Indian market has plunged below its crucial support levels in a matter of just 2 months amid COVID-19 outbreak hurting supply chain, earnings of companies, as well as economies across the globe.

The Nifty has already corrected 37 percent since 17 January, compared to 35 percent for Global Emerging Markets and 30 percent for Asia, but the risk-to-reward ratio has turned attractive now.

India’s COVID-19 response measures have arguably been proactive, even as the number of officially confirmed cases has remained low, UBS Securities India said in a report.

“The fall in the markets reflects concerns around India’s high population density and relatively weak health infrastructure. From a market perspective, risk-reward appears attractive for India, but only if we presume the negative impact of COVID-19 is short-lived and not crippling,” Gautam Chhaochharia, Analyst, UBS Securities India Pvt. Ltd said in a report.

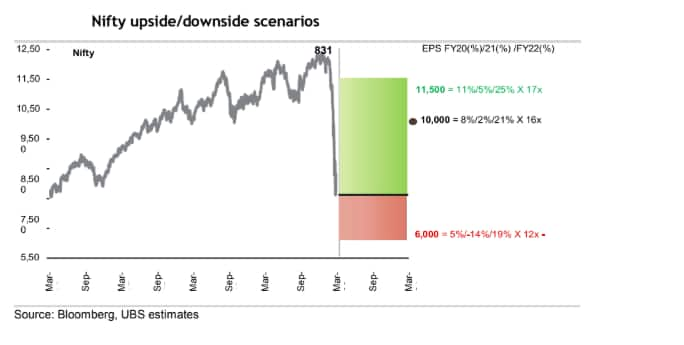

“Our revised Nifty target is 10,000 for end-March 2021, with upside and downside scenarios of 11,500 and 6,000, respectively,” he said.

UBS’s global macro team forecasts global GDP growth to tumble to -0.5 percent on a YoY basis, and are looking for 20-25 percent QoQ annualised declines in Q2 for a large number of economies.

Our India economist expects India's GDP growth of 4 percent for FY21. In an intermediate pandemic scenario (disruptions last until June), GDP growth could be 2.5 percent, while in a more severe pandemic scenario it could be negative, at -0.2 percent on a YoY basis.

In terms of earnings, UBS is of the view that a broad-based earnings cycle recovery over the next one to three years is clearly pushed out, with a more material near-term downside.

“In our Four Keys framework, policy retains near-term upside potential, but there could be a sharper downtick in the credit cycle before an uptick. Our new top-down earnings growth forecasts for the Nifty are 8% for FY20, 2% for FY21, and 21% for FY22,” said the report.

Given stimulus measures taken by the governments’ globally, markets have been waiting for policy stimulus, in vain until now. During the global financial crisis (GFC), India’s fiscal deficit expanded by 4.4 percent of GDP and news flow suggests 0.7 percent of GDP may be likely in this crisis.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.