With finance minister Arun Jaitley re-introducing Long Term Capital Gains Tax (LTCG Tax), the debate on whether the principle of keeping insurance and investments separate is still the right strategy has now been re-ignited.

Insurance players are saying that ULIPs (Unit-Linked Insurance Plans) will now be a compelling proposition and investors need to shift to ULIPs. On the other hand, purists reiterate that in spite of LTCG tax, buying term insurance and keeping investments/MFs separate is the best strategy for a healthy portfolio.

Moneycontrol has attempted to demystify this debate for you in this guide on ULIPs vs. mutual funds. This first edition of the personal finance show “Managing Money with Moneycontrol” looks at all the factors you should consider, including the different types of ULIPs and their associated costs. ULIPs as a product are a flexible combo of investments topped up with insurance, but the devil is in the detail and also the cost structures. To make the right choice, you need to deep dive into both mutual fund structures and ULIP costs. We bring you the analysis needed to take a considered call.

Three key factors you need to remember while making your decision:

Fund Performance of ULIPs vs. Mutual Funds

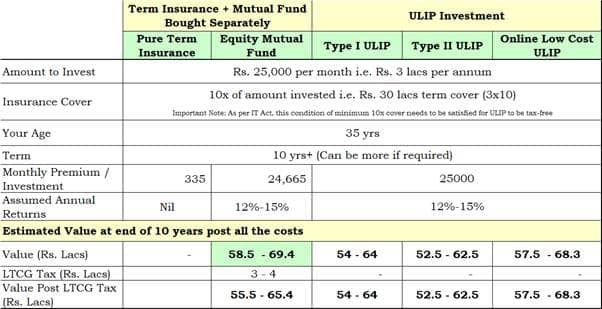

The underlying fund performance of ULIPs and mutual funds is not the same. Theoretically speaking, the NAV growth in both ULIPs and MFs should be the same if the fund management principles are the same. However, in India this is not the case. According to historic data, mutual funds do tend to outperform ULIPs by 1-4 percent on an annual basis and this can be a significant difference in the long term, despite the imposition of LTCG tax. Even if the performance of both ULIPs and MFs is the same, the outcome for you will be as below.

For understanding the types of ULIPs, you can see the video “Managing Money”. As you see, the Type 1 and Type 2 ULIP (even if they perform as well as a MF) will still be less efficient if you are looking at a 10-year period. But the low cost online ULIPs do emerge as a better option. However, one can argue that low cost online ULIPs should be compared with Direct options of mutual funds, in which case they will again lose out.

Cost Structures and Complexity

MFs and ULIPs differ significantly on cost structures. Mutual fund cost structures are embedded under a single head and hence are easy to understand. ULIP cost structures are embedded in five different heads viz. Fund Management Cost, Premium Allocation charge, Mortality, Policy Administration and Others. ULIP costs are front loaded, with the first few years having a higher cost structure and gradually reducing. Over a 10-15 year period, ULIPs costs become competitive and also if you are using a low cost ULIP, then here the total costs will be lower than the total costs of mutual funds. With actuaries designing the cost structure, the design is geared to bring in efficiencies over 15-years but with the different standards for various kinds of ULIPs, the complexity of this to understand is a significant challenge for investors and hence creates obstacles for making the right choice. Mutual funds score high on simplicity of design and ease of understanding.

Risk Measures and Control over investments

ULIPs and MFs both face market risks of the underlying instruments. But, being under separate regulators i.e. ULIPs being governed by IRDAI and MFs by SEBI, the regulatory measures are different for both the products. SEBI, being a market regulator, has evolved faster than IRDAI in terms of understanding market risks and setting guidelines for the same. Also, with the longer lock-in of ULIPs, even if you are unhappy with the underlying fund management in ULIPs, you will need to hold on to the ULIPs for at least 5 years. This creates a hurdle and lesser control over your investments in ULIPs vis-à-vis MFs.

Clearly, the principle of keeping insurance and investments still holds true for you even in the new era of LTCG tax despite. Buying term insurance separately is also more competitive in terms of costs and effectively reduces your overall cost and gives you more control your investments.

You can send in your queries to moneycontrolpf@nw18.com

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!