As a new year ushers, and given how the market has been breaking all records to mount new highs, there is hope that January will be another good month for Sensex and Nifty. Going by past history, investors might be left disappointed.

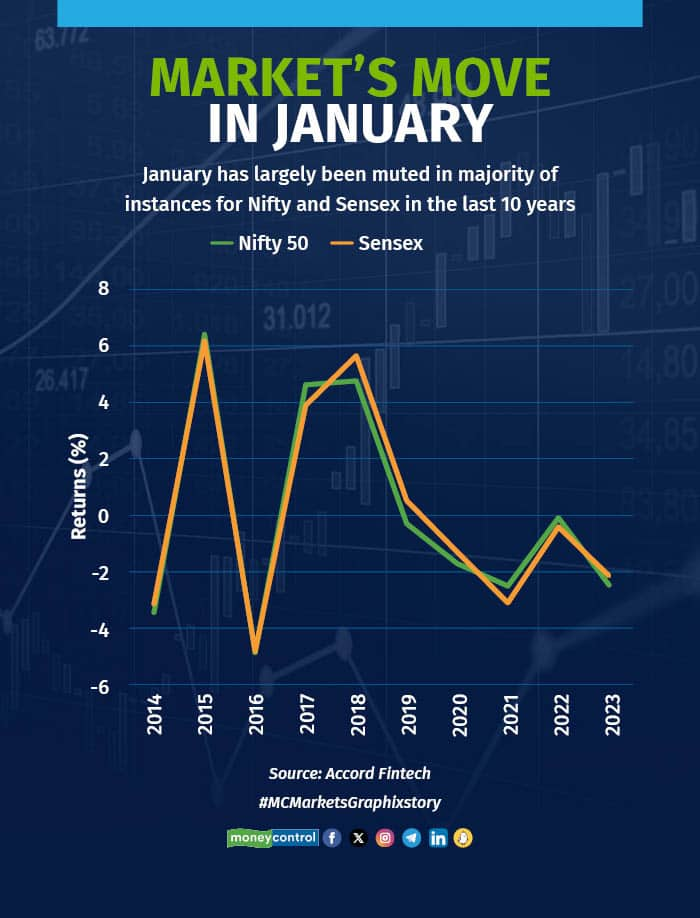

In the majority of cases in the last 10 years, January has largely been muted as far as market returns are concerned. Nifty 50 has closed in the red in seven of those years and the Sensex in six instances.

Data shows Nifty 50 has seen just three positive years in the last 10 years – 2015, 2017 and 2018 – gaining in the range of 4-7 percent. In other years, it fell the most in 2014 when it slipped over 3 percent in January.

Sensex, meanwhile, has seen four positive Januarys – 2015, 2017, 2018 and 2019.

In the last trading session of 2023, the markets took a breather, settling with modest cuts, snapping a five-day rally. Though, both Nifty and Sensex still trade very close to all time high levels, after delivering 19 percent and 18 percent returns, respectively.

Nifty ended the year at 21,731 while Sensex closed at 72,240. All time high for Nifty is 21,801.45 and for Sensex it is 72484.34. Now analysts see some consolidation in the near term.

“We may see further consolidation in the index and it would be healthy after the recent surge. We expect Nifty to hold the 21,300-21,500 zone in case of a dip during consolidation and reiterate our positional target of 22,150 level. Participants should stay focused on the selection of stocks and prefer index majors,” said Ajit Mishra, SVP - Technical Research, Religare Broking.

Though, in a slightly longer term, the market may come back to its winning ways riding on continuous flow, expectation of interest rate cuts. The anticipation of political stability in the upcoming national poll in 2024 and a positive market outlook are also supportive factors.

NSE cash market data collated by Moneycontrol shows that foreign institutional investors (FIIs) net bought shares worth Rs 31,959.78 crore in December. Though for the entire 2023, they were net sellers of Rs 13,194.40 crore worth of equities.

Domestic institutional investors, meanwhile, were net buyers of Indian equities in 10 out of 12 months. Riding on massive retail flows, they net invested Rs 1.68 lakh crore in equities, offsetting any negative impact by FII selling.

“The euphoria is expected to continue during the start of the next year on account of the exuberance of rate cuts and the drop in bond yields,” said Vinod Nair, Head of Research at Geojit Financial Services.

“It is advised to diversify the investment pattern to multi-assets. It is suitable to be diverse when equities are trading above the long-term average for a prolonged period.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.