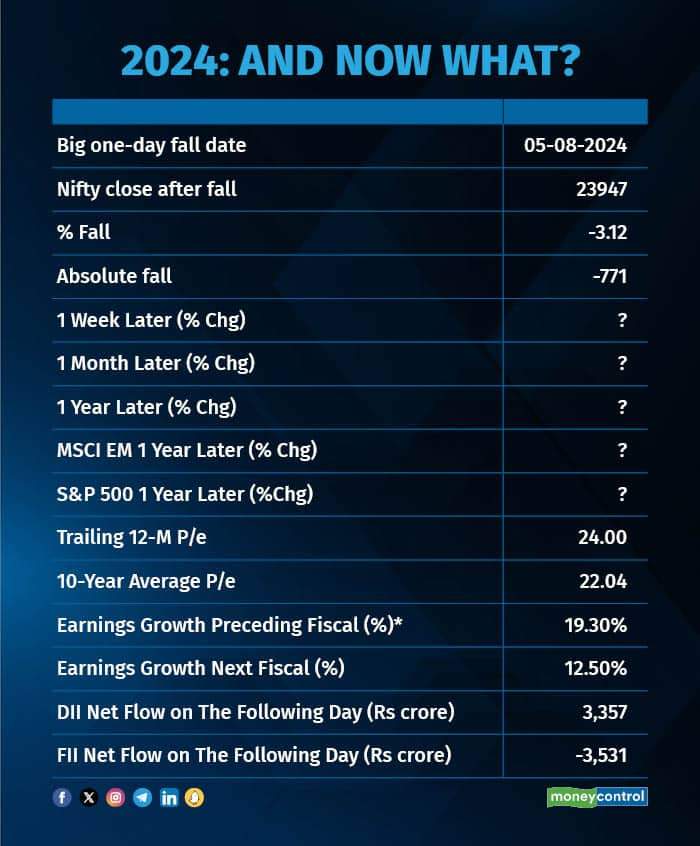

The Nifty took a 3% nosedive on August 5 due to US recession fears, yen carry trade unwinding, and geopolitical jitters. But guess what? It bounced back with a vengeance despite global headwinds.

In this brave new world of Indian stock markets, quick bounce-backs are the new norm. But don’t let this comeback act fool you into complacency. Market fundamentals today are playing a different tune compared to last year. Here’s how 2024 stands apart from previous post-Covid scares:

2021 – The earnings surge

On February 26, 2021, the Nifty dropped 3.76%, caught in a global equities storm and a spike in bond yields as the world anticipated a fast economic recovery and rising inflation.

Yes, a fast recovery indeed was worrisome for stock markets at the time because it meant the end of cheap money that fed the stock market boom. The Nifty looked pricey with a P/E ratio of 39.65, way above the 10-year average of 21, thanks to pandemic-hit earnings.

Also Read | Nifty, Sensex end strong, snap 3-day losing spree; all sectors close in green

Growth was barely half a percent, mirroring the economic woes of the time. The market made a 3% comeback a week later but kept traders on their toes with its volatility, trading slightly lower a month on. The year that followed, however, turned out to be a fairly good one with a return of 15.59% even as foreign investors turned risk-averse, pulling out as much as Rs 2.73 lakh crore from Indian markets.

India was an exceptional performer among emerging markets – the MSCI EM Index declined 12.49%. And this was primarily on the strength of two vital pillars: fabulous earnings performance during the year, which local investors were only too keen to cheer.

The stupendous performance of the equity markets, in the backdrop of continuously falling interest rates, had got local investors hooked.

2022 – The game of flows

Fast forward to February 24, 2022. The Nifty dropped 4.7% when Russia invaded Ukraine. Trading at a P/E of 21.59, just a tad above the 10-year average, it was still pricey. A robust 42% earnings growth (FY21-22) had emboldened investors to take bigger bets on equities. A month later, the index was up 6%, showing investors had strong faith in India’s growth story.

Markets, however, were not as benevolent in the following year, as US inflation reared its ugly head and rates started to inch up in what was to become the fastest monetary tightening in history. Indian markets were still better off, delivering a positive return (7.5%), in sharp contrast to other emerging markets.

The MSCI Emerging Market index declined 15.85%, with Chinese markets, the biggest weight in the EM index, still struggling. The S&P 500 was better, by only so much. It declined too, to a much lesser extent, sustaining a 7.43% fall. Again, what worked for Indian markets? Sustained flows from local investors.

Domestic Institutional Investors alone poured in Rs 2,54,000 crore in the year between February 2022 to February 2023. But the earnings story did not hold up as anticipated at the beginning of the year as commodity prices rose, the cost of money rose, all of which ate into profit margins while demand in certain segments remained sluggish.

Earnings growth was down to 12% from 42% in the previous fiscal. But for green pastures like banks that constitute more than 35% of the frontline index and were seeing their profits boom because of lower provisioning needs, coming out of a long spell of bad loans, corporate earnings growth would have been even lower. But then, local investors had just tasted blood.

.

.

2024 – The year of the locals?

This year’s market crash is playing a different ball game. Ignoring the Covid-distorted earnings year, Nifty’s valuations are at a historic high. With a trailing P/E of 24 above the 10-year average of 22.04, and earnings growth projected at a modest 12.5% for FY25 (down from 19% in FY24), it’s a cocktail of high valuations and tepid growth.

Corporate earnings are cooling off after a two-year sprint, but they remain decent. Vinit Sambre, Head of Equities at DSP Mutual Fund, says, “A likely revival in consumption, helped by good monsoons and a better rural outlook should support growth.”

Also Read | FPI holding at 12-year low, what that means for markets

The more worrying part is not what the index valuations reveal, but what they hide. The fact that currently, nearly 55% of stocks from the top 1000 companies by market-cap on BSE are trading at valuations more than 25x P/E. This proportion stood at 23% in FY20.

The valuation excesses are not showing up in the frontline indices, but in the smaller stocks that domestic investors are chasing.

On the brighter side, we may be at the end of the rate-tightening cycle, especially as fears of recession come to dominate the scene and inflation has started to behave in the US as well. The joker in the pack: geo-politics. That’s an unknowable, which can only be dealt with by buying stocks for cheap and keeping room to accommodate a correction.

Translation: keep it going, for it’s your money that’s propelling the markets higher. But moderate your expectations, embrace conservatism, and stop chasing the unsustainable, for they will find a way not to sustain anyway.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.