Amid challenges such as slowing earnings growth, a consumption slowdown, and profit booking from elevated levels, Jefferies forecasts moderate returns of around 10 percent for the Nifty 50 index. The brokerage expects the index to reach the 26,600 mark by the end of calendar year 2025.

The brokerage further noted that the index's one-year forward price-to-earnings multiple is trading above its five-year average and expects the 10 percent returns to align with projected earnings growth.

Much like others on the Street, Jefferies also took on a cautious stance on the market, betting on large-cap stocks over mid-cap and small-cap names. Among sectors, Jefferies gave an 'overweight' stance to financials, information technology, telecom, automobile, healthcare, utilities and power, and real estate while going 'underweight' energy, consumer staples, consumer discretionary and materials. On the other hand, the industrials sector received a 'neutral' rating.

Catch all the market action on our LIVE blog

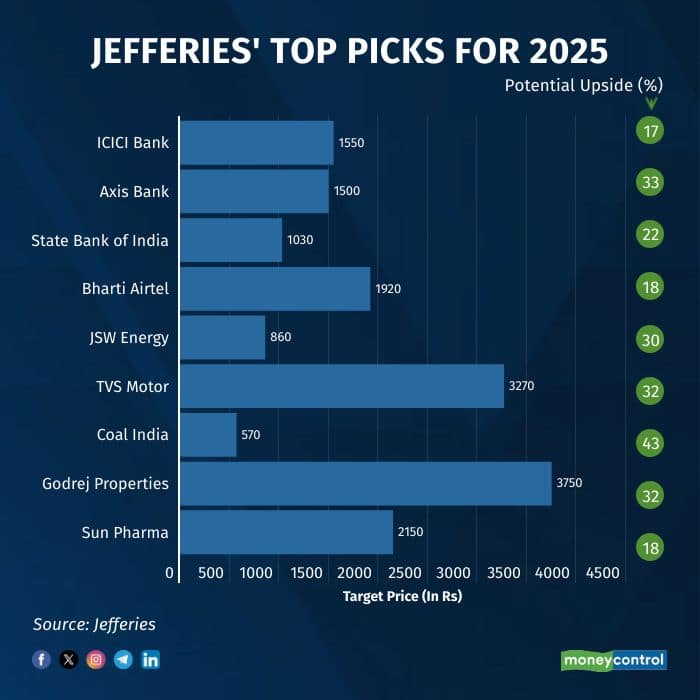

On the stock specific front, Jefferies chose names like ICICI Bank, Axis Bank, SBI, Bharti Airtel, JSW Energy, TVS Motor, Coal India, Godrej Properties, and Sun Pharma as its top large-cap bets for 2025. The brokerage sees upside potential of around 17-43 percent in these counters.

As for India's economic slowdown, Jefferies views it as shallow and expect it to likely conclude by the first half of 2025. "Factors such as increased government spending, improved liquidity, and a low base effect are expected to boost GDP growth, providing relief to corporate earnings," the brokerage said.

While it was domestic inflows that held the fortress for Indian equities in 2024, the primary market also remained in the limelight through the year, with companies raising nearly Rs 1.5 lakh crore through IPOs this year. Looking ahead, Jefferies also anticipates the acceleration in capital raising to spill over to 2025 as well, unless the market sees a steep correction.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.