till Nifty upholds 18,300. And, since all the sectors are participating in the move, traders should utilize this phase to add quality names on dips.

The rally in the domestic market was halted by negative cues from global counterparts and broad-based profit booking in large caps.

The correction in the market was led by auto stocks as the sales data came in lower than expected due to weaker exports and sequential de-stocking.

Declining manufacturing activity in the US is proof that the central bank’s policy tightening has started to show results, which in turn will encourage the Fed to keep rate hikes at bay.

With IT stocks supporting the Bulls well this week, today we witnessed price action across select themes in the Small & Midcap space.

On a day when Auto stocks dragged indices down post the monthly numbers, the street focused attention in the broader markets to segments like Tyres, Pipes & Sugar buoyed by positive newsflow as many stocks were keenly sought after in these pockets.

Indian rupee closed lower at 81.31 per dollar against previous close of 81.21.

Indian benchmark indices broke eight-day gaining momentum and ended lower with Nifty around 18,700.

At Close, the Sensex was down 415.69 points or 0.66% at 62,868.50, and the Nifty was down 116.40 points or 0.62% at 18,696.10. About 1995 shares have advanced, 1376 shares declined, and 137 shares are unchanged.

Eicher Motors, M&M, Tata Consumer Products, HUL and Hero MotoCorp were among the top Nifty losers. The gainers were Apollo Hospitals, Grasim Industries, Tech Mahindra, Tata Steel and Dr Reddy’s Laboratories.

On the sectoral front, except realty and metal, all other sectoral indices are trading in the red.

The BSE midcap and smallcap index rose 0.7-0.8 percent.

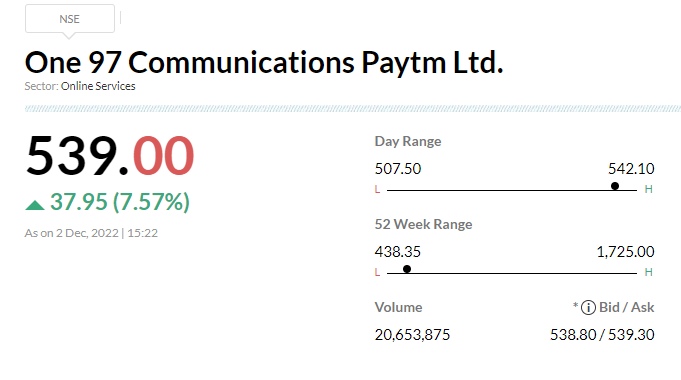

-Buy call, target Rs 650 per share

-Management explained business model & gave insights on its payments & lending business

-Company expects to become free cash flow positive in the next 12-18 months

-In-line with our view of cash burn ending in the next 4-6 quarters

-Buy call, target Rs 300 per share

-Over medium-term its strategy remains diversification to non-MFI categories

-Company to increase exposure to states beyond West Bengal and Assam within MFI

-Bank lacked management talent/depth to scale businesses beyond MFIs

-It was encouraging to see new senior hires from top private sectors

-In the near-term, normalisation in MFI will be key

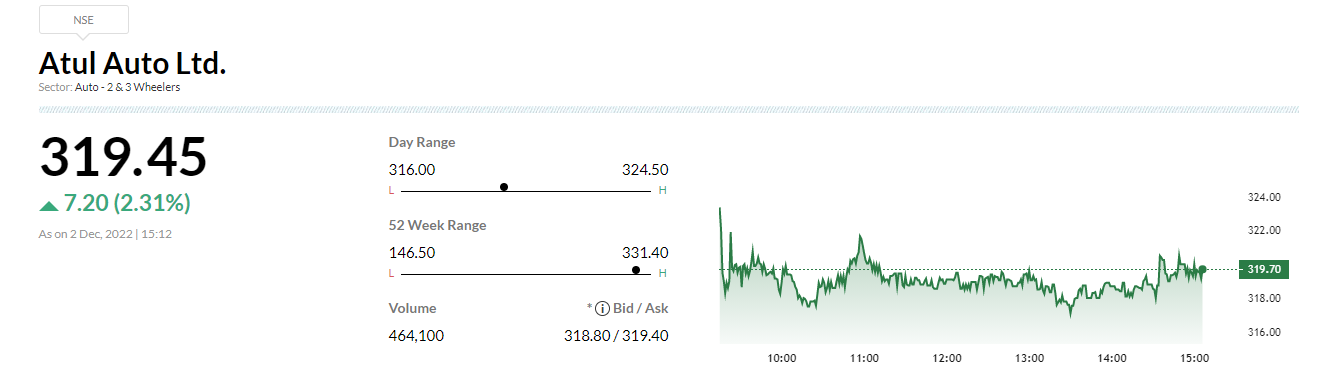

Atul Auto share price gained 2 percent as company sold 2,253 units in November 2022, a growth of 67.6% over 1,344 units sold in same month last year.

The financial year-to-date growth was 62% at 15,914 units sold November 2022 YoY.