June 02, 2022 / 16:37 IST

Prashanth Tapse, Vice President (Research), Mehta Equities

:

Dalal Street rose sharply in today’s trade shrugging off weak overnight Wall Street cues amid value buying backed by short covering in Reliance Industries and other IT stocks. Nifty bulls’ probably will rip to its 200-DMA 17253 mark. The index's immediate target is seen at 17837. Nifty has immediate support at 16421-16171, while resistance is seen at 16837-17264.

June 02, 2022 / 16:24 IST

Deepak Jasani, Head of Retail Research, HDFC Securities

:

Nifty snapped a two day fall on June 2 as expected. It opened flat and gradually rose through the day with minimal corrections to end almost at the intra day high. At close, Nifty was up 0.64% or 105.3 points at 16628.

Volumes on the NSE were a bit lower than the recent average. Among sectors, Oil & Gas and IT were the main gainers while Auto and Capital goods were the main losers. Broader markets did well as is clear from the sharply positive advance decline ratio and a gain in the smallcap index.

Nifty has expectedly started to rise post a small correction. 16696 is the next resistance post which 16888 could halt the upmove temporarily. A move below 16506 could result in some minor weakness.

June 02, 2022 / 16:16 IST

Shrikant Chouhan, Head of Equity Research (Retail), Kotak Securities

:

After a subdued start, markets bounced back sharply on the back of renewed optimism as investors lapped up shares of the recently beaten down IT and oil & gas stocks. In fact, Indian shares outperformed other Asian peers, which mostly ended in the red. Technically, after a muted opening, the Nifty took support near 16450 and reversed the trend. A promising reversal formation on intraday charts and a long bullish candle on daily charts is indicating further uptrend from the current levels.

For day traders, 16550 would act as a trend decider level, above which the Nifty could rally till 16720. In case of any further upside, the index could rally up to 16800. On the flip side, below 16550, uptrend would be vulnerable and could falter up to 16450.

June 02, 2022 / 16:06 IST

Vinod Nair, Head of Research at Geojit Financial Services

:

The bounce in the market is showing signs of getting extended further supported by a mid and small-cap. High-frequency data like GST collection and PMI have shown a good start to FY23. Crude prices have declined providing an edge to the performance of the Indian market. However, a lot will depend on central bank’s policy in India and US, which will be announced in the next two weeks.

June 02, 2022 / 15:53 IST

Rupak De, Senior Technical Analyst at LKP Securities

:

Nifty remained volatile with a positive bias throughout the session. On the daily chart, the benchmark index Nifty has formed an engulfing kind of pattern, suggesting bullishness. Daily RSI is in bullish crossover and rising. On the higher end, the index has resistance at 16700; above 16700, the Nifty can move towards 17000. The trend is likely to remain positive as long as it sustains above 16400.

June 02, 2022 / 15:48 IST

Rupee at close

Rupee ends at 77.61 per US dollar against June 1 close of 77.52 per US dollar

June 02, 2022 / 15:46 IST

Market at Close; Benchmark indices ended the session on June 2 on a positive note with Sensex gaining 436.94 points or 0.79% at 55818.11, and the Nifty adding 105.20 points or 0.64% at 16628. Reliance surged over 3% to close at 1-month high, lifted Nifty by 68 points. Financials kept market gains in check with HDFC, HDFC Bank and ICICI Bank being the main losers. About 1919 shares have advanced, 1301 shares declined, and 134 shares are unchanged. Among the sectors, the oil & gas index added over 2 percent while selling was seen in auto and capital goods names. The midcap index ended flat while the smallcap index closed with gains of half a percent.

June 02, 2022 / 15:21 IST

Auto sector was the biggest loser of the day, down 0.61 percent at 3.20 pm

Source:BSE

June 02, 2022 / 15:05 IST

Market at 3.00 PM

Benchmark indices off day's high, Sensex trading higher by around 350 points, Nifty above 16,600

The Sensex was up 339.88 points or 0.61% at 55,721 and the Nifty was up 89.70 points or 0.54% at 16612.45. About 1885 shares have advanced, 1384 shares declined, and 132 shares are unchanged.

Source: BSE

June 02, 2022 / 14:51 IST

Nifty IT lead the pack of gainers with a gain of 1.91 percent

Source: NSE

June 02, 2022 / 14:35 IST

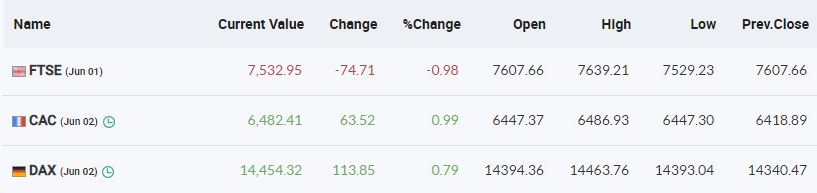

European Markets Updates

June 02, 2022 / 14:17 IST

Tapan Patel, Senior Analyst (Commodities), HDFC Securities

:

Crude oil prices traded lower with benchmark NYMEX WTI crude oil fell by more than 2% to $112.30 per barrel. Crude oil prices were down on Thursday morning in Asia, falling by around $3 a barrel in early Asian trading. Investors cashed in on a recent rally with OPEC and allies meeting later in the day set to pave the way for expected output increases. The US crude oil supply from the American Petroleum Institute showed a draw of 1.181 million barrels for the week ended May 26.

We expect crude oil prices to trade sideways to down with resistance at $116 per barrel with support at $110 per barrel. MCX Crude oil June contract has important support at Rs 8590 and resistance at Rs 9010 per barrel.