Taking Stock: Here’s what led to 700-point drop in Sensex, Nifty ending below 10K

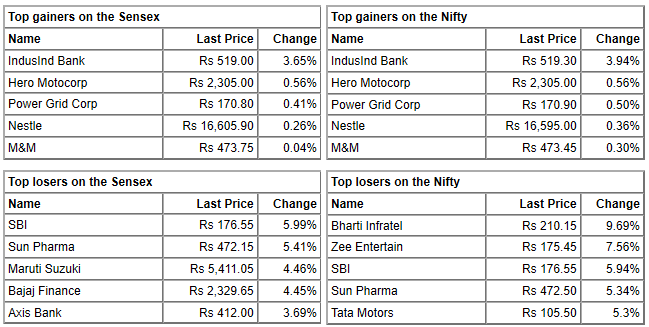

Top Nifty losers include Sun Pharma, SBI, ZEE Entertainment, and Bharti Infratel.... Read More

| Index | Prices | Change | Change% |

|---|---|---|---|

| Sensex | 85,706.67 | -13.71 | -0.02% |

| Nifty 50 | 26,202.95 | -12.60 | -0.05% |

| Nifty Bank | 59,752.70 | 15.40 | +0.03% |

| Biggest Gainer | Prices | Change | Change% |

|---|---|---|---|

| M&M | 3,757.30 | 76.10 | +2.07% |

| Biggest Loser | Prices | Change | Change% |

|---|---|---|---|

| SBI Life Insura | 1,966.00 | -38.50 | -1.92% |

| Best Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Auto | 27774.60 | 170.90 | +0.62% |

| Worst Sector | Prices | Change | Change% |

|---|---|---|---|

| Nifty Energy | 35548.30 | -207.90 | -0.58% |

The positioning of the global markets will continue to dictate the market trend ahead also. Nifty should hold 9850 for any rebound else profit taking would continue. We suggest limiting the leveraged trades and keeping the existing positions hedged.

With the passing of the session, we saw good correction in mostly large cap counters with on average 2-3% correction in the counters. At present level, downside support comes at 9800 while upside resistance comes at 10100 levels.

With the passing of the session, we saw good correction in mostly large cap counters with on average 2-3% correction in the counters. At present level, downside support comes at 9800 while upside resistance comes at 10100 levels.

Index witnessed a profit booking and closed a day at 9902 with loss of more than 2 percent and formed bearish candle on daily chart. Index closed below strong support zone of 10k mark and now if continue to trade below 10 mark then we may see some cuts towards immediate support zone of 9800-9700 zone. On the other hand strong hurdle is formed at 10000-10100 zone.

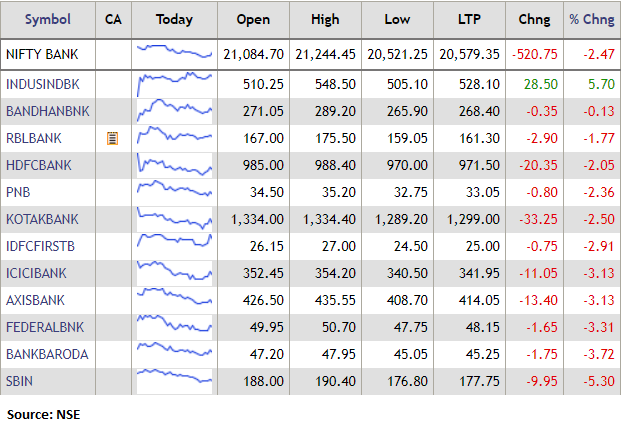

Nifty Bank closed a day at 20525 with loss of nearly 3 percent, support for Nifty Bank is coming near 20300-20000 zone and resistance is coming near 20800-21000 zone.

The markets traded negative today on the back of data emerging globally and domestically. The awaited FOMC announcement drove the negativity in the international markets as the Fed diminished hopes of a quick recovery in the US economy, with their outlook. Major global indices were mostly in the negative. With infections continuing to remain high, the markets are also worried about any additional lockdown measures being imposed. This could mean offsetting the optimism of the last 2 weeks, where investors were banking on the economy restarting fully. Markets are in sync with global cues and with Nifty closing below the 10000 mark, investors are advised to be cautious.

: Benchmark indices ended on negative note on June 11 on the back of weak global cues and Supreme Court's verdict on the AGR case.

At close, the Sensex was down 708.68 points or 2.07% at 33538.37, and the Nifty was down 214.20 points or 2.12% at 9902. About 1016 shares have advanced, 1497 shares declined, and 146 shares are unchanged.

IndusInd Bank, Nestle, Hero MotoCorp, M&M and Power Grid were among major gainers on the Nifty, while losers included Bharti Infratel, Zee Entertainment, SBI, Vedanta and Tata Motors.

All the sectoral indices ended in the red. BSE Midcap and Smallcap indices shed over 1 percent each.

The markets were successful in breaking the range that it was stuck in. 10000 which was a crucial support was broken and we fell over a 100 points in no time. The level to watch out for would be 9850 where markets should take a breather. For the upside, the markets would now need to go past 10150.

At 15:16 IST, the Sensex was down 751.60 points or 2.19% at 33495.45, and the Nifty was down 227.35 points or 2.25% at 9888.85.