AMFI, in consultation with SEBI and stock exchanges, came out with its half-yearly list of stocks, based on the data provided by Bombay Stock Exchange (BSE), National Stock Exchange (NSE) and Metropolitan Stock Exchange of India (MSEI). The list has highlighted seven companies that have entered the largecap segment.

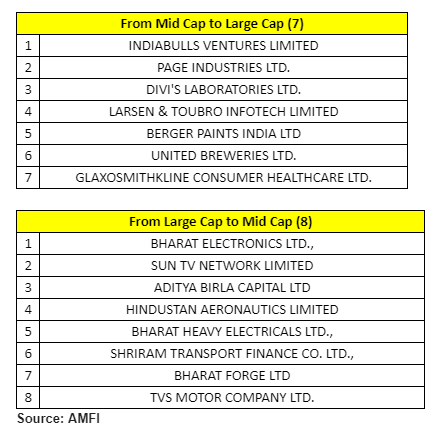

According to AMFI, seven companies jumped from the mid-cap category into the large-cap category, based on listed companies’ average market capitalisation (cap) data in the six months ended December 31, 2018.

The list includes Indiabulls Ventures, Page Industries, Divi’s Laboratories, L&T Infotech, Berger Paints, United Breweries and GlaxoSmithKline Consumer Healthcare.

During July-December 2018 period, eight companies fell into the mid-cap category from largecap, 13 moved from small-cap category to mid-cap category; and 15 moved from mid to small-cap category.

Large-cap stocks which were the clear winners of 2018 are likely to remain on top of the list for investors in 2019 as well, suggest experts. Investors should use the opportunity to get into quality largecaps, they say.

“We continue to believe that largecaps is the space we should invest in currently with higher exposure as compared to mid and smallcaps. This largely given the undergoing risk mentioned in the near term even though valuations have corrected,” Vinod Nair, Head of Research at Geojit Financial Services told Moneycontrol.

“Currently, we are suggesting a mix of portfolio - with 82.5% for largecaps and 17.5% for mid & smallcaps, which can be increased in the future as risk subsides,” he said.

Nair further added that this portfolio can focus on stable domestic stories with leadership qualities in industries like consumption, IT, chemicals and export-oriented companies. Value buying stocks in Pharma, NBFCs, Cement & Infra should also be added.

Stocks which fell from large-cap category to mid-cap category include Bharat Electronics, Sun TV, Aditya Birla Capital, Hindustan Aeronautics, BHEL, Shriram Transport Finance, Bharat Forge, and TVS Motor Company.

According to SEBI circular, the first 100 companies in terms of six-month average market capitalisation are considered as large-caps, while the ones that fall between a 101st-250th place in terms of full market capitalization are considered mid-caps, and any company which secures a place above 250 in terms of market capitalisation are considered small-caps.

Subsequent to any updation in the list, mutual funds would have to rebalance their portfolios (if required) in line with an updated list, within a period of one month.

According to the Association of Mutual Funds in India (AMFI), assets under management (AUM) of the Indian mutual fund industry came in at Rs 22.86 lakh crore in December 2018 as against Rs 24.03 lakh crore in November 2018, a fall of 4.87 percent on a month-on-month basis.

The decline likely reflects a quarter-end phenomenon wherein companies tend to redeem assets for advance tax payments. Data shows that in the last 21 quarter-end months, AUM has declined on 19 instances.

AUM under Equity (including Equity Linked Savings Schemes, or ELSS), Balanced, and other ETFs came in at Rs 10.73 lakh crore, up 2.84 percent MoM and 6.40 percent YoY.

“The mutual fund industry witnessed net outflows of Rs 136,951 crore in December 2018 as against net inflows of Rs 142,359 crore in November 2018. Liquid/money market category saw outflows of Rs 148,906 crore in December 2018 as against net inflows of Rs 136,135 crore in November 2018, ICRA said in a note.

“Inflows are cyclical for this category and outflows reflect withdrawing of money by companies, banks and financial institutions at the quarter-end for paying advance taxes,” it said.

The Income category’s outflows decreased to Rs. 3,407 crore in December 2018 from Rs. 6,518 crore in November 2018. Inflows in Equity funds (including ELSS) declined 21.49 percent MoM to Rs. 6,606 crore amid volatile capital markets.

In terms of sectors, MFs showed interest in utilities, oil & gas, banks and capital goods. These sectors saw a MoM increase in weight.

On the other hand, technology, automobiles, healthcare, metals, consumer, telecom and cement saw a MoM decrease in weight, added the report.

The top 10 stocks which fund managers bought ONGC, Coal India, IOC, Bharat Electronics, and NTPC witnessed highest buying interest in the large-cap space during December 2018.

In midcaps, stocks like Oil India, NBCC, SJVNL, Reliance Infrastructure, and REC witnessed highest buying during October 2018.

In small caps, stocks like JK Cement, CDSL, Healthcare Global, SH Kelkar, and Sanghi Industries Ltd witnessed highest buying during November 2018.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.