After a forgettable performance in the fourth quarter, technology behemoths are bracing for more uncertainty in the near-term, thanks to the banking turmoil in US and fears of an impending recession. Management commentary from both TCS and Infosys paint a grim picture. Growth, margins and discretionary tech spends remain areas of concern.

However, while most analysts still have a ‘buy’ call on both the IT majors, TCS comprehensively beats Infosys on most parameters, even as it commands a higher price multiple.

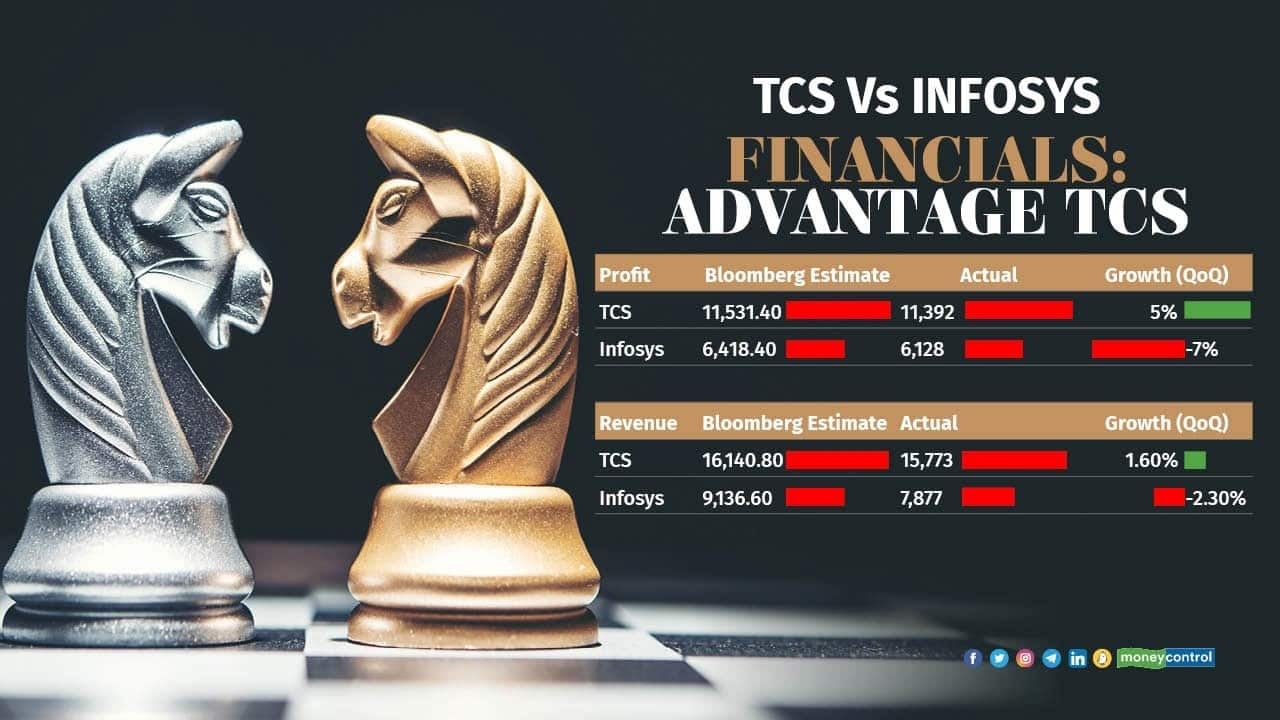

Financials: It is mostly a choice between bad and worse. While TCS results missed expectations, Infosys’ numbers were a punch to the gut. Revenues, profit, and margin declined sequentially. This was in stark contrast to the past few quarters when Infosys had managed to outshine the IT sector bellwether.

A bigger jolt came in the form of a cut in FY24 revenue forecast to 4-7% by Infosys. This is markedly lower than the 13-15% forecasted for FY23.

TCS does not give guidance but a deterioration in growth is widely anticipated. But based on the Q4 narrative, Infosys seems to be on a weaker wicket.

“Between TCS and Infosys, the growth outlook for TCS is better -- TCS has a much diversified portfolio and the order book is pretty strong with a strong, healthy pipeline,” said Siddhartha Khemka of Motilal Oswal Financial Services.

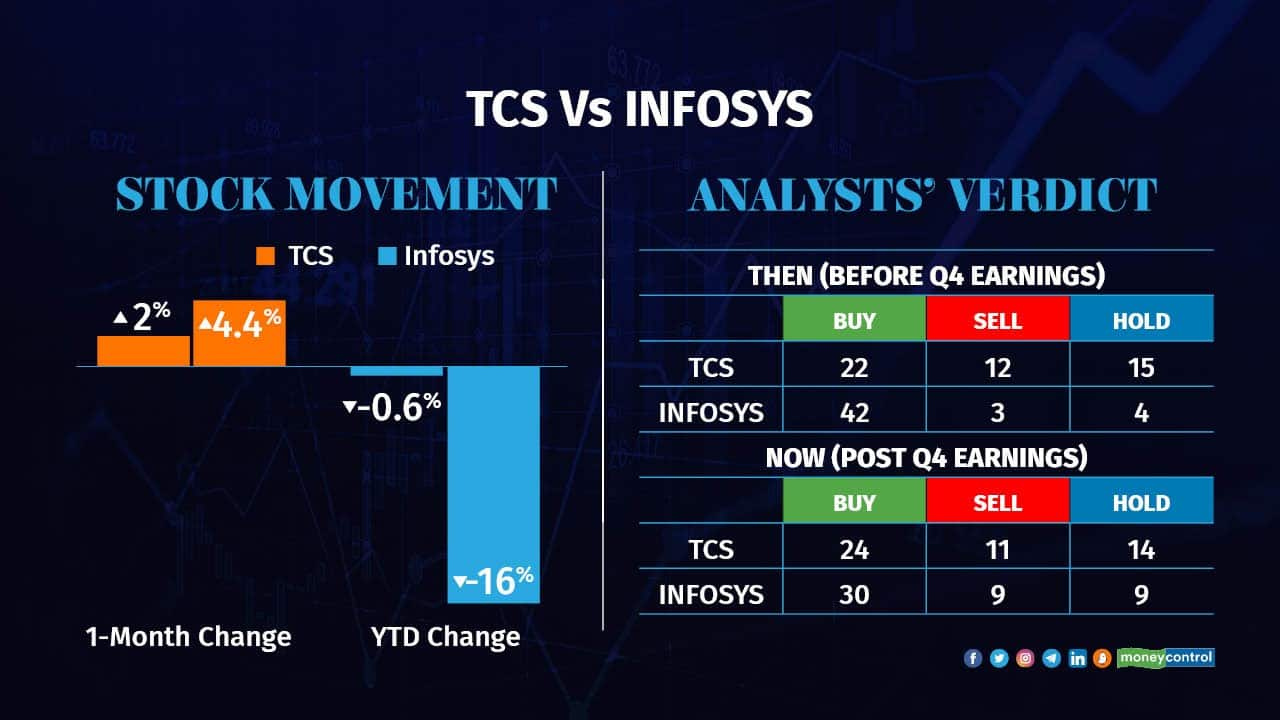

Market Moves: Shares of TCS and Infosys have seen contrasting fortunes since their results, in tandem with the Street commentary. The gap in their YTD performance demonstrates the uphill task confronting Infosys at present.

Analysts’ Views: The verdict on TCS remains largely unchanged even post its muted show in Q4, mainly due to its healthy order book. Infosys, on the other hand, has suffered a steep 28 percent drop in ‘buy’ calls.

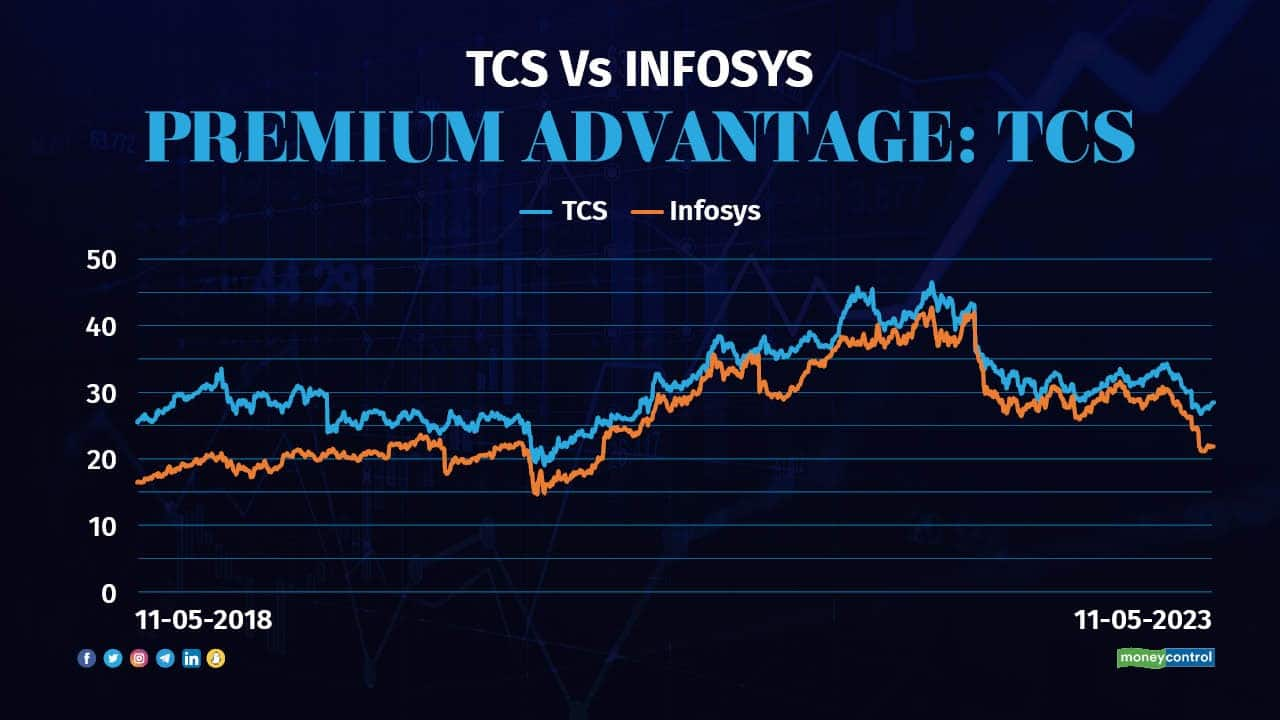

Valuations: IT stocks have seen a correction over the past year, which has brought down their valuation multiples below the 10-year averages. However, TCS is an exception here as it trades above its 10-year average of 22.58x. At a trailing PE of 25.7x, TCS commands a premium to Infosys which is trading at 16.6x currently (below its 10-year average of 19.5x).

Historically, TCS has always commanded premium valuations vis-à-vis Infosys, though the gap has narrowed over the past few quarters as the Tata Group firm’s growth trailed that of Infosys. In fact, in some instances their valuations have even converged (March 2022 and March 2021).

HDFC Institutional Equities expects Infosys to grow less than TCS in FY24, based on portfolio mix (relative differential between North America and UK portfolio and the relative weakness and strength in those geographies). Thus, it values Infosys at a 20 percent discount to TCS’ valuations.

Gaurang Shah of Geojit Financial Services says, “Our order of preference is TCS followed by HCL Tech, Tech Mahindra, and Infosys. We are most cautious on Infosys when it comes to deal wins.”

AK Prabhakar of IDBI Capital echoes this view. “Despite trading at a premium, we have always been bullish on TCS as it has a diversified client set.”

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.