Factoring the worst, Morgan Stanley in a note on March 17, warned investors that the seismic waves of COVID-19 are likely to trigger a global recession.

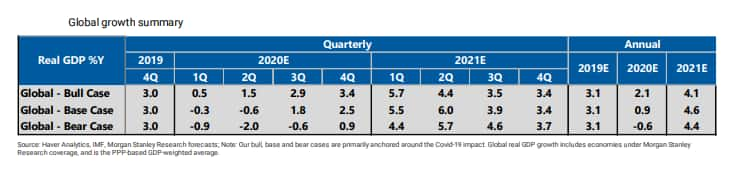

"Global recession in 2020 is now our base case scenario," Morgan Stanley Chief Economist Chetan Ahya said in a note on March 17. “We expect 2020 global growth to dip to 0.9 percent, the lowest since the global financial crisis when global growth bottomed at -0.5 percent in 2009. This time will be worse than the global recession of 2001,” the note added.

Under the base case scenario for India, Morgan Stanley estimates India’s growth rate at around 4.5 percent till Q4CY20, and in bear case, it could be near 4 percent.

The Reserve Bank of India (RBI), the global investment bank expects, could slash policy rates by a cumulative 40-65 basis points in the second quarter of the calendar.

While the policy response will provide downside protection, the underlying damage from both COVID-19’s impact and tighter financial conditions will deliver a material shock to the global economy.

The global investment bank is of the view that with COVID-19 spreading in Europe and the US after hitting Asia, the disruptions and dislocations in the economy and markets will trigger a YoY contraction in global growth in H1CY20. But, the strong monetary and fiscal policy response underway will help to revive global growth from Q3CY20.

With looming recession risks, the G4 plus China will expand its primary fiscal deficit by 200 bps in 2020.

In China, Morgan Stanley expects the PBOC to cut its medium-term lending facility (MLF) rate by another 40bp in the coming months. In Brazil, the global investment bank expects the BCB to cut rates by 50 bps at its March meeting and another 25 bps by Q220.

The note added that the global recession will seriously damage corporate profitability globally and impair balance sheets, triggering corporate credit risks and further damaging the cycle.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.