June 03, 2022 / 15:59 IST

Expert's Take on Bank Nifty

The Bank Nifty index formed a Bearish Engulfing candle on the last of the week indicating stiff resistance on the upside at the 36,000 level. The Bears took over the market and the index ended at a day's low. The lower-end support zone stands at 35,000-34,800 levels and if fails to hold this level will trigger further selling pressure,KunalShah, Senior Technical & Derivative Analyst atLKPSecurities said.

June 03, 2022 / 15:49 IST

Aether Industries Locked in 20% Upper Circuit on Debut

June 03, 2022 / 15:42 IST

Technical View

Nifty index opened gap up by around 130 points and then headed towards 16,800 zones in the morning tick. However, it failed to hold at higher zones and then sharply drifted lower towards 16,567 markin the last hour of the session by wiping out all the intra gains. It formed a Bearish candle on daily scale while a small bodied Bullish candle on weekly scale which indicates that absence of follow up buying and sustained supply pressure at higher levels. Now it has to hold above 16,550for an up move towards 16,800 and 17,000 zonewhereas supports are placed at 16,442 and 16,400 zones,Chandan Taparia,Vice President|Analyst-Derivatives atMotilal Oswal Financial Services said.

June 03, 2022 / 15:40 IST

Market Closing Update

The benchmark indices ended moderately lower amid volatile session, while the broader space was under selling pressure. The BSE Sensex fell more than 600 points from day's high to end with 49 points loss at55,769.23, and the Nifty50 shed 44 points to16,584.

The Nifty Midcap 100 and Smallcap 100 indices have fallen 1.6 percent and 0.86 percent respectively. About two shares declined for every share rising on the NSE.

UltraTech Cement, Maruti Suzuki, NTPC, Bajaj Finserv, IndusInd Bank, and Axis Bank were top losers, whereas Reilance Industries extended gains on Friday as well, followed by Infosys, L&T, HCL Technologies and Sun Pharma.

June 03, 2022 / 15:29 IST

Mobisafar Services Partners with Suryoday Small Finance Bank

Suryoday Small Finance bank, one of India’s leading small finance bank, today announced its partnership with Mobisafar to provide banking services through all Mobisafar’s franchisees and Business Correspondent networks across India.The partnership is aimed at strengthening financial inclusion by providing key banking services, digitallyto the underbanked customers even at the remotest parts of the country, the small finance bank said in its release.

June 03, 2022 / 15:22 IST

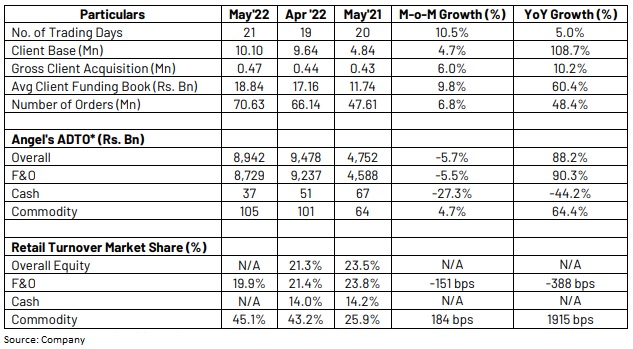

Angel One - Monthly Business Updates

June 03, 2022 / 15:12 IST

Market Update

The benchmark indices turned lower in late trade, with the Nifty50 falling below 16,600 levels, pulled down by banking & financial services, auto, metal, FMCG and pharma stocks. The broader markets were also under pressure as the Nifty Midcap 100 index fell 1.7 percent and Smallcap 100 index declined nearly 1 percent.

June 03, 2022 / 15:06 IST

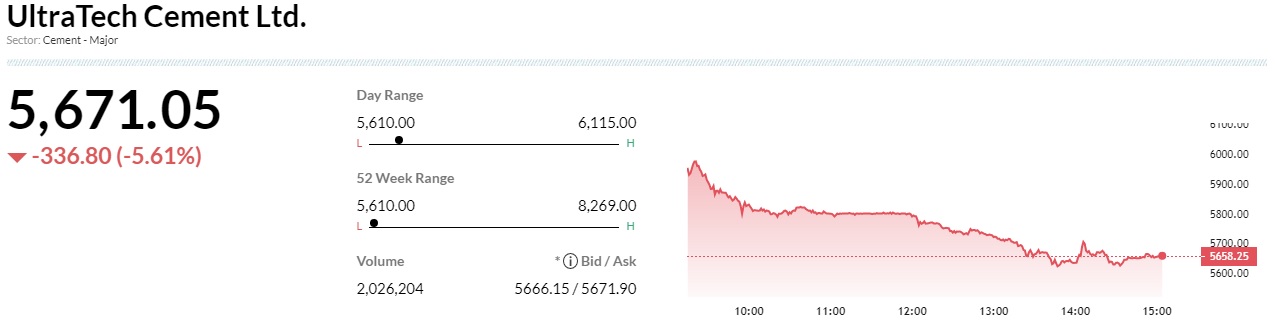

UltraTech Cement Under Pressure Despite Capex Announcement

The cement major announced Rs 12,886 crore towards increasing capacity by 22.6 mtpa with a mix of brownfield and greenfield expansion. This would be achieved by setting-up integrated and grinding units as well as bulk terminals. The additional capacity will be created across the country. Commercial production from these new capacities is expected to go on stream in a phased manner, by FY25.

June 03, 2022 / 14:57 IST

May Services PMI Review

India’s services PMI (seasonally adjusted) continued to improve, rising to 58.9 in May, the highest reading in 11 years. This suggest that the post-Omicron recovery in services activity remains solid and that concerns over higher input and transportation costs have had limited effects on activity so far. Indeed, services activity continues to outpace the recovery in manufacturing, which pushed the composite index in May to 58.3 , from 57.6 in April. Still, high inflation, tightening domestic financial conditions and risks to the global growth outlook could temper recovery in the coming months, Barclays said.

June 03, 2022 / 14:55 IST

Market Turns Flat

The benchmark indices wiped out all gains to turn flat amid volatility, while the broader space are under severe pressure with Midcap index falling over 1 percent.

The Nifty50 fell 19 points to 16,609, and the BSE Sensex gained 50 points at55,868.50, while India VIXwas down 1.8 percent at 19.95 levels.

June 03, 2022 / 14:46 IST

Sensex Top Gainers and Losers

June 03, 2022 / 14:39 IST

India Outperformed global Markets in CY22 Till Date

According to the India Strategy - the Eagle Eye Report by Motilal Oswal Financial Services Limited (MOFSL), India outperformed global markets in CY22 till date. Overall, Global Cyclicals were the top losers in May’22 while Autos and Consumer were the only gainers. There was a sharp surge in yields in CY22 till date, as the focus of global central banks shifts towards fighting inflation. 4QFY22 results were in line with BFSI and Commodities driving the earnings. The MOFSL Universe reported sales, EBITDA, PBT, and PAT growth of 25 percent, 12 percent, 19 percent, and21 percentYoY (estimates32 percent, 14 percent, 21 percent, and 19 percent) respectively,:MotilalOswalFinancial Services said.