Dear Reader,

The Indian markets reached a new high, driven by global trends and strong domestic buying, marking a record twelve-day winning streak, surpassing the previous record of 11 days set in 2007. This broad market rally propelled benchmark and smaller indices to new heights, despite foreign investors selling approximately Rs 19,000 crore in the cash market over the week. This brought total FII selling for the month to over Rs 21,000 crore.

A surprise bonus issue by Reliance Industries further boosted the Indian markets.

Globally, markets delivered mixed returns. US markets were shaken by Nvidia's earnings, which led to a 10 percent drop at its lowest point, erasing $300 billion in market capitalisation. Despite Nasdaq's nearly one percent decline, the Dow Jones and S&P 500 closed in positive territory.

European markets gained during the week, with the Euro Stoxx 600 closing 1.34 percent higher, marking a fourth consecutive week of gains. Lower-than-expected inflation numbers fuelled the rally. Germany's DAX hit a new high, rising 1.47 percent, while Italy's FTSE MIB led the European surge with a 2.15 percent gain. Headline annual inflation in the eurozone slowed to 2.2 percent in August from 2.6 percent in July, the lowest level in three years.

In Asia, Japanese markets ended the week 0.7 percent higher, recovering from earlier losses in the month due to the unwinding of the Yen carry trade. Meanwhile, Chinese stocks declined as economists lowered their 2024 growth forecasts to below five percent, with poor corporate earnings adding further pressure on the market.

A likely pause

The Nifty closed higher for the third consecutive week, marking an impressive 12-day winning streak, nearing a record. The weekly upper band at 25,700 suggests there is still room for the market to rise, even in the face of short-term corrections or volatility. As a result, it's a "buy on dips" market. However, the extended winning streak also warrants caution, as pullbacks are inevitable in a bull run. The 25,000 level has solidified as a strong support.

Meanwhile, the daily swing is now making lower highs, even as the Nifty continues to climb. Recently, negative divergences between the swing and price have led to short-term corrections lasting two days or more, depending on the situation. This development will keep us vigilant in the short term.

Advance Decline Ratio

Source: web.strike.money

A few weeks ago, FIIs reduced their largest long position in seven years to almost zero (see chart FII net position). They’ve recently rebuilt their positions cautiously, and the current reading is now above both the red lines historically associated with peak levels. While the markets are surging ahead, this positioning suggests we may be approaching overbought territory. However, a clear price reversal is still needed to confirm this.

FII net position

Source: web.strike.money

The 20-day advance/decline ratio saw an uptick on Friday after a period of stagnation, as market breadth hasn’t significantly improved from the oversold levels observed at the start of August (see chart Advance Decline line). A short-term dip could quickly push this indicator back into oversold territory. However, there is still plenty of room for expansion on the upside.

Advance Decline line

Source: web.strike.money

Sector Rotation

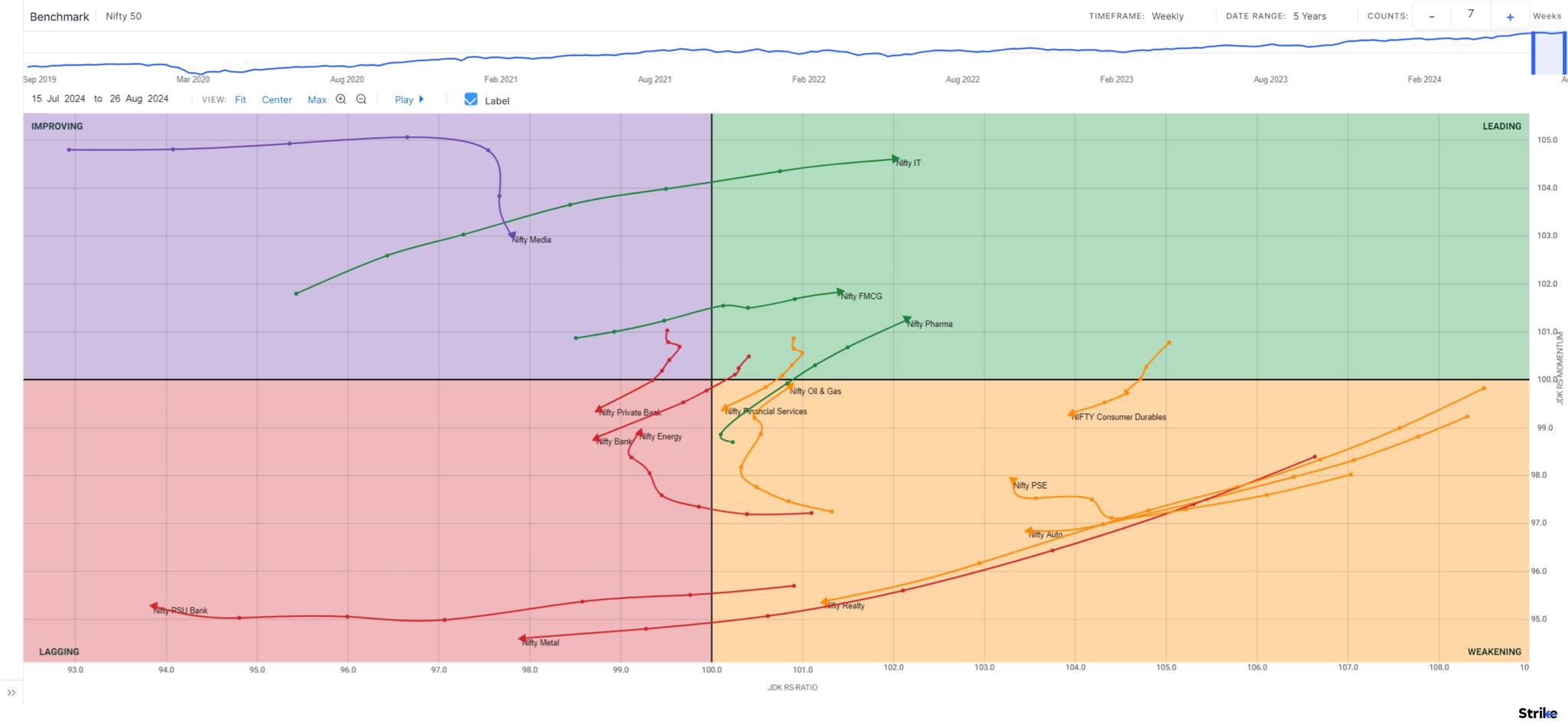

The Weekly Relative Rotation Graph (RRG) from India Charts shows few changes. IT, Pharma, and FMCG continue to maintain their positions in the leading quadrant.

RRG Weekly

Source: web.strike.money

The IT index continued to gain during the week and re-entered the leading quadrant in last week’s update. Nifty Consumer durables continued to stretch in the leading quadrant. Nifty Pharma remained in the weakening quadrant; there was some pick-up in momentum on Friday. Nifty Financial Services gained relative strength and outperformed other banking indices.

Daily RRG

Source: web.strike.money

Indices and Market Breadth

During the week, the BSE Sensex touched a new high of 82,637.03, gaining 1.57 percent, while the Nifty50 index touched a new high of 25,268.35, closing 1.66 percent higher.

Among the stocks in the derivative segment that gained during the week were Birla Soft, which gained 11.53 percent, AU Bank, which was up 10.05 percent, and LTIM, which closed 9.12 percent. Among the losers during the week were Marico, which closed 4.58 percent lower, Zydus Life, which lost 4.31 percent, and Apollo Tyre, which was down 3.09 percent.

Stocks to watch

Among the stocks expected to perform better during the week are Infosys, Page Industries, Dr Reddy’s Lab, HDFC Life, Metropolis, Mphasis, Cholamandalam Finance, Tech Mahindra, ITC, Coromandel, Muthoot Finance and Hindalco.

Among the stocks that can witness further weakness are IDFC First Bank.

Cheers,

Shishir Asthana

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.