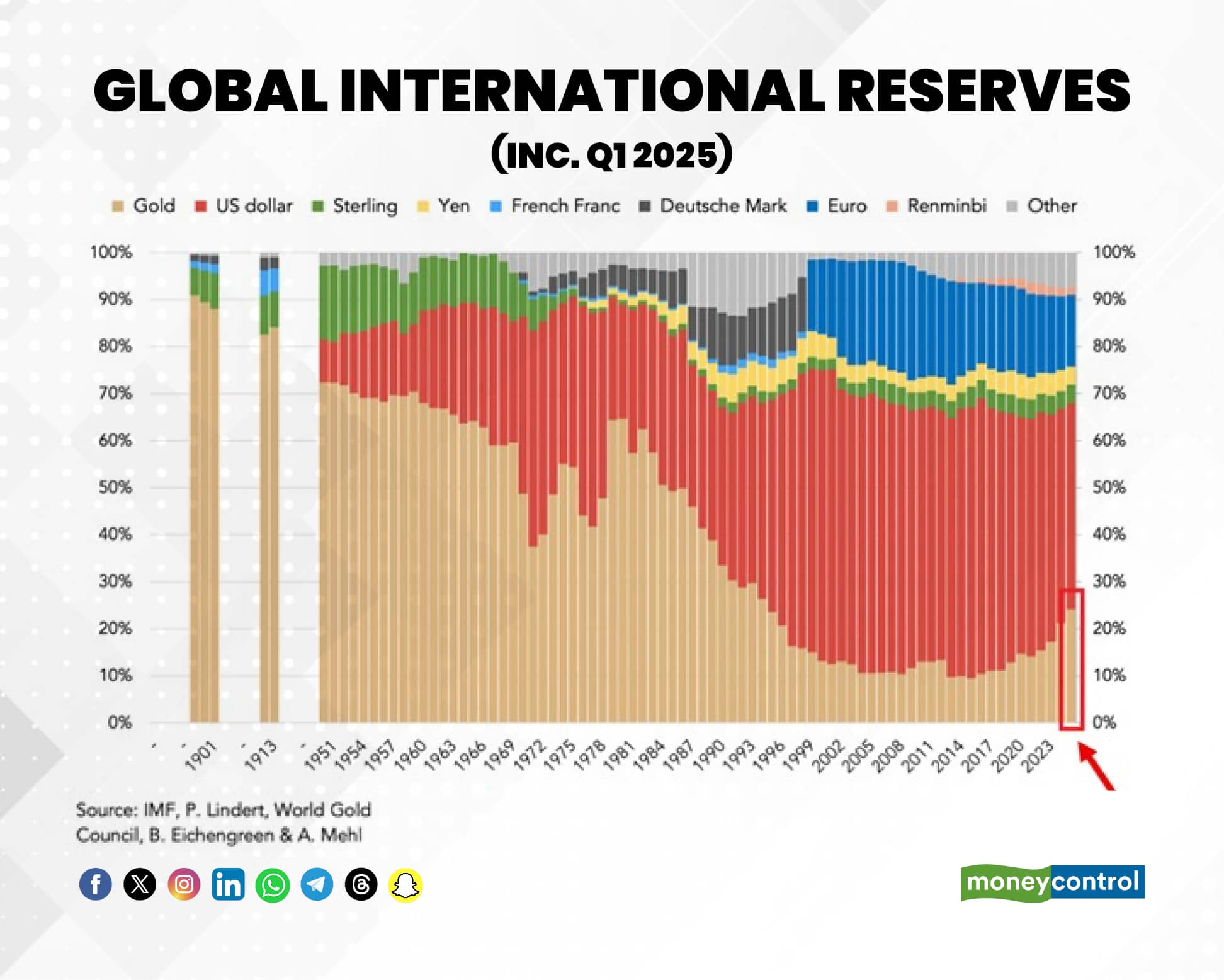

Gold’s dominance in global reserves is strengthening as central banks turn to the yellow metal amid historic demand and rising global uncertainty. In the first quarter of 2025, gold’s share of international reserves rose by 3 percentage points to 24 percent, which is its highest level in three decades, following the third straight year of gains.

Gold’s share in global international reserves has now surpassed the Euro since 2024, making it the world’s second-largest reserve asset. In contrast, the U.S. Dollar’s share has slipped by about 2 percentage points to 42 percent, which is the lowest since the mid-1990s, while the Euro’s share was roughly around 15 percent.

The rise in holdings comes due to two key reasons: first, the price of gold has been soaring, thus increasing the value of current holdings of the precious metal; second, amid a volatile geopolitical landscape, central banks continue to accumulate gold given its safe-haven demand.

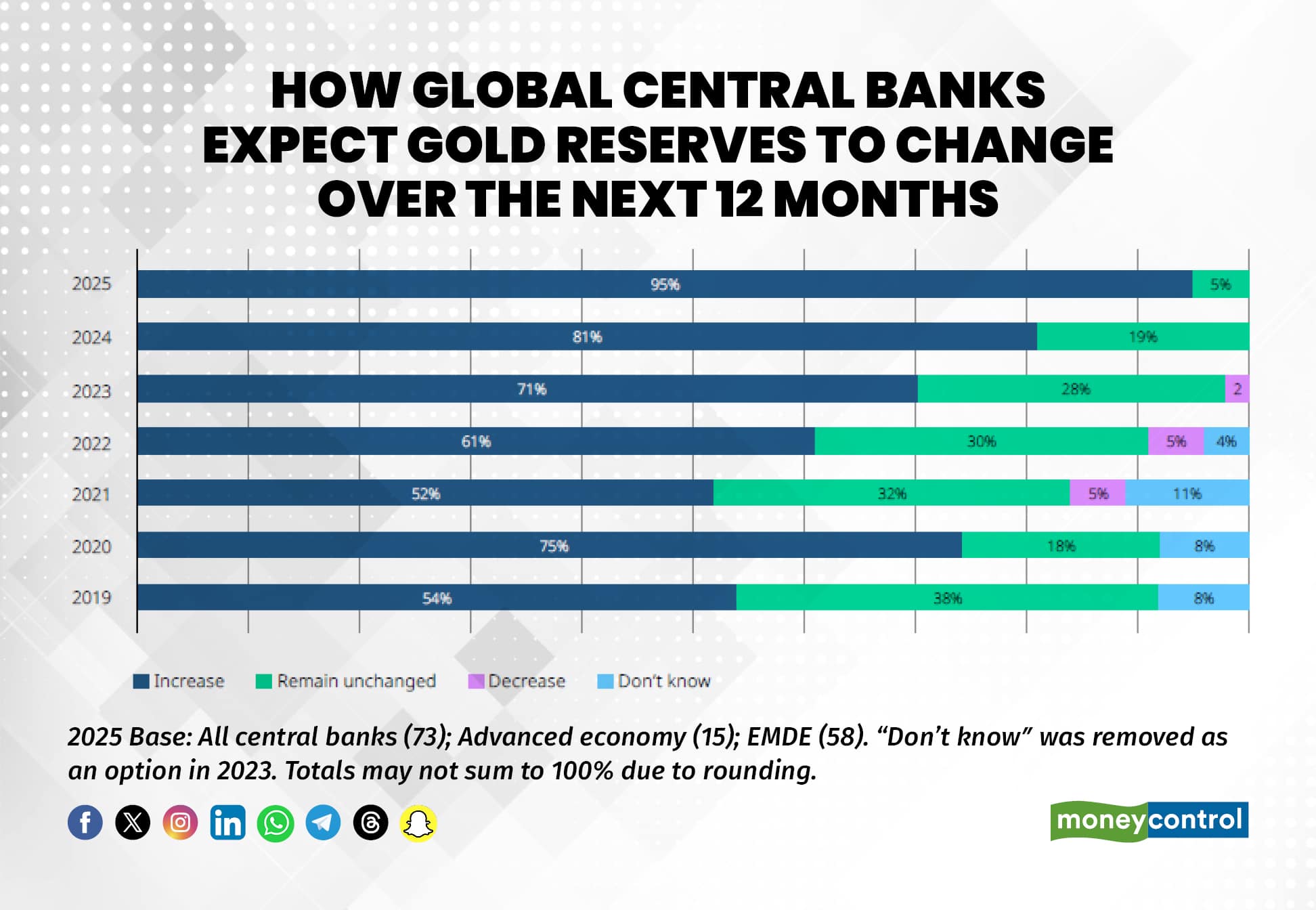

According to the World Gold Council’s (WGC) latest survey of central banks, gold’s performance in times of crisis, ability to act as a store of value, and its role as an effective diversifier, continue to be cited as key reasons for an allocation to gold.

According to the World Gold Council’s (WGC) latest survey of central banks, gold’s performance in times of crisis, ability to act as a store of value, and its role as an effective diversifier, continue to be cited as key reasons for an allocation to gold.

Going ahead, nearly all central banks expect their reserves to rise. Interestingly, the WGC noted that the majority of central banks see moderate or significantly lower U.S. dollar holdings within global reserves over the next five years. Respondents also believe that the share of other currencies, such as the euro and renminbi, as well as gold, will increase over the same period.

While the U.S. Dollar does hold the dominant position currently, making up almost half the reserves, central banks are of the opinion that protectionist measures such as tariffs could incentivise central banks to diversify their reserve holdings. Further, the falling dollar has indicated waning confidence in the world’s premier reserve currency.

If diversification were to occur, central banks would favour currencies like the Euro and Chinese renminbi, along with gold. Around 40 percent of all central banks surveyed by the WGC expect that the Euro holdings, which is roughly around 15 percent, would see an increase. Over 60 percent expect that the two percent share of the Chinese renminbi would increase over the next five years.

If diversification were to occur, central banks would favour currencies like the Euro and Chinese renminbi, along with gold. Around 40 percent of all central banks surveyed by the WGC expect that the Euro holdings, which is roughly around 15 percent, would see an increase. Over 60 percent expect that the two percent share of the Chinese renminbi would increase over the next five years.

However, despite the move towards gold and other currencies, the dollar's role remains underpinned by deep and liquid financial markets, strong legal institutions, and the lack of a full substitute currency with comparable characteristics. “Therefore, although a decline in its share is plausible, it is likely to be gradual and modest,” noted a central bank respondent to the WGC.

Also Read | Gold, silver ETFs surge on hopes of Fed rate cut; momentum likely to continue amid festival season

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.