December 16, 2021 / 16:27 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities:

Key benchmark indices eked out small gains in a volatile trading session as strength in global markets boosted sentiment here. On intraday charts, the Nifty has maintained a lower top formation as it once agains witnessed selling pressure near 17350, which is broadly negative for the market. However, in this week so far, the index corrected over 450 points and now it is trading near the important retracement support level.

While the short term texture of the market is still weak, a quick pullback rally is not ruled out, if the Nifty succeeds to trade above 17350. However, if it trades below 17350, a correction wave could continue up to 17200-17150. For the bulls, 17350 would be the intraday breakout level and above the same, the reversal formation will persist up to 17400-17435.

December 16, 2021 / 16:03 IST

Ajit Mishra, VP - Research, Religare Broking:

Markets managed to end marginally higher amid volatility, taking a breather after the recent fall. After the initial uptick, the benchmark drifted lower and retested the previous session’s low. However, recovery in the select index majors in the final hours helped the index to pare losses and end in the green.

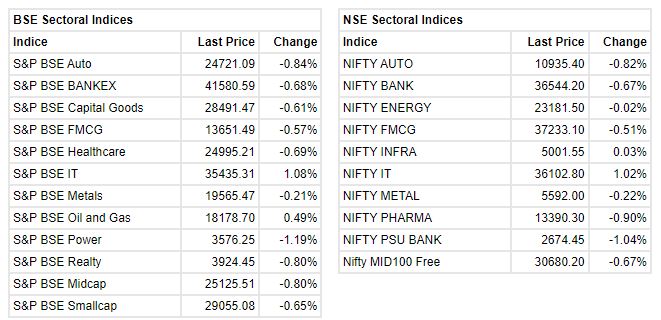

Amid all, the sectoral indices traded mixed wherein IT, Consumer Durables and Oil & Gas ended with gains, while auto, banking and capital goods ended with losses. The broader markets also witnessed selling pressure as both Midcap and Smallcap ended with 0.6% and 0.8% losses, respectively.

As all the major events are over now, we feel the performance of the global markets would be critical in days to come. At the same time, we expect the buzz to continue in the primary market. Among the sectors, only the IT pack looks decisive to us while others are witnessing mixed trends. Participants should plan accordingly.

December 16, 2021 / 16:01 IST

Sahaj Agrawal, Head of Research- Derivatives at Kotak Securities:

After witnessing momentum breakdown in November, Nifty has managed to form an important support at 16600 levels. Volatility continues to remain elevated due to global factors.

Currently markets are hovering around critical support levels and provide a good risk-reward opportunity. As long as 16600 is held, there are high chances of the Index testing 19000 odd levels; failure would have meaningful negative implications.

December 16, 2021 / 15:58 IST

Rohit Singre, Senior Technical Analyst at LKP Securities:

Index opened a day with good gap but profit booking since start of the day erased most of the gains and index closed a day at 17248 with minimal gains.

Index again respected the support zone of 17200 & witnessed some pull back, now going forwards also 17200 again will be the first support for Nifty followed by 17140 zone and if it managed to sustain above said levels then some extension can be possible towards 17370-17450 zone which are immediate resistance on the higher side.

December 16, 2021 / 15:57 IST

Vinod Nair, Head of Research at Geojit Financial Services:

Domestic bourses closed flat with a mild positive bias despite an upbeat economic outlook by the US Fed. Domestic weakness was due to FII selling and moderation in retail activity. The Fed chair announced their decision to double the pace of asset tapering by early 2022 rather than a mid-2022 paving way for three interest rate hikes, backed by a rapidly strengthening economy and employment gains amid inflation concerns.

This is mostly in line with expectations taken positively by the rest of the world equity market.

December 16, 2021 / 15:35 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets opened on a positive note following Asian market cues as globally investors assess US Fed's decision on taper and rates. The US Fed communicated to aggressively unwind bond buying and sees three rate hikes in 2022 and two each in following next two years.

During the afternoon session, the markets continued to hold their head above water. However, upside remain capped on relentless FII selling in capital markets which impacted traders’ sentiment. During the closing session, the markets succumbed to selling pressure.

December 16, 2021 / 15:34 IST

Market Close

: Benchmark indices managed to close in positive territory in the volatile session on December 16 led by the IT stocks.

At close, the Sensex was up 113.11 points or 0.20% at 57,901.14, and the Nifty was up 27 points or 0.16% at 17,248.40. About 1462 shares have advanced, 1803 shares declined, and 103 shares are unchanged.

Bajaj Finance, Infosys, BPCL, Titan Company and Reliance Industries were among the top Nifty gainers. Losers included Hindalco Industries, Cipla, Maruti Suzuki, ICICI Bank and Hero MotoCorp.

Among sectors, except IT and oil & gas all other sectoral indices ended in the red. BSE midcap and smallcap indices down 0.5 percent each.

December 16, 2021 / 15:27 IST

Mohit Ralhan, Managing Partner & Chief Investment Officer:

The Fed has signalled a hawkish stance in the coming years while keeping the policy rates unchanged for now. The dot plot shows that the Fed expects to raise policy rates three times in 2022 and three times in 2023 based on median projections. But even after that, the rates will not reach the level of 2.5%, which is considered a neutral level by the Fed. It will still remain on the side of supporting growth although the intensity will come down. Another factor is the threat to the economy mounted by the Omicron variant which was duly listed as a risk and therefore if the economy takes a hit, there is a high likelihood of postponement of rate hikes.

The shift in the commentary on inflation from “being transitory” to “being persistent” has made the start of tapering a foregone conclusion. The acceleration of tapering indicates that the Fed is playing catch up to inflation and at the same time it also indicates that the policymakers are comfortable with the sustainability and projections of economic growth. With the uncertainty around tapering now out of the equation, a positive outlook on economic growth and a likely supportive action by the Fed if the Omicron variant proves to be a dampener, the stock markets in the US have responded positively to the policy announcement.

As far as Indian markets are concerned, it has been witnessing a downward pressure in anticipation of the Fed’s policy decisions as there is likely to be a decrease in liquidity, which is un-correlated to economic recovery and growth. Therefore, the impact is expected to be relatively smaller and post a stabilizing event, the bull run in India is likely to continue on the basis of domestic factors. The Fed actions will spur central banks around the globe, including RBI, to adjust their own policy stances to balance the demands of local macroeconomic factors.

December 16, 2021 / 15:21 IST

CarTrade Tech board approves investment of up to Rs 750 crore for strategic acquisition

CarTrade Tech plans to deploy up to USD 100 mn (Rs 750 crore) to strategically acquire and invest into companies in the automotive space, company said in its press release.

CarTrade Tech was quoting at Rs 903.25, down Rs 6.05, or 0.67 percent.

December 16, 2021 / 15:18 IST

BEML signs MoU with RITES

BEML signed a Memorandum of Understanding (MoU) with Rites to explore and jointly bid for opportunities in the fields of Metro systems and export of rolling stock.

As part of the MoU, Rites will provide expertise in design, engineering, marketing and any other support that may be required for tapping domestic and overseas opportunities while BEML will be responsible for manufacturing of customized metro coaches and rolling stock.

RITES was quoting at Rs 266.20, down Rs 0.10, or 0.04 percent on the BSE.

December 16, 2021 / 15:12 IST

Nifty Power index shed 1 percent led by the Torrent Power, Tata Power, Adani Green

December 16, 2021 / 15:07 IST

Ravi Singh, Vice President and Head of Research at ShareIndia:

The impact of the pandemic has effected the travel and hospitality the most among others. Post covid the pick up in travel services showcases optimism. But as the fear of Omicron again gripping the world, the path of recovery for this industry is still gloomy.

Rategain offers travel and hospitality software solutions and it's price band seems on upper side as per the valuations. It may list in the range of Rs 380 - 420 and it's recommended to book the subscription at the time of listing.

December 16, 2021 / 15:04 IST

Market at 3 PM

Benchmark indices were trading with marginal gains in the final hour of the trading amid volatility.

The Sensex was up 56.40 points or 0.10% at 57844.43, and the Nifty was up 14.50 points or 0.08% at 17235.90. About 1264 shares have advanced, 1847 shares declined, and 71 shares are unchanged.