Goldman Sachs upgraded India market to ‘Overweight’ from market weight with a Nifty50 target of 12,500 for the next 12 months which was also raised from 11,700 earlier.

The global investment bank had downgraded India to market weight in mid-September last year on near-term macro headwinds, stretched valuations as well as election uncertainties.

Now, better than expected December quarter earnings with signs of an uptick in demand and improving asset quality, and the return of foreign institutional flows are some of the factors which led to the upgrade.

“On a full calendar-year basis, we expect earnings growth in India to pick up to 16 percent this year and 14 percent next year. We expect Nifty to reach our refreshed target of 12,500 in 12 months compared to 11,700 earlier,” said the Goldman Sachs note.

The global investment bank expects returns to be driven largely by earnings with potential valuation overshoot in the near term.

Goldman Sachs is of the view that ‘Value’ and ‘Cyclical’ parts of the markets will perform better in coming months with investors rotating out of ‘safe haven’ or ‘quality’ stocks as political uncertainty continues to fade.

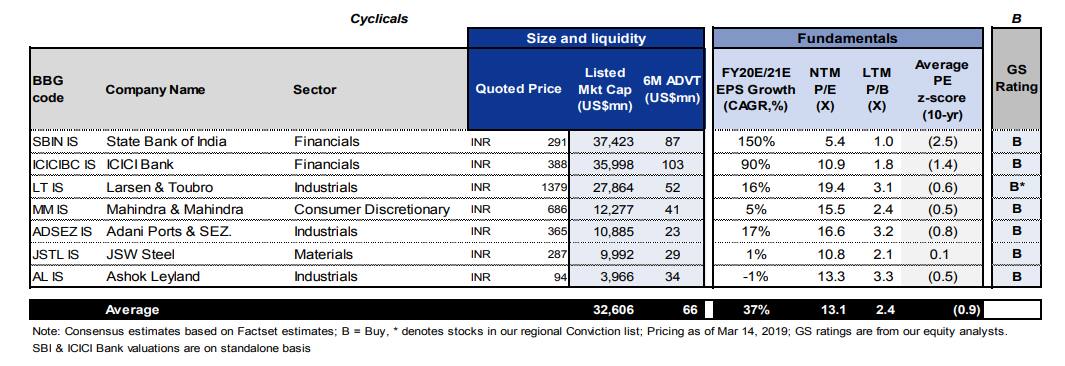

The global investment bank lists out seven stocks which trade at 16x forward PE and offers 16 percent earnings growth on a median basis. “On an equal-weighted basis, our ‘Value cyclicals’ list of stocks outperformed Nifty by 15 percent in the three months heading into 2014 elections,” it said.

Some stocks on the list like State Bank of India, ICICI Bank, Larsen & Toubro, Mahindra & Mahindra, Adani Ports, JSW Steel and Ashok Leyland are currently trading 17 percent below their 1-year highs and trading at mid-cycle valuations suggesting attractive risk-reward.

Oversold midcaps are also another category of stocks which could do well in the near future, suggests the Goldman Sach note. While mid and small-cap stocks have recovered with the Nifty Mid-cap 100 index rallying by about 11 percent over the past month, the recovery follows a sharp underperformance over the past 1-year.

The relative performance of the Nifty Midcap-100 is still more than 20 percent below its 2018-highs suggesting further room for upside.

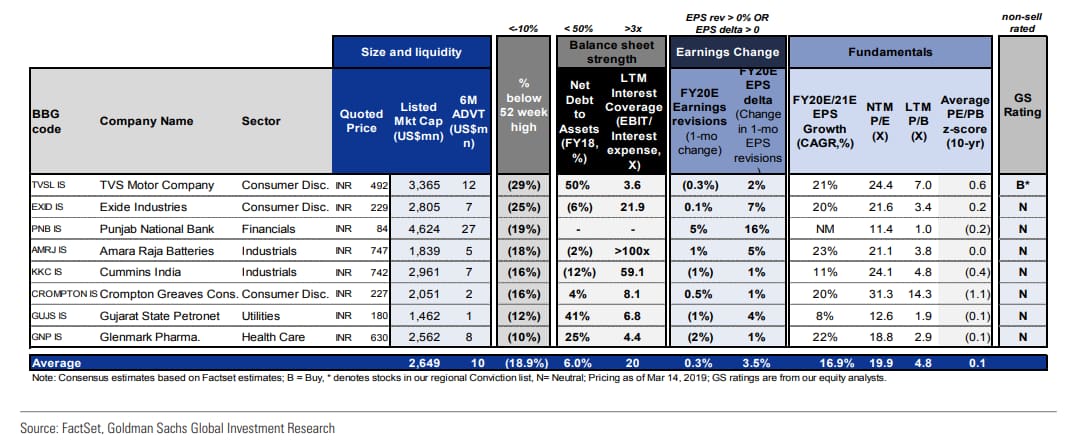

However, earnings sentiment remains weak with mid and small-cap stocks continuing to see sharp earnings cuts. “We thus remain selective in mid-caps and prefer stocks that have been oversold but are seeing positive earnings momentum and have relatively stronger balance sheets,” said the Goldman note.

The global investment bank filter stocks which have either a Buy or a Neutral-rating within Nifty Mid Cap 100 that are at least 10 percent below their 1-year high, have seen either EPS upgrades or slowing downgrades over the past month and have relatively stronger balance sheets.

Goldman Sachs list of stocks in the mid-cap space include names like TVS Motor Company, Exide Industries, Punjab National Bank, Amara Raja Batteries, Cummins India, Crompton Greaves, Gujarat State Petronet, and Glenmark Pharma.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.