April 10, 2023 / 16:20 IST

Ajit Mishra, VP - Technical Research, Religare Broking

Market started the week on a flat note, after hovering volatile in a range. After the initial uptick, Nifty inched higher in the first half but profit taking erased all the gains as the day progressed. Finally, it has settled at 17624.05; up by 0.14%. On the sectoral front, buying interest in auto, energy and IT capped the damage. Besides, recovery on the broader front kept the traders busy.

We expect further consolidation in the index however the tone is likely to remain positive. Now, the upcoming results and global cues will largely dictate the trend. Meanwhile, we recommend focusing on stock specific opportunities.

April 10, 2023 / 16:11 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

While benchmark indices ended a tad higher in a lacklustre trading session, realty, oil & gas, auto and power stocks rallied sharply after having retreated last month. There are hopes that the interest rate cycle seems to be peaking out after the last week's status quo by RBI and if rates begin to fall going ahead, rate-sensitive stocks would be the most preferred bet by investors.

Technically, the Nifty has formed a small inverted Hammer candlestick, which indicates indecisiveness between bulls and bears. Due to temporary overbought conditions we could see some profit booking at higher levels going ahead.

For Nifty, 17,525-17,550 would act as an immediate resistance area while 17,550-17,500 or the 50-day SMA (Simple Moving Average) would act as key support zones.

April 10, 2023 / 16:03 IST

Jatin Gedia, Technical Research Analyst, Sharekhan by BNP Paribas:

The Nifty continued with positive momentum and closed with gains for the sixth consecutive trading session. On the daily chart we can observe that the Nifty has faced selling pressure from the zone of 17,680 – 17,700 where resistance in the form of the downward sloping trendline and the daily upper Bollinger band is placed.

The hourly momentum indicator has a negative crossover along with a negative divergence which indicates loss of momentum on the upside. Considering that prices have reached a minor resistance and with the momentum also not supportive can lead to a consolidation in the immediate short term.

Overall, the consolidation shall provide an opportunity to initiate fresh longs. In terms of levels crucial support is placed at 17,550 – 17,500 while immediate hurdle is placed at 17,680 – 17,700. Overall, the uptrend is still intact and we expect Nifty to target levels of 17,800 from short term perspective.

April 10, 2023 / 15:53 IST

Vinod Nair, Head of Research at Geojit Financial Services

Sentiments in the domestic market improved after the RBI’s decision to keep rates unchanged, coupled with positive revisions in GDP and inflation forecasts. The positive quarterly business updates from auto and real estate firms caused strong movements in their respective sectors, but the overall mood was slightly dampened by solid US job data, which raised fears of further rate hikes by the Fed. The release of inflation data in India and the US, along with the FOMC minutes, have now become crucial in determining the market trend.

April 10, 2023 / 15:48 IST

Kunal Shah, Senior Technical Analyst at LKP Securities

The Bank Nifty index faced selling pressure from higher levels after a strong rally last week. The index if fails to sustain above the level of 41,200 can witness some profit booking towards 40,600-40,500 levels.

The upper resistance if taken out will lead to further short covering towards the 42,000 level.

April 10, 2023 / 15:45 IST

Rupak De, Senior Technical Analyst at LKP Securities

Nifty remained volatile within a narrow range before closing on a muted note. On the daily chart, the index has maintained its position above the breakout zone.

The momentum oscillator RSI is in bullish crossover and rising. The market continues to remain buy-on-dips as long as it sustains above 17,500. On the higher end, immediate resistance is visible at 17,700; above which the index may move up towards higher levels.

April 10, 2023 / 15:32 IST

Rupee Close:

Indian rupee ended lower at 81.98 per dollar against previous close of 81.89.

April 10, 2023 / 15:30 IST

Market Close

: Benchmark indices ended on flat note in the highly volatile session on April 10.

At close, the Sensex was up 13.54 points or 0.02 percentat 59,846.51, and the Nifty was up 24.80 points or 0.14 percentat 17,624. About 1,965 shares advanced, 1,568 shares declined, and 146 shares were unchanged.

Tata Motors, ONGC, Grasim Industries, Adani Enterprises and Wipro were among major gainers on the Nifty, while losers included Bajaj Finance, Tata Consumer Products, HUL, Asian Paints and IndusInd Bank.

On the sectoral front, except bank and FMCG, all other indices ended in the green with realty index jumping4 percent, while auto, power and oil & gas rose 1 percent each.

The BSE midcap and smallcap indices ended with marginal gains.

April 10, 2023 / 15:25 IST

JSW Ispat Special Products Q4 Update

JSW Ispat Special Products has posted 9 percent jump in its Crude Steel Production at 0.18 mt versus 0.17 mt YoY, while up 84 percent, QoQ.

JSW Ispat Special Products was quoting at Rs 31.11, up Rs 0.43, or 1.40 percent.

April 10, 2023 / 15:23 IST

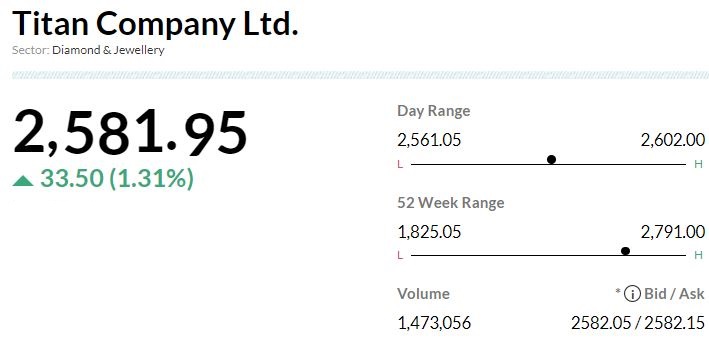

Citi View On Titan Company

-Buy rating, target at Rs 3,091 per share

-Impressive growth despite relatively weak march

-Growth for other segments was impressive as well

-All standalone categories recording double-digit growth

-Remain upbeat on near-term as well as long-term growth prospects

April 10, 2023 / 15:21 IST

Saumil Gandhi, Senior Analyst - Commodities, HDFC Securities:

Crude Oil prices steady with benchmark NYMEX WTI crude oil were trading slight up by 0.09% at $80.75 per barrel on Monday. Crude oil price traded with in limited range as last week OPEC+’s surprise decision has boosted bullish sentiment on prices while recent US macro data indicators are showing signs of weakness and slowdown concerns persist. Meanwhile, geopolitical tensions in the Middle East are abating as top diplomats from Saudi Arabia and Iran meet to continue mending relations, de-escalating a decades-long rivalry that’s fueled proxy wars and rattled oil markets.

We expect bullish momentum will continue in crude oil until NYMEX WTI crude oil price trade above $75.70 per barrel. This week investor focus will be on release of OPEC and IEA monthly report which could through light on further demand supply scenario. NYMEX WTI Crude oil prices face resistances at $84.70/$87.80 per barrel and find supports at $75.70 per barrel. MCX Crude Oil April future having supports at Rs 6370 and resistances at Rs 6840 for this week.

April 10, 2023 / 15:17 IST

CLSA View On Tata Motors

-Buy call, target at Rs 544 per share

-JLR posted 19 percent/24 percent QoQ/YoY improvement in wholesale volume

-Management expects strong FCF generation in excess of £800 mn

Tata Motors was quoting at Rs 461.30, up Rs 23.75, or 5.43 percent on the BSE.