The market may find its short-term bottom in the next few sessions, going by the net short positions taken by Foreign Portfolio Investors (FPIs).

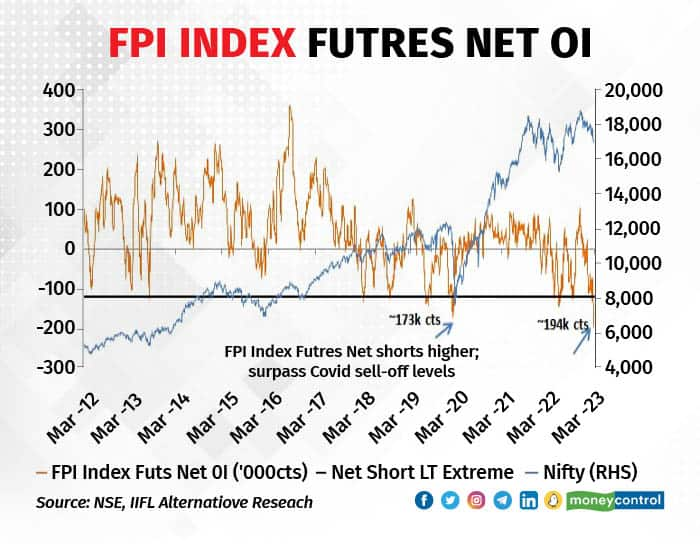

FPI net shorts in index futures are now at the highest levels, surpassing even COVID-time sell-offs. Net short contracts in Nifty have touched about 1,95,000, which is higher than the 1,73,000 in March 2020. Net short contracts mean short contracts are more than long contracts.

The structure is extremely sold in Nifty and a rally is overdue, said Sriram Velayudhan, Vice President and Head of Alternative Research Vertical at IIFL Securities.

Follow our live updates and analysis on markets here

“This is a pretty good indicator of the markets bottoming out in the short term. But for the longer term, we will have to assess if the momentum sustains or not,” said Sriram.

Ashish Kyal, CMT and founder of Wavesstrategy.com, said that the short position build-up by FPIs is a sentiment indicator and it reflects bullishness. “If there is a big build-up of shorts in the system, and the market (trend) reverses, these short sellers will start covering their positions and if the positions are huge, it will result in a sharp reversal on the upside,” he said.

Nature of the rallyOn whether it will rally sharply after the bottom, IIFL’s Sriram said that this indicator has to be read along with the larger picture. “The market is feeling the pressure of interest-rate hike uncertainty and the banking crisis. Therefore, it may not rally as sharply as it did following such instances earlier,” he said.

However, if the market starts moving up from here, we can expect the momentum to sustain for a week or two, he said.

When COVID-19 hit and the markets were extremely oversold, the market briefly consolidated and then shot up. “The markets were heavily oversold then and the central banks unleashed quantitative easing,” he said.

“In this case, if we minutely observe the data, we have already spent a decent amount of time (in the correction) and a rally is overdue,” he added.

The Nifty climbed 129 percent over a year -- from 8,000 levels in April 2020 to 18,300 in October 2021. But Sriram isn’t sure if a similar rally will unfold this time.

“The COVID correction found a long-term bottom and that was a unique event,” he said.

Sriram said the current net short position is a good technical indicator but it won’t be enough to predict how long the rally following that will sustain. That will also depend on global macros.

Kyal said we should look for the 17,530 level this week, to see if there will be a longer term rally.

Also read: F&O Manual| Analysts foresee tepid trading as investors take cautious steps

“If you look at the Nifty, it has not closed above any prior week’s high for many weeks now. To check if a meaningful rally has started on the upside, we need to see if the market has closed above the previous week’s high of 17,530,” he said.

“If the market crosses that, we can say that a meaningful rally has started,” he added.

Discover the latest Business News, Sensex, and Nifty updates. Obtain Personal Finance insights, tax queries, and expert opinions on Moneycontrol or download the Moneycontrol App to stay updated!

Find the best of Al News in one place, specially curated for you every weekend.

Stay on top of the latest tech trends and biggest startup news.