July 29, 2021 / 16:11 IST

Shrikant Chouhan, Executive Vice President, Equity Technical Research, Kotak Securities:

On the monthly F&O expiry day, the market witnessed a smart pullback rally, although the July series has been volatile with a momentum of nearly 450 points. While the sectoral performance in the current month series was mixed with Realty and Metal indices gaining over 13 percent, Auto and Energy indices lost ground and shed nearly 6 percent.

Technically, for the bulls 20 day SMA or 15820/ 52700 would be the key resistance level for the market, while on the flip side, 50 day SMA or 15650/ 52200 could be the strong support zone. The texture of the chart suggests that trading below 20 day would increase further weakness, while on the other side uptrend wave could continue up to 15900/53200 if indices succeed to trade above 15820/ 52700 levels.

July 29, 2021 / 15:40 IST

Ashis Biswas, Head of Technical Research at CapitalVia Global Research:

The market witnessed a swift recovery after yesterday’s fall. The market suggests 15,800 will be an important support level in the short-term perspective. If the market sustains above the level of 15,800, expects to gain momentum, leading to an upside projection of 15,950 levels.

The momentum indicators like RSI and MACD recovered from their respective oversold zone and support the upside move and indicating potential upside from the current market level.

July 29, 2021 / 15:37 IST

Rupee Close:

Indian rupee ended higher by9 paise at 74.28 per dollar, amid buying saw in the domestic equity market.It opened marginally higher at 74.32 per dollar against previous close of 74.37 and trade in the range of 74.22-74.33.

July 29, 2021 / 15:36 IST

Market Close:

Market broke the three-day losing streak and ended higher with Nifty above 15,750 supported by the IT, metal, financial stocks.

At close, the Sensex was up 209.36 points or 0.40% at 52653.07, and the Nifty was up 69.10 points or 0.44% at 15778.50. About 1781 shares have advanced, 1170 shares declined, and 109 shares are unchanged.

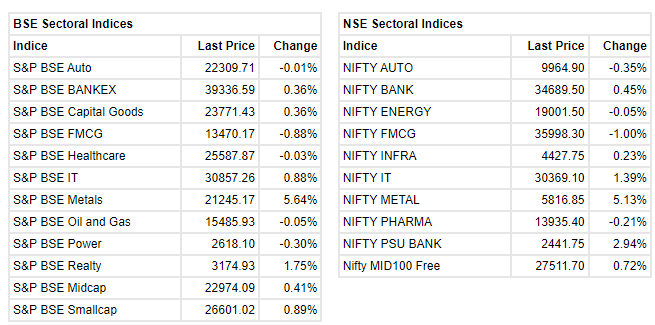

Among sectors, the metal index gained 5, while IT, PSU Bank and realty indices rose 1-3 percent. However, FMCG index was down 1 percent. BSE midcap and smallcap indices rose 0.4-0.9 percent.

Hindalco, Tata Steel, Bajaj Finserv, SBI and JSW Steel were the top Nifty losers. Maruti Suzuki, Power Grid Corp, Bajaj Auto, ITC and Coal India were among the top losers.

July 29, 2021 / 15:26 IST

Rolex Rings IPO subscribed 7.33 times on second day of bidding:

The IPO of Rolex Rings, the manufacturer of hot rolled forged bearing rings and automotive components, has subscribed 7.33 times so far on July 29, the second day of bidding. The issue closes on July 30.

The offer, so far, has received bids for 4.16 crore equity shares against an initial public offering size of 56.85 lakh equity shares, the subscription data available on the exchanges showed.

Retail investors remained at the forefront as the portion set aside for them was subscribed 13.11 times and that of non-institutional investors 3.60 times.

Qualified institutional buyers have put in bids for 52,768 equity shares against their reserved portion of 16.24 lakh equity shares.

July 29, 2021 / 15:22 IST

Glenmark Life Sciences IPO subscribed 27.10 times on final day:

The initial public offering of Glenmark Life Sciences, a subsidiary of Glenmark Pharmaceuticals, was subscribed 27.10 times, getting bids for 40.69 crore equity shares against the IPO size of 1.5 crore shares on July 29, the last day of the offer, subscription data available on exchanges showed.

Retail investors have put in bids 13.19 times their reserved portion and that of non-institutional investors 76.40 times. The portion set aside for qualified institutional investors was subscribed 14.26 times.

July 29, 2021 / 15:20 IST

KRChoksey on Granules India

Granules India is facing challenges owing to supply disruption in API segment, that we believe is likely to cause higher loss in profitability than in revenue over FY22-FY23. In the wake of likely margin headwinds to be faced in FY22, we downgrade our Revenue/EBITDA growth estimates over FY21E-FY23E to 18% and 10% CAGR, respectively,

We apply a P/E multiple of 16.4x on FY23E EPS of Rs 28.0 (earlier 16x on FY23E EPS of INR 28.4) and maintain our target price of Rs 459/ share as we believe the company is facing temporary headwinds due to supply constraints and can revive its financials from H2FY22 onwards. As the target price gives an upside of 23.4% over the CMP of Rs 372, we reiterate our buy rating on the shares of Granules India.

July 29, 2021 / 15:18 IST

Narendra Solanki, Head- Equity Research (Fundamental), Anand Rathi Shares & Stock Brokers:

Indian markets started on a positive note following upbeat Asian market peers with reports that the Chinese Securities regulator has stepped-in to assuage investor concerns over tech crackdown supported sentiment and favourable outcome of Federal Open Committee which ended its two-day meeting by keeping interest rates in a target range between zero and 0.25%.

During the afternoon session markets continued their firm trade. Investors’ remain energized as Chief Economic Adviser (CEA) stated that India is expected to hit a growth rate of 6.5-7% in 2022-23 and accelerate further to 8% in the subsequent years on the back of reforms undertaken by the government.

Forecasts for gross domestic product were raised to a 9.2% expansion in the fiscal year ending March 2022, from the previous 9%, while the gross value added outlook edged down slightly to 9%. On sectoral front, Metals outshined all others sector and was trading with gains higher than 4% followed by Realty, IT, PSU Banks while FMCG and Auto traded in red.

July 29, 2021 / 15:12 IST

Welspun Corp Q1 results:

The company's consolidated net profit jumped 87.8% at Rs 97.5 crore against Rs 51.9 crore and revenue was down 37.2% at Rs 1,300 crore versus Rs 2,069 crore, YoY.

Welspun Corp was quoting at Rs 142.55, down Rs 5.25, or 3.55 percent on the BSE.

July 29, 2021 / 15:04 IST

Market at 3 PM

Benchmark indices erased some of intraday gains but still trading higher with Nifty around 15800.

The Sensex was up 253.59 points or 0.48% at 52697.30, and the Nifty was up 80.50 points or 0.51% at 15789.90. About 1806 shares have advanced, 1131 shares declined, and 115 shares are unchanged.

July 29, 2021 / 14:55 IST

PVR Q1 earnings:

The company has reported net loss at Rs 219.4 crore versus loss of Rs 225.7 crore and revenue was at Rs 59.4 crore versus Rs 12.7 crore, YoY.

PVR was quoting at Rs 1,355.75, up Rs 19.75, or 1.48 percent on the BSE.

July 29, 2021 / 14:51 IST

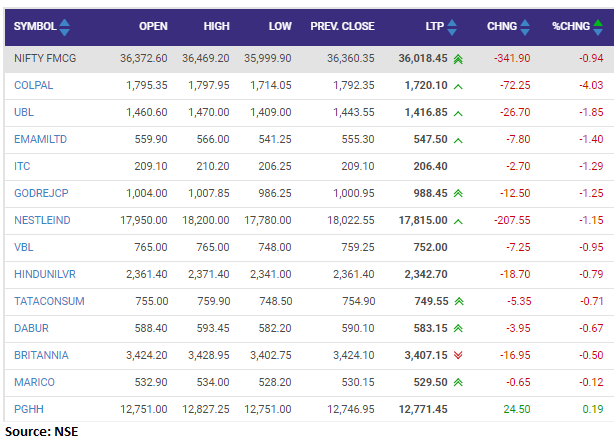

Nifty FMCG index shed nearly 1 percent dragged by the Colagte Palmolive. United Breweries, Emami: