Oracle has emerged as one of the biggest winners of the artificial intelligence wave, as seen in the previous session, as strong guidance from its cloud infrastructure business has boosted the outlook for the company.

Shares of the firm rallied over 35 percent in a single session, leading founder Larry Ellison to briefly leapfrog Elon Musk to claim the title of the world’s wealthiest person. The surge marked the company’s strongest single-day advance since 1992.

While the firm’s earnings show for the quarter was underwhelming, falling under expectations, analysts brushed that aside to focus on the strong guidance for Oracle’s cloud infrastructure.

According to the firm, the segment’s revenue will rise to $18 billion, up 77 percent, while doubling to $32 billion in the next financial year. Oracle expects revenue to rise sharply to $73 billion, $114 billion, and $144 billion over the following three years.

"Over the next few months, we expect to sign-up several additional multi-billion-dollar customers and RPO is likely to exceed half-a-trillion dollars," the CEO noted in the earnings call.

Meanwhile, Oracle’s remaining performance obligations (RPO), which is considered a measure of future contracted sales which are to be realised, has jumped to $455 billion, up around 360 percent surge year-on-year.

Analysts were left stunned. Experts at Bank of America Securities hiked their rating on Oracle to a ‘buy’, seeing over 50 percent upside from the previous session’s closing.

Deutsche Bank analysts echoed the optimism, calling the results “truly impressive” and highlighting Oracle’s strengthening leadership in AI infrastructure. They reiterated a buy rating and raised their price target on the firm’s shares to $335 from $240.

However, with bets on artificial intelligence boosting the outlook for the firm, how does Oracle stack up against AI peers?

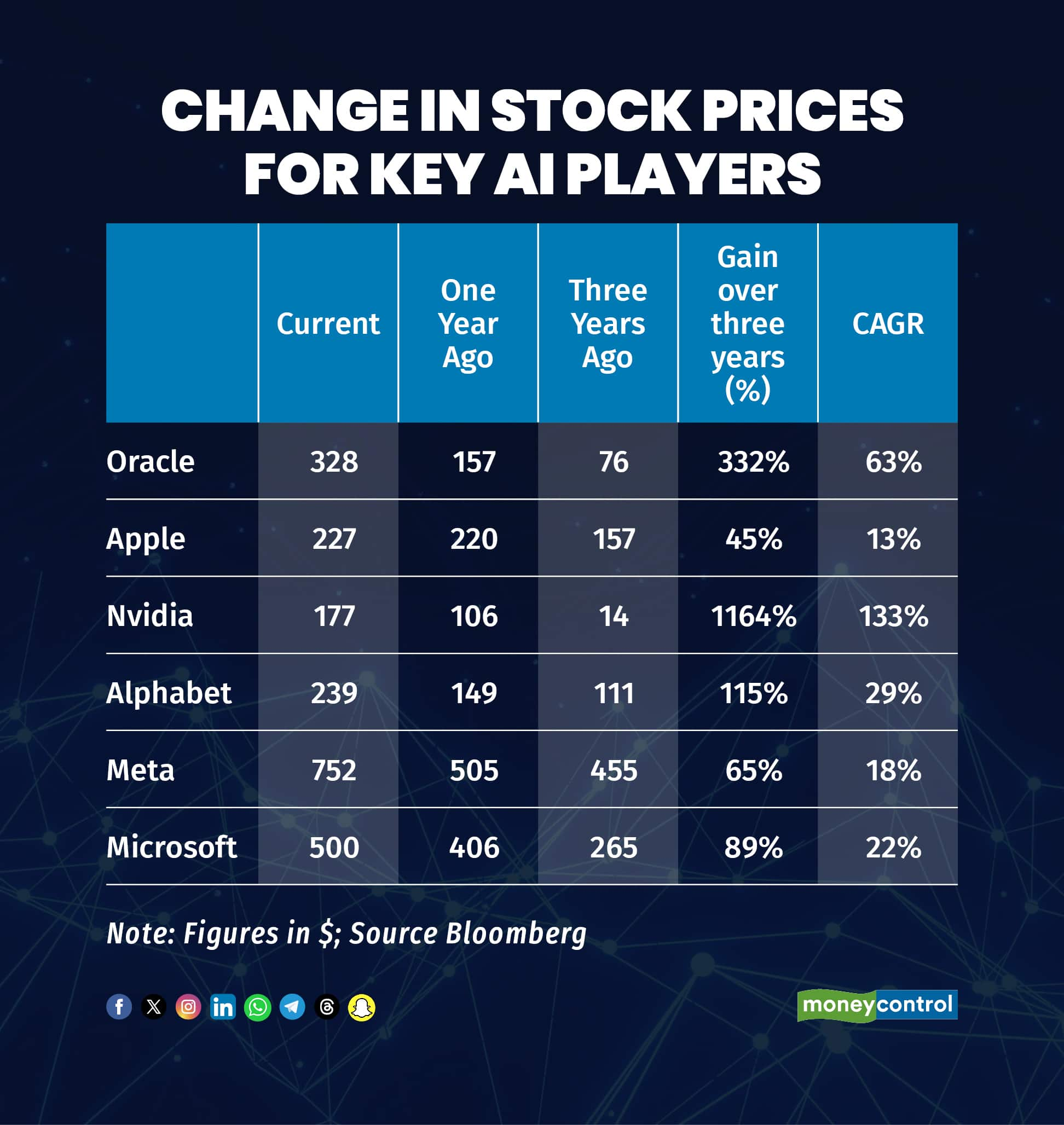

Stock performanceOver the past year, Oracle’s stock has outperformed, rallying over 100 percent to more than double investors’ capital. However, zooming out over three years, Nvidia emerges as the best performer, jumping 1,164 percent in absolute terms with a 133 percent CAGR.

On the flip side, Meta has risen just 65 percent in three years, while Apple saw the weakest momentum, at 47 percent, a modest 13.1 percent CAGR.

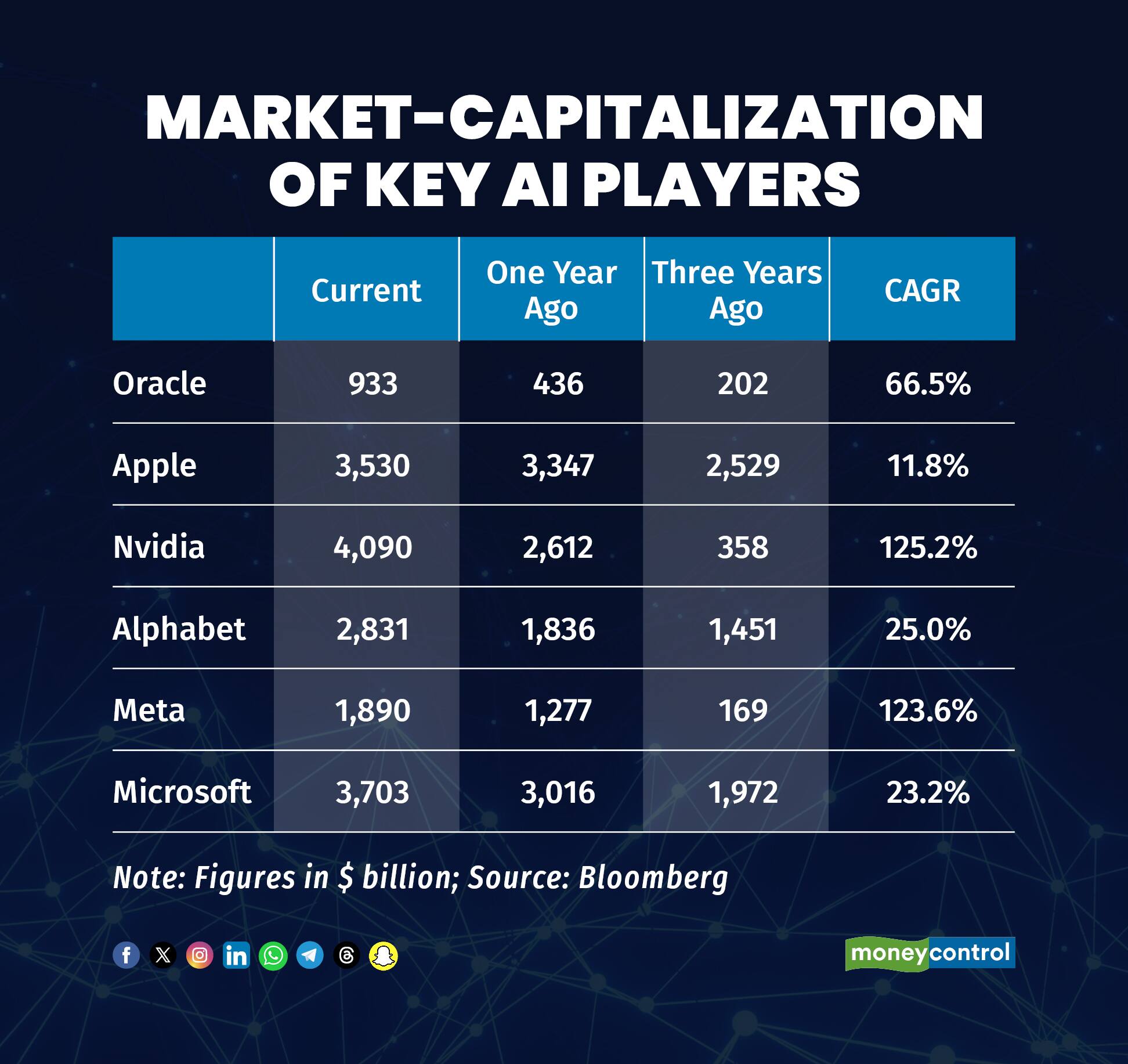

On the market-capitalization front, Nvidia and Meta have seen a higher CAGR over the past three years.

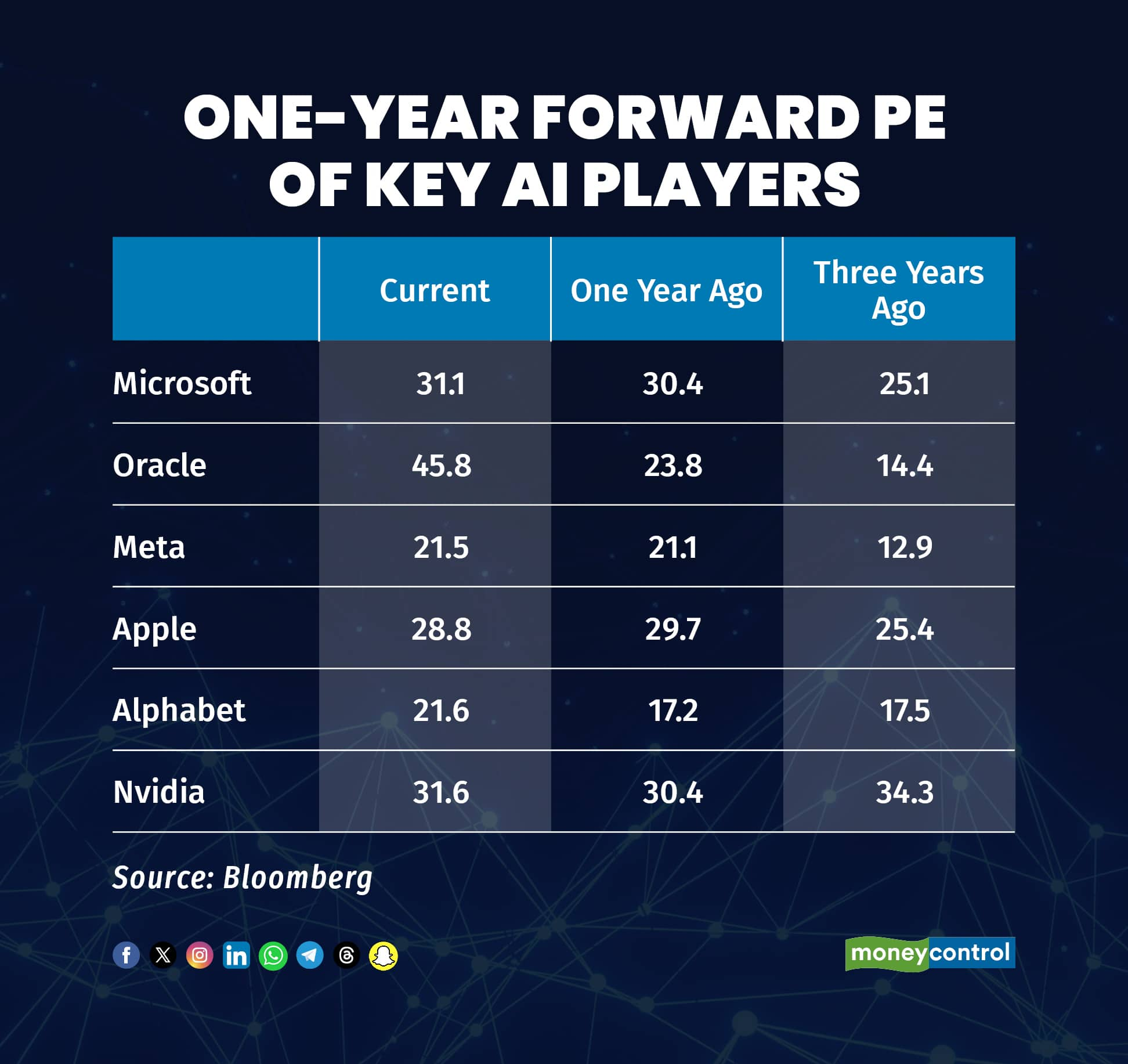

ValuationsOn the valuation front, Oracle is the most expensive following the recent rally, commanding a one-year forward P/E of 45.8x.

Meta and Alphabet are the cheapest large-cap AI players, while the others are between 28-31 times one-year earnings.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.