In a much-awaited move, Bloomberg announced that it will add Indian bonds to its Emerging Market indices from January 31, 2025. The decision comes after the Bloomberg Index Services advisory committee suggested adding Indian government bonds to its Emerging Market Local Currency Index in mid-February.

Talks of the inclusion of Indian bonds in the Bloomberg EM index has been going around since JPMorgan Chase & Co announced its inclusion in its benchmark in September last year.

The inclusion combined with the one in the JP Morgan EM index, will result in a rush of foreign flows into the country. How will this impact India’s macros and various asset classes?

Let's break it down piece-by-piece to understand.

How will the inclusion impact foreign flows?

The inclusion will increase the flow of foreign money into Indian bonds. How so? Index funds are essentially mutual funds that track a certain index, meaning they mimic the index and hold securities exactly in the same proportion as the index. Fund managers do not actively ‘manage’ these funds, they simply deploy the money they get from investors into the index basket as constructed by the index provider. This is called a passive investment strategy.

Just as in the case of stocks, when a stock makes an entry into an index, all the index funds adjust their portfolios to reflect the change in the index, here too, all index funds tracking the Bloomberg Bond index will adjust their portfolios to make way for Indian bonds – only sovereign bonds. This means they will buy these Indian government securities, thus ploughing funds into Indian treasury bond market.

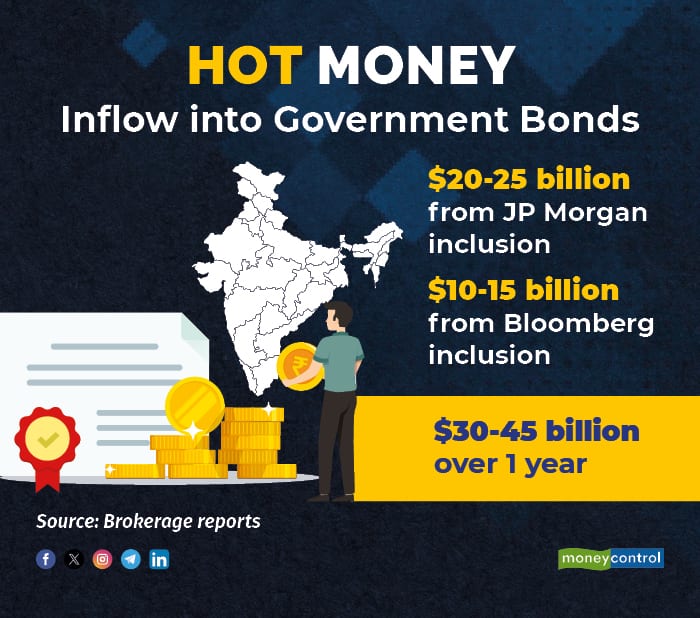

Currently, the total assets under management under index funds that track the Bloomberg Bond Index is about $3 trillion. India is likely to have a 0.6-0.8 percent index weight, meaning $10-15 billion will probably be directed towards Indian treasuries, IDFC First Bank stated in a note.

Apart from these passive flows, one could also witness additional flows from actively managed funds. Active funds are those where fund managers benchmark against an index, but do not mimic it. They may decide to go underweight or overweight a certain securities in the index which in this case are Indian treasuries. In any case, most fund managers will not avoid a security entirely if it is present in the index – they may just buy a bit more if they are bullish on some securities relative to others in the index, or buy a less if they are bearish on a relative basis.

Will it make access to global capital easier or reduce the cost of funds?

When a country's bonds are included in leading global indices, investors looking to diversify their portfolios will be attracted to these new entrants. The inclusion also acts as a confidence booster among global investors who benchmark their portfolios as per these indexes. The additional funds may ensure a cap on treasury yields, so there won’t be pressure on yields to rise even if local credit demand picks up in a big way, or if the government were to borrow more.

But this visibility, through inclusion into the index, by itself may neither make global capital easier to access for a country’s corporate borrowers, nor reduce their cost of borrowings. This will require a ratings upgrade for the country which will benefit all companies from the country as they will be seen as more credit-worthy.

Also Read | Bloomberg advisory panel backs entry of Indian bonds in EM Index

How will it impact the Indian rupee?

Normally, increase in foreign fund inflows is a positive for the rupee.

Following India’s inclusion in the index, foreign investors wishing to invest in India to align to the new weightage in accordance with the bond index will need to convert their local currency/dollars into rupee, increasing rupee demand. With new foreign flows of $30 billion-45 billion ($10 billion-15 billion from possible inclusion to Bloomberg's bond index and $20 billion-25 billion JP Morgan's bond inclusion) over FY25, it could actually be a problem of plenty for India. If too many dollars flow in, and the rupee appreciates, it will make imports expensive, causing inflation.

Also Read | After JPMorgan, Indian govt bonds could become part of Bloomberg indices in 2024

But this is not an insurmountable problem, forex experts believe. So far, the central bank has been managing the rupee in a range by buying or selling dollars in the open market. Besides, any outflows by foreign investors as a result of the rise may be offset by the new fund inflows. Market participants do not seem to be too worried about any potential rise in the rupee just yet.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!