India Gold MCX April futures slipped more than 1 percent on March 25 tracking muted trend seen in the international Gold prices which have also given up the gains as investors are looking to cash liquidate positions to cover losses in other assets.

International gold is likely to remain volatile as positive rhetoric from the US lawmakers regarding a stimulus bill to cushion the economic damage from the coronavirus outbreak lifted investor sentiment.

On the Multi Commodity Exchange (MCX), April gold contracts were trading lower by Rs 300, or 0.7 percent, at Rs 41,079 per 10 gram at 09:40 hours.

Experts feel that the yellow metal is likely to remain volatile and could well find support near 40,850-40,144 on the downside and on the higher side resistance are placed at 41,550-41900.

On the daily chart, Gold rose for a third straight session on Wednesday, hitting its highest in about two weeks on stimulus hopes before giving up gains.

“Gold prices skyrocketed after the Fed rolled out yet another series of unconventional policies. Fed will start purchasing corporate bonds, while also considering direct loans to companies, including small and medium-sized businesses,” YES Securities said in a report.

“It also said it would expand its asset portfolio by "as much as needed" in order to further stabilize the credit markets,” it said.

Trading strategy: What should investors do?

Experts feel that investors should deploy a buy on dips strategy with resistance firmly placed near 42000 levels on the MCX Gold.

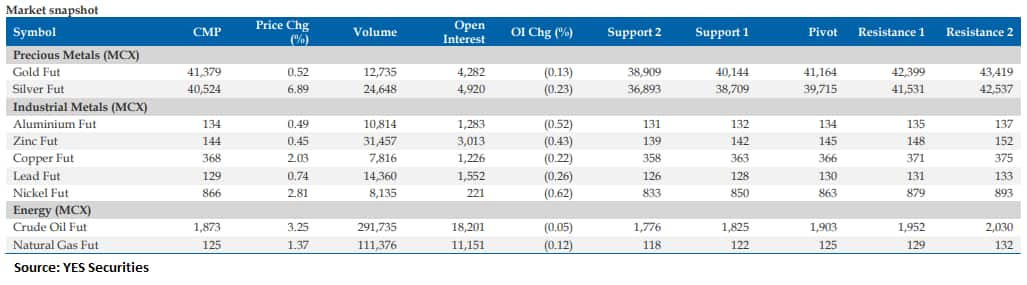

Yes Securities see major support for Gold placed at 40,144 followed by 38,909 while on the higher side resistances are placed at 42,399 followed by 43,419.

Technically, major moving average such as 20, 50, 100-Days EMA are suggesting range trades. “Overall the trend remains positive till the time 39500 holds on a closing basis but volatile sessions will be seen,” Jateen Trivedi, Senior Research Analyst (Commodity & Currency), LKP Securities told Moneycontrol.

“For the day 41550-41900 will act as resistance whereas 41250-40850 as supports,” he said.

Disclaimer: The views and investment tips expressed by experts on Moneycontrol.com are their own and not those of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.