Santosh Pasi

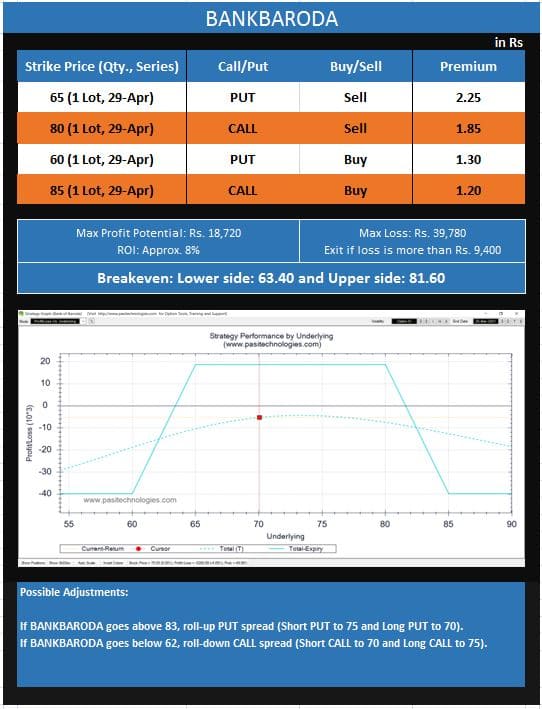

Bank of Baroda is in a bearish trend based on price action. Considering Open Interest Analysis, maximum open interest on the PUT side is at Rs 70 and maximum open interest on the CALL side is at Rs 80. Considering the price action and open interest analysis, we are assuming our profitable range of Rs 63.40-81.60 should be a reasonable one. The probability of profit for this trade is around 53%.

Although we have limited the loss, following our adjustment will reduce loss in the direction of the trend and increase profit potential.

If Bank of Baroda opens gap up or down (before initiating trade), you can change all strikes accordingly to reflect the same change and make sure the credit received is similar or higher.

You may wish to close this trade if profit is more than 50% of max profit potential. Avoid carrying this trade in the last week of expiry.

Currently, volatility is neutral. We expect a volatility drop and an increase in theta rate will benefit this strategy trade.

Disclaimer: https://www.moneycontrol.com/app-disclaimer

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.