More than half of the top 500 companies by market capitalisation has fallen more than 20 percent from their September 2024 highs, an analysis by Samco Securities has highlighted.

The note said the current downturn in Indian equities have knocked down 272 out of top 500 stocks by over 20 percent, which is 54.40 percent of the top 500 stocks, as of February 21, 2025.

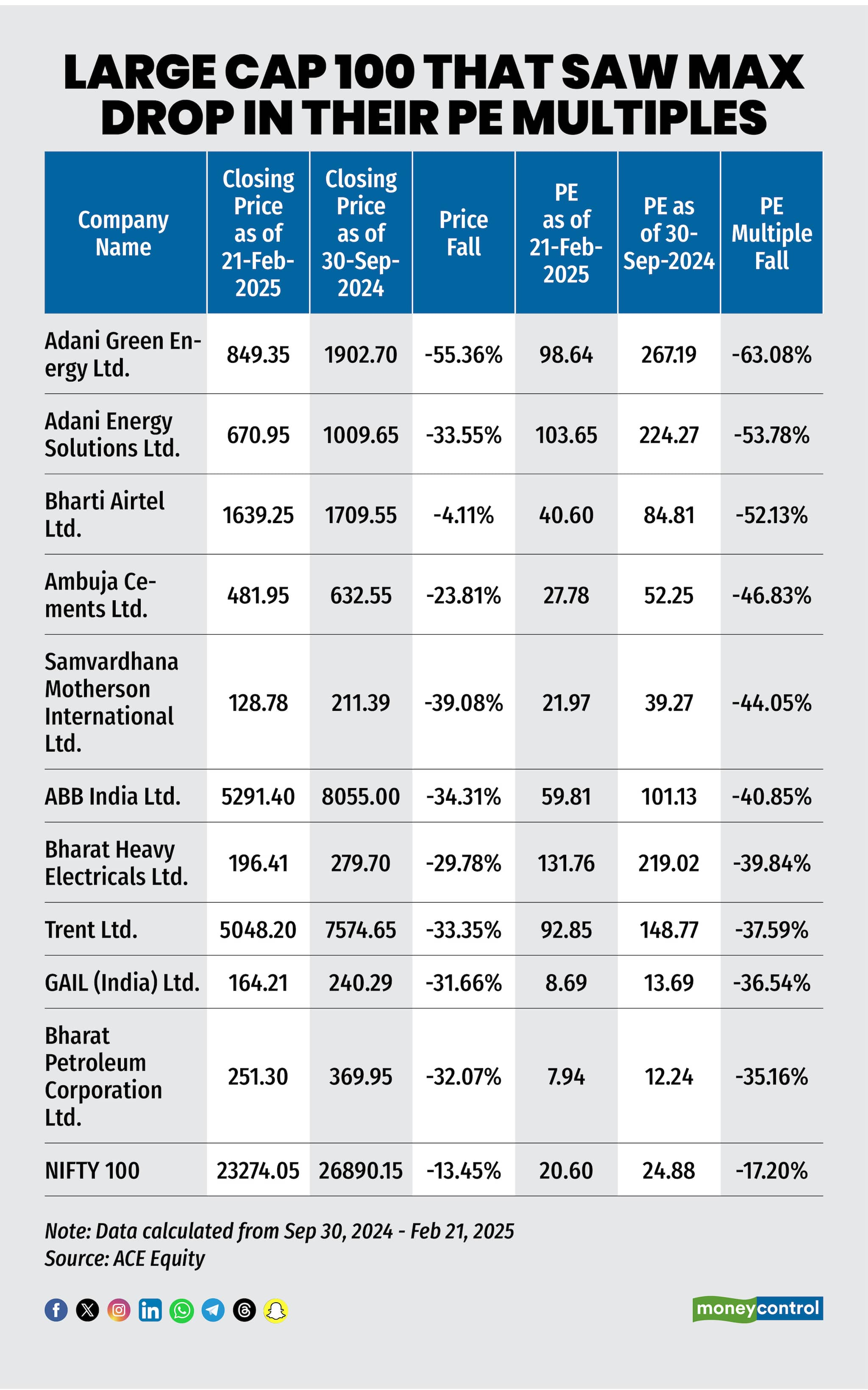

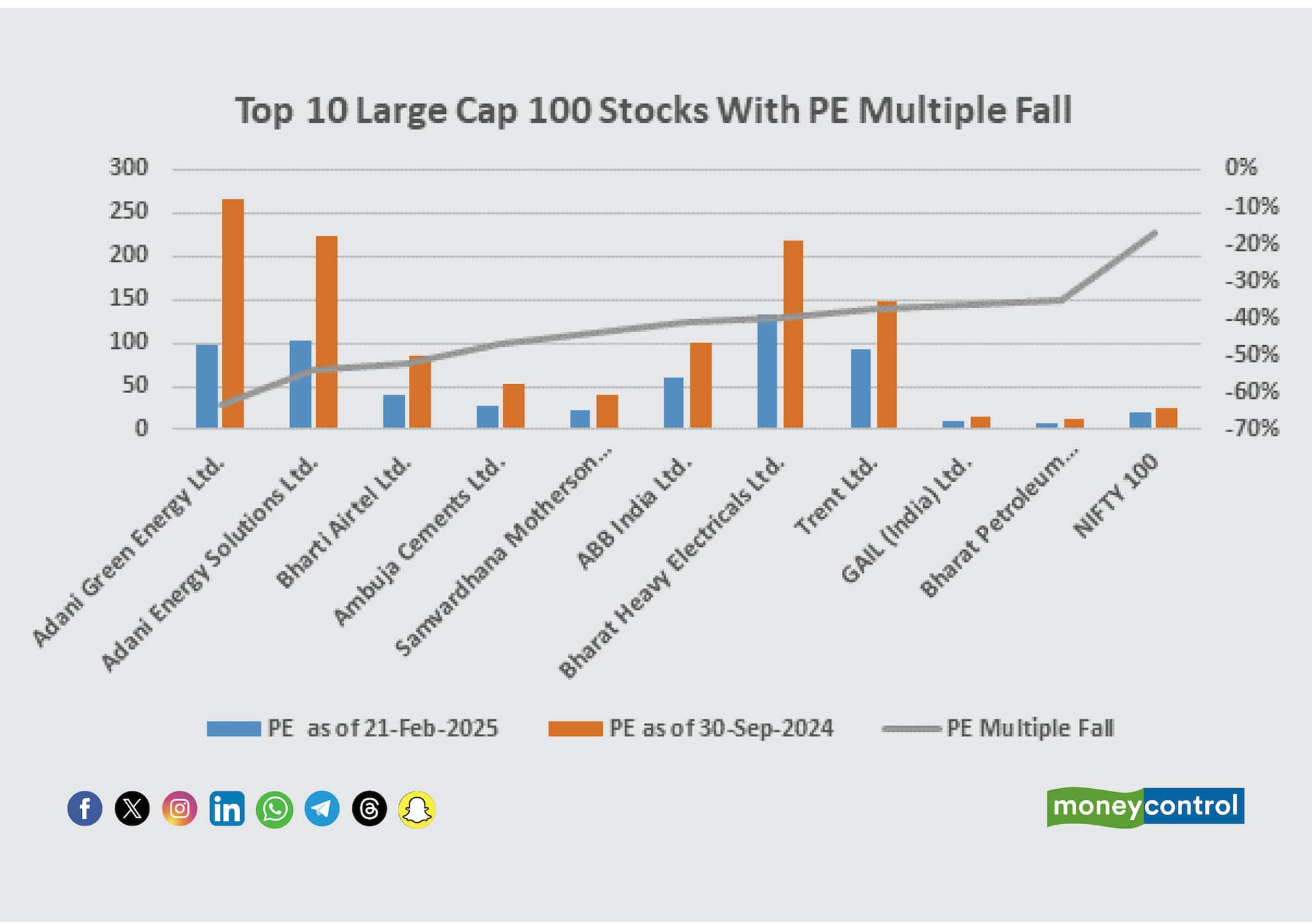

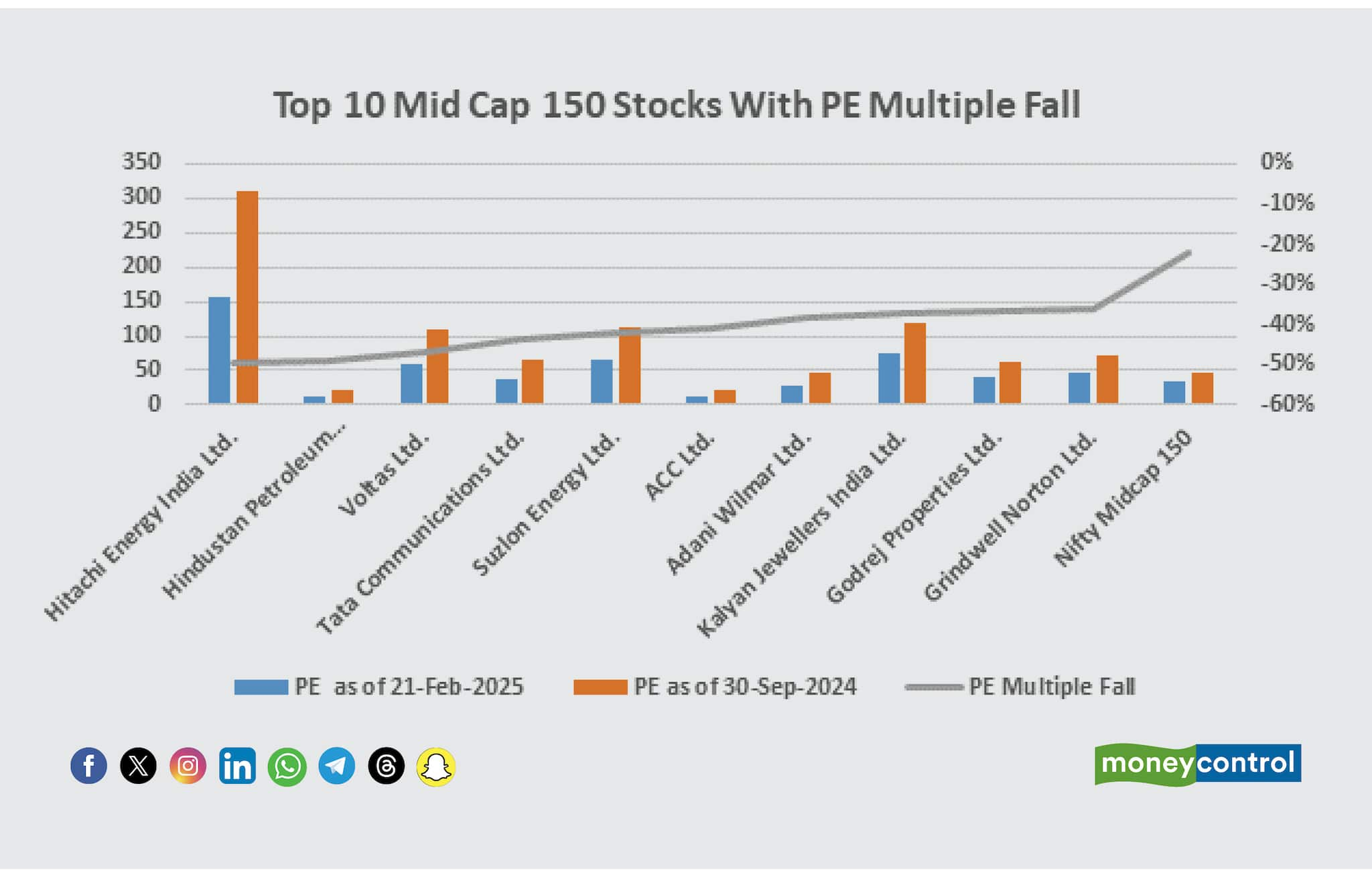

Below are the top 10 stocks from each of the market capitalization category - Large Cap 100, Mid Cap 150 and Small Cap 250 - that saw maximum fall in their P/E multiples since September 30.

The market capitalisation of Adani Energy has fallen over 55 percent among Large-cap 100, followed by Samvardhana Motherson and ABB India with a drop of approximately 39 percent and 34 percent, respectively.

Grindwell Norton's market capitalisartion has fallen 37.26 percent among Midcap 150, followed by Godrej Properties and Kalyan Jewellers with a drop of 37 percent and 33.55 percent, respectively.

Whirlpool India's market capitalisation has fallen 57.23 percent among Smallcap 250, followed by Kirloskar Oil Engine and Honasa Consumer with a drop of over 52 percent and 52 percent, respectively.

The current market downturn which began in September 2024 has brought fresh investment opportunities, as the correction has further reduced earnings premium and creating valuation comfort for investors, said the Samco note.

A technical correction happens when a stock price fall by 10 percent or more from recent highs. The fall may bring down inflated valuations, making shares more attractive for future growth, according to experts.

Buying shares during a market decline can translate into higher compounding returns once the uptrend begins, however, risks of a further fall may still remain. From a long-term perspective, some experts believe the current levels may be suppressed and could lead to strategic entry opportunities.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.