Adani Group companies may have faced a rout in the equity markets and a punishing overseas bond market but India’s big bond investors who have put their money into the group’s domestic bonds are keeping calm and carrying on.

But this tranquility can end if Adani group bonds face rating downgrades, according to bond market participants. On February 3, S&P Global Ratings slashed the outlook on the ratings of Adani Electricity Mumbai and Adani Ports and Special Economic Zone to negative from stable. In essence, the ratings firm sees higher credit risk from these companies because of corporate governance issues at the group. That said, the credit ratings on all the Adani firms have been kept unchanged for now.

The Adani group is currently locked in a battle with shortseller Hindenburg Research after it accused the former of serious lapses in corporate governance in a detailed report on January 24. Hindenburg holds short positions in Adani firms’ foreign currency bonds. Following the report, shares of Adani group companies have fallen sharply, eroding the group’s aggregate market valuation by nearly half. Foreign currency bonds have also witnessed selling pressure in global markets and yields have jumped there.

But in the domestic bond market, the reaction has been largely muted, partly due to an illiquid secondary market and partly because investors are confident of repayments. That said, the biggest risk that Adani companies face is refinancing upcoming maturities. Since the stockpile of Adani group’s domestic bonds is small compared with the size of the corporate bond market, refinancing risks do not seem alarming as of now. The same, however, cannot be said about foreign currency bonds.

House of bonds

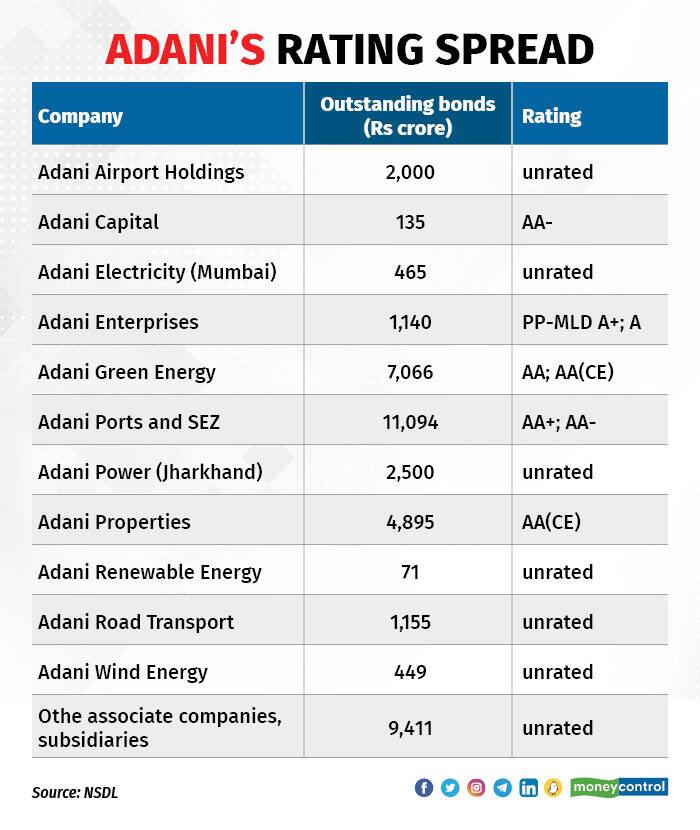

Of the raft of subsidiaries that the group has under its umbrella, only a handful have been regular issuers in the domestic bond market.

Data from National Securities Depository Ltd (NSDL) shows that Adani group companies have an aggregate outstanding bond pile of roughly Rs 40,000 crore with the largest issuer being Adani Ports and SEZ. This total bond outstanding number also includes bonds that are compulsorily convertible into equity shares after a specified time. The outstanding of such compulsory convertible debentures (CCD) totaled roughly Rs 11,000 crore.

Of the total domestic bond pile of Rs 40,000 crore, about Rs 6,000 crore or 15 percent is set to mature in the current year. Another Rs 2,700 crore is scheduled to mature in 2024. The rest have redemption dates spanning 10 years and more. The structure of these bonds vary as the group companies have issued a variety of debt instruments, from zero coupon bonds to market-linked debentures. “Investors who are holding these bonds are comfortable holding them. There is no concern but there will be some worry until this storm blows away. The company is also not planning to tap the market until the dust settles and this is appropriate,” said Ajay Manglunia, managing director and head of fixed income at JM Financial.

According to bond arrangers, Adani group bonds are in the hands of long-term investors such as insurance companies, pension funds and provident funds. Besides, bank treasury desks that saw an opportunity in these bonds have largely kept the papers under the held-to-maturity category. Perhaps the more worried lot is the high net-worth individuals who hold Adani bonds, especially market-linked debentures that Adani Enterprises had issued a few quarters ago. “We know that MLDs are going to have a higher tax liability now. Imagine your return being eroded and the risk on those papers just got steeper,” said a wealth fund manager, requesting anonymity. NSDL data shows that Adani Enterprises has an outstanding pile of Rs 740 crore worth of MLDs that mature in 2024.

Meanwhile, the stockpile of foreign currency bonds has grown in the past years. Brokerage firms CLSA, Bernstein and Jefferies all point out that the share of foreign currency debt in overall debt of the Adani group is not more than 30 percent. On the outstanding debt as of March 2022, this works out to Rs 60,500 crore ($7.6 billion) and some firms have raised more money since then.

Refinancing risk here is larger than domestic bonds because of a volatile exchange rate. A weaker rupee puts further outflow pressure on Adani companies when coupon payments or maturities come up.

The rating knife

So far, rating agencies have not revised their opinions on the credit rating of Adani firms. On February 3, Fitch Ratings in a statement said that there is no immediate impact of the Hindenburg report on the credit profile of Adani group companies. Fitch rates eight Adani group companies and all the ratings are at the sovereign India rating of BBB(-).

Back home, Crisil Ratings rates 23 Adani group companies and it has so far kept the credit ratings unchanged on these companies. That said, the agency pointed out that any adverse developments that stymies the company’s fund-raising efforts would be watched for. “Any adverse regulatory/ government action in the wake of the research report, emerging issues around corporate governance, or a decline in group’s resource raising capabilities from banks or capital markets because of a continuing slide in share prices will be key monitorable,” Crisil said in a release on February 2.

Domestic Adani bonds are rated AA+ and below. Any cut in the rating could force insurance firms and pension funds to begin offloading the bonds. The insurance regulator mandates insurers to invest in bonds below AA rating only after explicit board approval. Such investments would be termed as other approved investments and cannot exceed 25 percent of the investible surplus.

As for offshore bonds, Adani firms have multiple headwinds to manage such as exchange rate fluctuations and weakening of risk perception among investors. The price of a clutch of offshore bonds has fallen sharply since the Hindenburg report.

As said earlier, the biggest risk to Adani group companies is refinancing upcoming maturities. So far, the group has managed to keep investor confidence intact by meeting scheduled coupon payments on its offshore bonds as well as releasing a part of pledged shares through prepayment.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.